The CFO’s Guide to Leading with RPA

Blog post

Share

Though the office of finance goes through cycles of high and low activity, there is always room for improvement. Too many organizations build their financial close process around manual methods that limit visibility, communication and innovation.

Innovating your close processes with Robotic Process Automation (RPA) means increased efficiency, decreased costs and reduced risk for your organization. CFOs who have helped their organizations implement an RPA solution have created positive ripples from management to individual employees, through steps such as:

• Providing your team with standardized tools

• Automating and connecting workflow processes

• Ensuring strong controls with visibility throughout the close process

• Attracting talented, modern employees with automation

• Developing your employees through higher-value tasks after implementing RPA

1. Review your foundation

Only once you truly reflect on the nature of your disjointed internal structure can you improve. Therefore, before moving into a transformational future with RPA, it is imperative to understand your organization’s current level of maturity.

The organizations that require the most “self-reflection” are often those that perform it most poorly. Ad Hoc environments are still very manual and disjointed, leaving organizations struggling to process their data, with little time left to address their own process issues. As well, a manual management of processes and data does not equate an adequate risk management strategy.

If you only have time to put up a quick defense, you will never get ahead of the work coming down the pipe, as well as your compliance requirements. Reactive organizations are typically unprepared for changes in technology, regulation and increased transactions.

Only best-in-class companies are at the forefront of innovation with CFOs that are secure in their data and technology, compliant with their industry standards and ready for the next challenge.

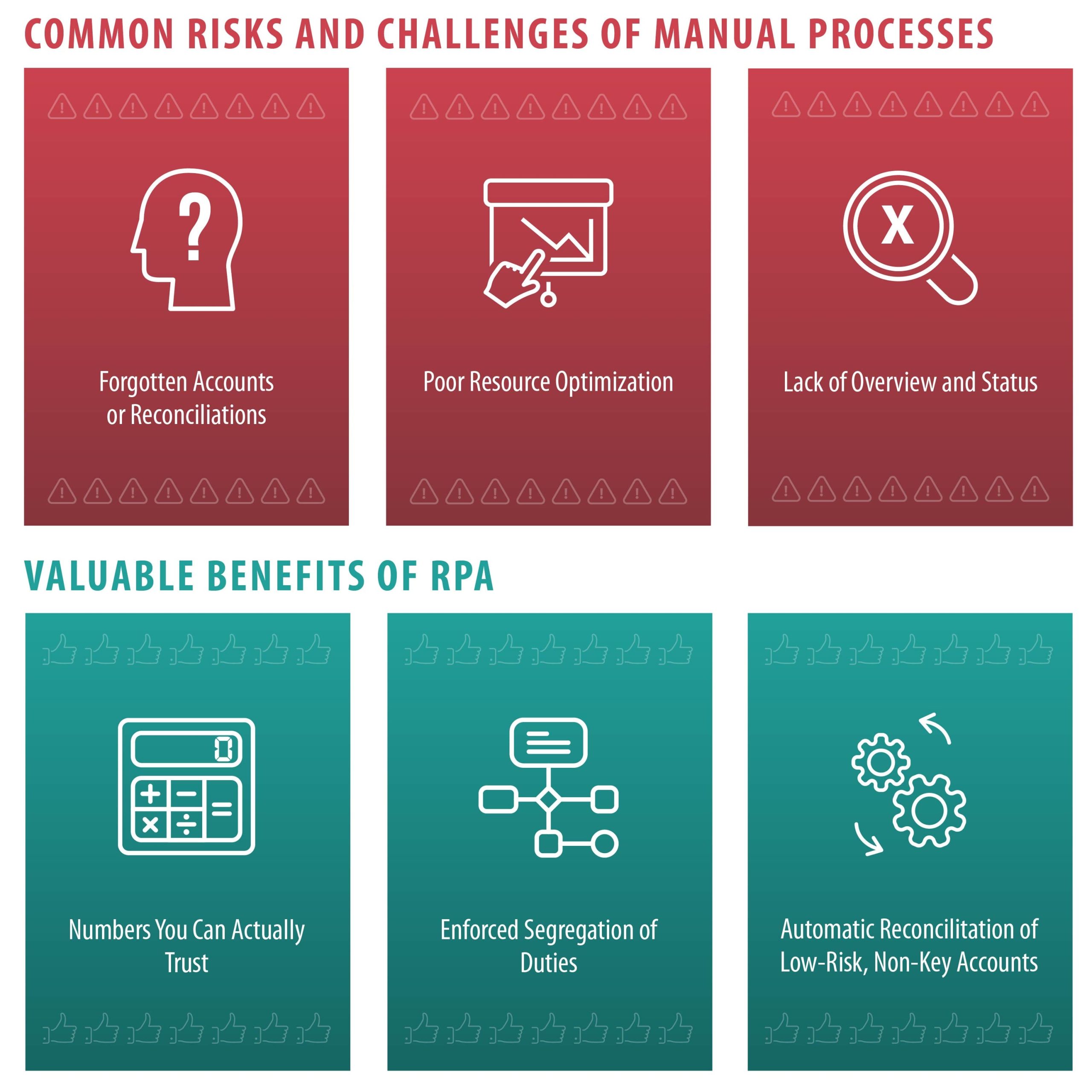

2. Transform challenges into benefits

Manual processes present many common challenges for CFOs and their organizations. With RPA you can take those challenges and quickly turn them into benefits for your team.

Many roadblocks beyond this list that stymie your team when they’re working with manual methods are also opportunities to add value and efficiency when RPA is applied throughout the financial close.

3. Realize the benefits of robotics

Instead of hovering over a manager or analyst’s desk, CFOs can rest easy with greater visibility into the reconciliation process and easily delegate responsibility. Continuous visibility ensures a reliable record of all reconciliation history, leading to actionable items during the period and not just regrets as it ends.

By implementing new technology, a uniform approach irrespective of an organization’s number of internal companies, banks, businesses and accounts becomes the standard. By implementing a customizable solution, you will encourage growth for your team and organization while finding the resources to restructure as needed and maximize your team’s talents.

Technology available to the office of finance is always changing, so people and their processes must be adaptable. A customizable RPA solution will grow with your organization and empower your team to contribute more valuable insights to the business.

To learn more about transforming your office of finance with RPA, download the complete CFO’s Guide to RPA.

Written by: Chelsea Downey