What COVID-19 Will Mean for Future Work-From-Home Policies

Blog post

Share

Recently, Trintech’s CEO, Teresa Mackintosh, sat down with the Dallas Business Journal to discuss how COVID- 19 has changed the business landscape. In recent months, most organizations have implemented a work-from-home (WFH) policy under the current government restrictions and many, Mackintosh included, believe this may have long-standing changes to work-from-home policies. As organizations are allowed to begin working within an office again, the question remains whether this forced experiment will lead to a more virtual workforce.

“It’s been an interesting cultural shift, and it will be even more interesting as we transition back to the workplace and consider what that looks like.” – Teresa Mackintosh

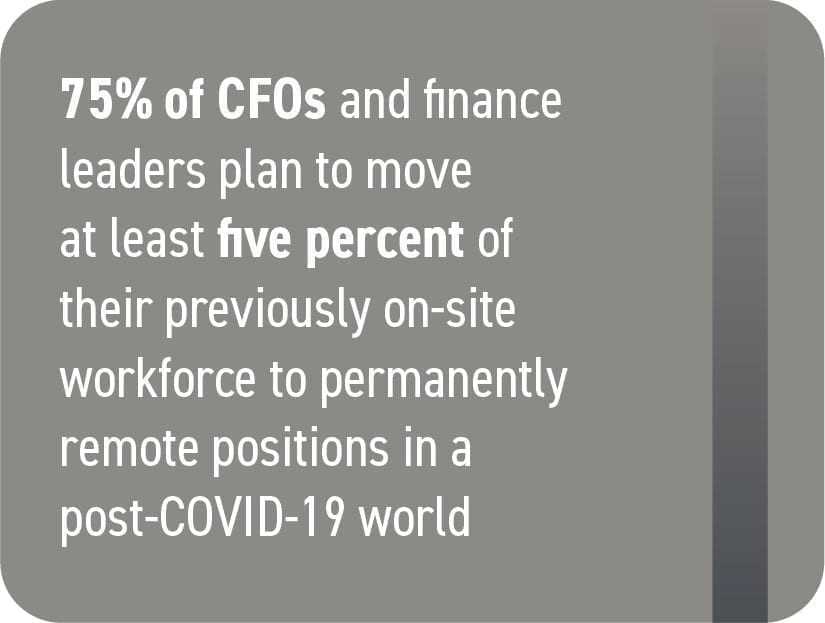

A year ago, only 5% of the U.S. workforce worked completely from home, but today that number has increased six-fold. However, even before this pandemic, a permanent WFH option for employees was picking up traction amongst large organizations. Stretching back to the year 2000, there’s been a steadily increasing number of employees that either worked from home permanently or occasionally. A recent survey by Gartner Finance Practice found that nearly 75% of CFOs and finance leaders planned to move at least five percent of their previously on-site workforce to permanently remote positions in a post-COVID-19 world. With all of this in mind, it’s very unlikely that global business will go back to “normal”, even after the restrictions are lifted.

A year ago, only 5% of the U.S. workforce worked completely from home, but today that number has increased six-fold. However, even before this pandemic, a permanent WFH option for employees was picking up traction amongst large organizations. Stretching back to the year 2000, there’s been a steadily increasing number of employees that either worked from home permanently or occasionally. A recent survey by Gartner Finance Practice found that nearly 75% of CFOs and finance leaders planned to move at least five percent of their previously on-site workforce to permanently remote positions in a post-COVID-19 world. With all of this in mind, it’s very unlikely that global business will go back to “normal”, even after the restrictions are lifted.

However, there are many complex problems and questions that arise when organizations consider WFH as a long-term option for their organization. And, more often than not, the issues aren’t ones that were predicted. When discussing with the Dallas Business Journal, Mackintosh said that the biggest business lesson she has learned so far from the pandemic, is this: “The things that I thought would be easy, are hard…and the things that I thought would be hard, are easy”. The COVID-19 crisis has exposed us to several key learnings but one of the biggest is to continue investing in the processes and technologies to support a remote workforce. This not only includes our internal processes and technologies, but also the customer-facing solutions that we are bringing to market to help the Office of Finance automate and streamline their financial close processes virtually. In addition, I’m consistently amazed at how our employees have been able to transition to this new work environment and continue to provide the same level of support to our customers – It’s been truly remarkable and the transition was far easier than I anticipated. Conversely, I miss the energy and vibe of our office.”

As organizations move towards a virtual close with their newly remote workforce, they quickly discover the breakdown that takes place. Historically, financial processes have been handled manually, and with spreadsheets. This approach offers very little in terms of visibility into the close process and control of the accuracy of all reported financial documentation.

The problems that resulted from this approach were somewhat remedied by walking to a coworker’s desk and having a brief conversation. Instead, this is now filling up calendars with multiple, half-hour long meetings. And accounting teams— that were strapped for time before their new work situation—are now finding it harder than ever to effectively and accurately complete the close process. Additionally, in these uncertain times, the office of finance is relied upon by the entire organization to take a leading role in addressing any pressing concerns, and providing actionable insights to drive critical business decisions.

In a recent article by McKinsey, the critical role of the CFO in a crisis, like the one we are facing, is described as paramount “to ensuring that their organizations not only survive the current crisis but thrive in the next normal.”

To keep up with both their responsibilities as well as the new expectations that have been placed on them, the office of finance needs a solution that empowers its employees by promoting communication and productivity.

By utilizing automation within the office of finance, organizations can remove the issues associated with manual processing, and move towards being able to provide actionable insight into how their organization can navigate the current economic environment.

The Dallas Business Journal interview in its entirety can be found here.

See how an automated R2R solution can help your organization during these unprecedented times.