How to Ensure Accurate and Efficient Top-Sided Journal Entries

Blog post

Share

Many firms operate as a parent company (or holding company) with multiple subsidiaries. In such firms, there are adjustments made by the parent company on the accounting sheets of its subsidiaries during the preparation of the consolidated financial statements. This practice is referred to as top-sided journal entry and is allowed within the scope of the Generally Accepted Accounting Principles (GAAP). It is perfectly legitimate practice to allocate some of the parent company’s income or expense to its subsidiaries to accurately reflect business activity. But it can also be used to improperly reduce liability accounts, increase revenue or decrease expenses. Typically, companies record them after the consolidation of journals or ledgers and right before preparing the financial statements. They are also not reflected in a company’s general ledgers and sub-ledgers as those may happen after period-end. If you are a CFO, you should be thinking about what controls you have in place to protect your firm from such risk?

Trintech is helping many firms enhance the controls and automate manual steps around posting top-sided journal entries in consolidation or disclosure management systems to reduce material risk of misstatements in financial reporting.

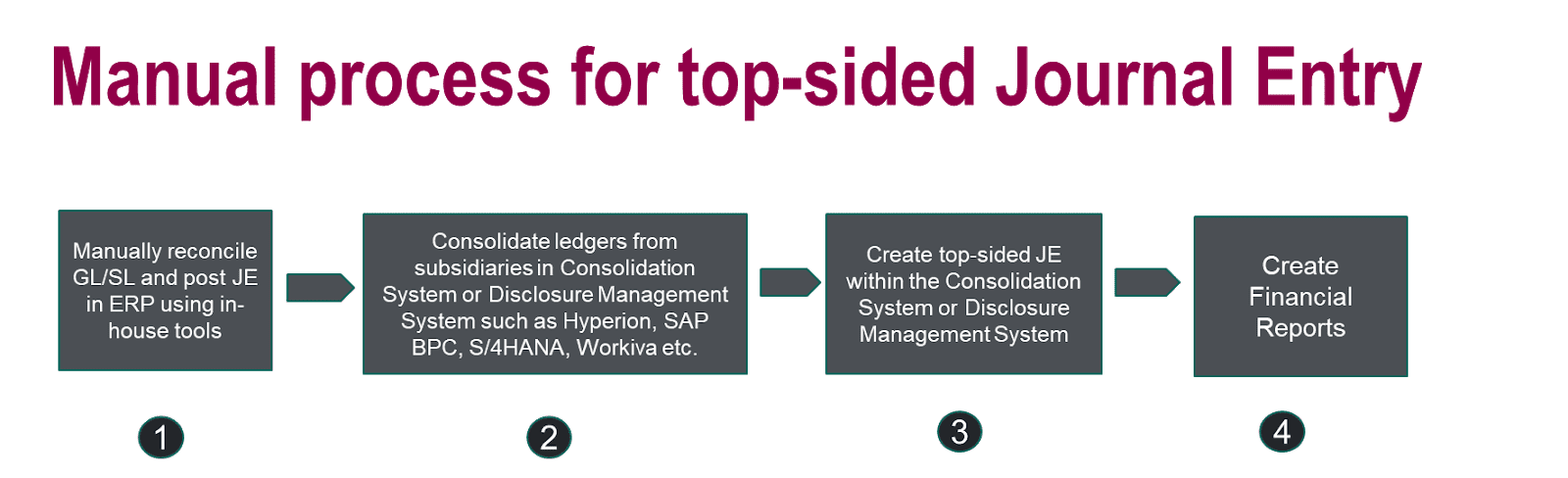

The below diagram depicts the typical flow that firms may use for posting top-sided journal entries

- Manually reconcile general ledger and sub-ledgers and post journal entries (JE) using custom inhouse tools throughout the posting period

- Consolidate ledgers from subsidiaries into consolidation or disclosure management system in preparation for producing financial statements

- Get approval for creating top-sided journal entries via email or non-standard approval process from the leadership team; Post top-sided entries manually in the consolidation system bypassing the GL and SL

- Create financial reports

As you can see, this manual approach not only increases the operational cost but also significantly increases the risk of material misstatements due to the lack of adequate controls with top-sided JE posting. Trintech can help streamline and automate this process, reducing material risk drastically.

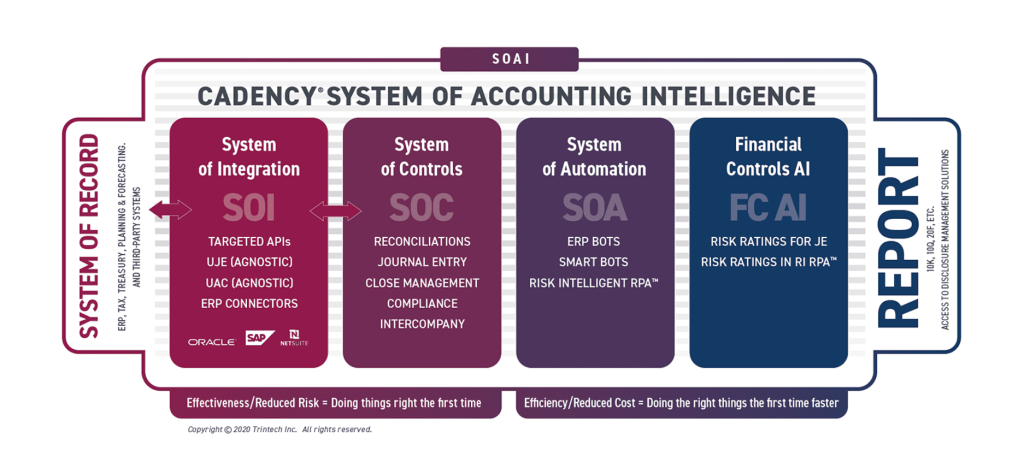

Now you may wonder why you should use Trintech when you have already made investments in an expensive ERP system, consolidation system, multitude of 3rd party tools and home-grown custom solution within your ERP, SAP® ECC6 or have plans to move to S/4HANA. ERP Systems such as SAP® ECC6, S/4HANA, Oracle EBS etc. do a great job at what they were created for but do not provide the automation or controls over the top-sided JE posting to consolidation or disclosure management systems such as Hyperion, SAP® BPC, S/4HANA, Workiva, etc. There are numerous use cases which transcends the system/tools boundaries and that is where Cadency is purpose-built to bridge the gaps via its System of Accounting Intelligence™. You can solve some of these challenges by developing custom integration, but most customizations are prohibitively expensive and do not provide future proofing (for e.g. as firms migrate to/from SAP® ECC6 or S/4HANA). With such approach, you scramble every time you are looking to accomplish a new use case. What your organization needs is to take a deeper look into a comprehensive System of Accounting Intelligence™ (SOAI) platform that includes:

- System of Integration – Leverage purpose-built ERP and JE connectors for major ERPs and APIs

- System of Controls – Automate key Record to Report processes including Reconciliation (Balance Sheet, Intercompany and High-Volume), Journal Entry, Close and Compliance processes that are designed to provide seamless workflow from one process to another

- System of Automation – Apply innovative Risk Intelligent RPA™, such as Dynamic Account Maintenance, Dynamic Approval Routing, etc., to your processes, as well as, a suite of ERP Bots which provide native automation within leading ERPs to provide journal entry automation and close task automation

- Financial Controls AI™ (FC-AI) – Use machine learning algorithms and artificial intelligence to examine trends in your data over time, identify abnormalities, and automate workflows based on the associated risk

The breadth and depth of offerings that Cadency provides is simply unmatched in the Record to Report space. With an extensive roadmap that is continually updated based on market feedback and internal R&D, and differentiated offerings such as a SAP-Certified Connector and ERP Bots, FC-AI (AI Risk Rating for JE), etc. our customers can rest assured that they can grow with Trintech as their business needs evolve over the years.

We understand that the CFO organization is focused on improving and optimizing the Record to Report process to produce accurate financial reporting while reducing risk and cost. CIO organizations care about aligning 3rd party software with their core IT strategies such as standardization of tools and processes, reducing customization effort and support, and ensuring compliance with all security requirements. Cadency is designed with both the CFO and CIO in mind and its core System of Controls provides peace of mind to CFOs while its System of Integration and Automation offering directly aligns with CIO’s priorities. It provides standard interfaces with end to end data and transport security and is completely maintained and supported by Trintech. This not only eliminates the expensive customization, maintenance and support efforts for our customers but also future proofs them for new ERP upgrades. Further, as more and more companies increase their remote working, the Wall Street Journal discusses how companies who rely heavily on cloud-based technologies to automate accruals, adjustments and internal transactions may be in for a smoother close than those that use on-premise technology on virtual private networks or enter data into spreadsheets manually.

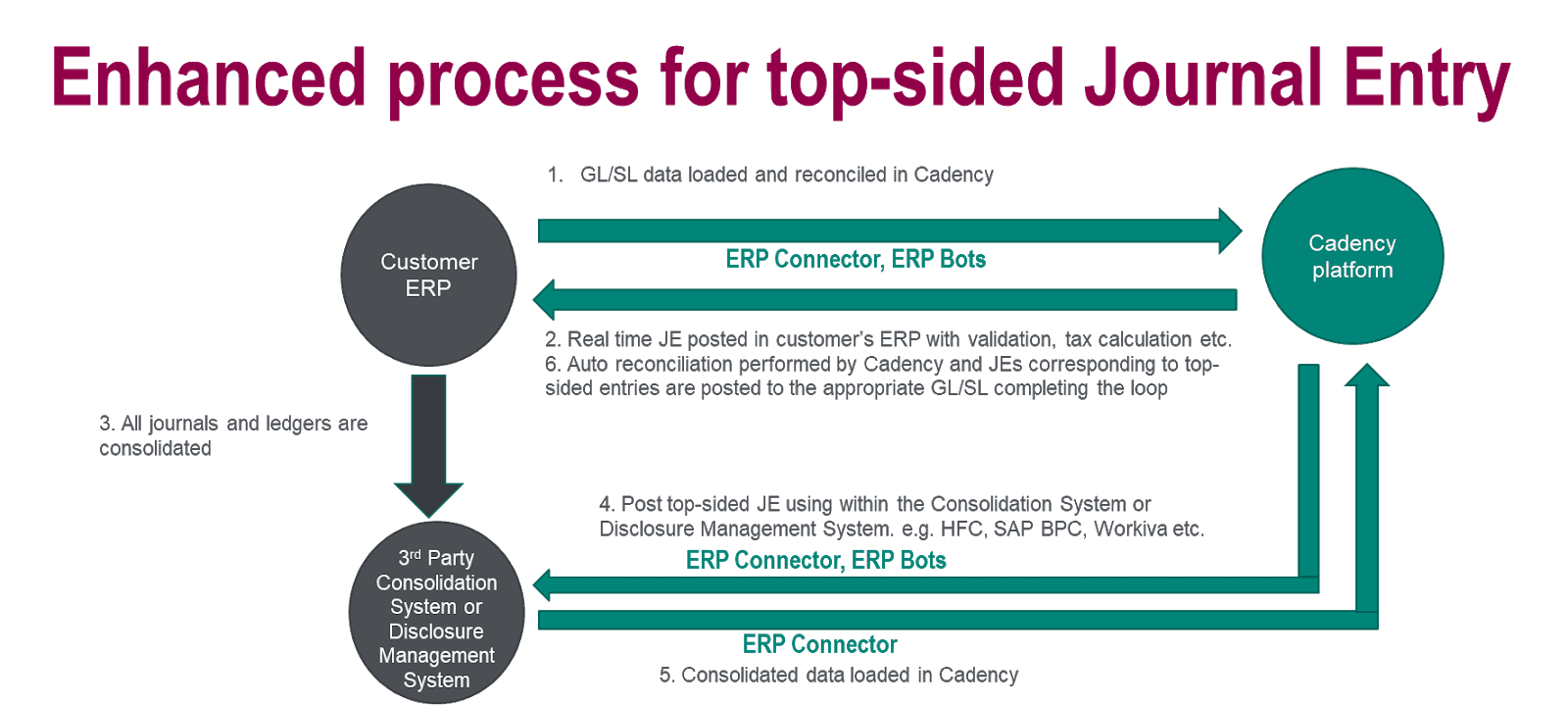

When posting journal entries to consolidation or disclosure management systems, Cadency provides a seamless and comprehensive solution by leveraging Cadency Journal Entry Process (System of Controls), Cadency JE Connector (System of Integration) and ERP Bots (System of Automation) to enhance controls and reduce manual steps. With Cadency, customers can:

- Use Cadency ERP connectors to import GL and SL data in Cadency and reconcile them

- Use Cadency JE Process with ERP Connectors and Bots to post real time journal entries in your ERP with built-in validation, tax calculation, etc.

- Consolidate all the journal and ledgers in consolidation or disclosure management system, e.g. HFM, SAP® BPC, S/4HANA, Workiva etc.

- Use Cadency JE process with ERP Connectors and Bots to post top-sided JE within the consolidation or disclosure management system. This provides the desired controls, auditability and traceability reducing the risk of any irregularities

- Load consolidated data in Cadency using ERP Connector for auto reconciliation

- Post JE corresponding to top-sided entries made in step 4

This is what it looks like after implementing Cadency:

Adopting the above process would lead to material reduction in financial reporting risks and enhances traceability and auditability. For more information on how Cadency can transform your Office of Finance, contact us.