Control Risk in Your Balance Sheet Reconciliation Process

Blog post

Share

Nothing sinks a company’s office of finance’s credibility faster than a poorly-managed balance sheet reconciliation process – but where is the risk and how can you control it?

For many businesses, managing financial risk could be the difference between sink or swim. The close process should be a way to clearly gauge your financial position, but if the fiscal crisis has shown us anything, it’s that risk isn’t always plainly visible.

Where are errors in your financial close process coming from?

The simple answer to the question above is this: the risk of human error significantly increases while reconciling balance sheets. While not impossible, it is particularly difficult to accurately track changes made in spreadsheets. Anyone with access to the spreadsheet can edit it, and this lack of control can be extremely damaging. In most circumstances, these errors are caused by a simple mistake made as early on as during the data transfers from your ERP software or other sources into a spreadsheet. Even if the reconciler believes that their work is error-free, despite their heavy workload and tight deadlines, that won’t prevent even the smallest mistake from severely impacting your reconciliation process.

Remember, the average error rate in Excel spreadsheets is about 1%1, which means a company with £100m ($133M) turnover has a spreadsheet risk potential between £800,000 ($1.1M) and £1.8M ($2.4M).

Proving Capability of Control

Businesses can no longer rely solely on an auditor to catch mistakes. A company must now prove that their internal staff is capable of catching errors. But how do companies even begin to acquire this level of control?

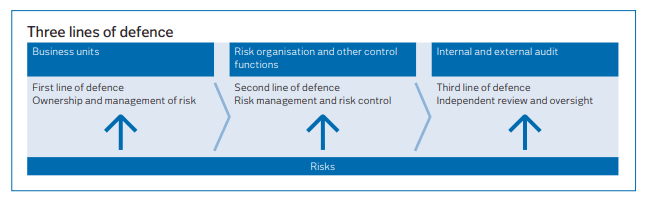

According to recommendations in the Basel II Financial Directive, to gain complete control of the financial close process, companies should implement the ’3 Lines of Defense’.

The Three Lines of Defense Model

Source2: Vattenfall 2012 corporate governance report

- Each business unit is its own first line of defense. It maintains and manages the financial risk for itself.

- Risk organization in small companies should manifest as a board risk committee. In larger enterprises, risk organization should fall to a separate department. Altogether, the responsibility for managing and controlling the risk falls to the front lines.

- The internal auditor is the final line of defense. They pick out errors before the final report and improve the risk control and management process before the external audit.

The Control Challenge CFOs Face

As a CFO, your responsibility is to investigate new technologies and ideas, as well as capitalize on your financial team’s “cognitive surplus” to discover more effective solutions for financial processes.

These 3 Lines of Defense are great for clamping down on risk in the financial reconciliation management process, but is there a smaller-scale solution available? For small businesses, risk is often due to human error in spreadsheets, so a single solution that allows you to move away from risk-laden spreadsheets must be comprehensive and specifically designed to combat these challenges.

When done correctly, automating your balance sheet reconciliation process can provide very effective executive-level risk management by minimizing human error while providing a strong audit trail and accountability level.

To learn more about the full benefits of automated reconciliation software, take a look at our solutions.

Written by: Ashton Mathai

1 Olshan, J. (2013, April 20). 88% of spreadsheets have errors. Retrieved from MarketWatch.

2Vattenfall Annual and Sustainability Report[PDF]. (2016).