How Cadency’s System of Accounting Intelligence Improves the Record to Report Process

Blog post

Share

Historically, accountants have been perceived by their organizations in a way that does not accurately reflect the value they bring to the table. They were the ones in charge of telling members in other departments that they were over-budget on expenses and under budget on sales. Further, they were seen as an area of the business where boxes simply needed to be checked to adhere to certain regulations and laws. Maybe some accountants are guilty of being the “little annoying sibling”, but that was all the majority of outside teams could see—that, and the perpetual lateness or inaccuracy of reporting. Keeping this history in mind is what led to the “do more with less” mindset that has dominated the accounting profession for years.

In recent years, there has been a shift and the value that accounting provides to the overall organization has grown exponentially. Insights gained from the analysis of financial data can be used to both solve current issues within the organization’s day-to-day activities and to help navigate future challenges.

However, the current approach many accounting departments take to complete the Record to Report (R2R) process hinders them from being able to successfully meet new demands. Spreadsheet usage and a heavy focus on manual processing take valuable time away from accountants that could instead be spent providing critical insights. In order to more efficiently perform the R2R process and free up highly-educated accountants to follow through on these new demands, the Cadency® System of Accounting Intelligence needs to be put in place.

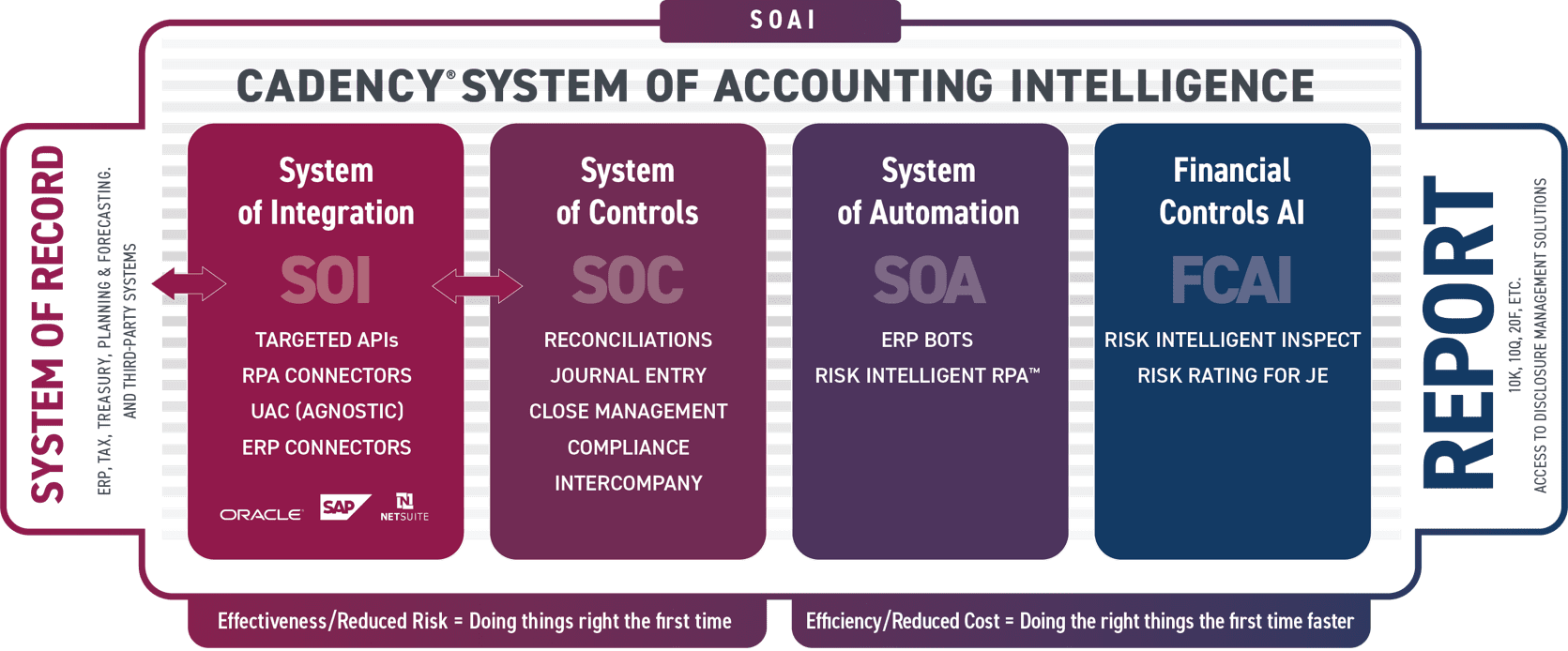

As you can see below, the Cadency System of Accounting Intelligence is built on key pillars that enable organizations to start, or enhance, their R2R transformation journey to achieve cost savings and reduce risk. Within this blog, we will discuss the first three pillars, and explain how a properly implemented System of Record, System of Integration and System of Controls benefit the office of finance.

System of Record

Everyone has a System of Record (SOR) in their organization. The problem is that as organizations grow, whether through organic growth or M&A activities, how they build out their IT environment to accommodate the expansion will impact finance and accounting the most. Either the organization decides to ‘bring along’ the acquired entity ERP and continue to manage it standalone while ‘slamming’ summarized acquired entity data at the month-end, or they do a ‘quick’ addition of the entity into the acquirer ERP. The ramifications are endless for both approaches.

As time goes on, companies may find themselves with multiple ERPs, multiple instances of the same ERP, multiple tax systems or treasury systems and other SORs in which financial data is housed. All of this leads to disconnected or haphazard data profiles. The larger these companies grow, the more complex the environment becomes, the more SORs they accumulate and the more challenging the data.

With so many systems to pull data from, validating the integrity of said data is a time-consuming, disjointed, and manual process. While multiple instances of the system can exist, in order to efficiently verify the accuracy and reliability of an organization’s financial data, a single SOR needs to be established. Centralizing the information ensures that any data that is being referenced or manipulated is accurate, reliable and easily accessed.

After a single source of truth is established in the form of a centralized SOR or in understanding how to standardize data across all SORs, the next step in improving the Record to Report process is to ensure that all of an organization’s day-to-day transactions are accounted for properly.

System of Controls

A System of Controls (SOC) ensures that, foundationally, all activities that are part of the R2R process are defined in their appropriate workspace: reconciliations (whether managed by balances or transactions), standard and ad-hoc journals, controls testing and finally a full blueprint of the financial close cycle. Even without getting to automation, this ensures an organization has a central repository to everything that is happening to support their ability to report with confidence. This creates a single point of truth for the performers, the leaders and auditors. To the point above regarding M&A, an established SOC enables the organization to easily divest (send them on their way with their own financial close tools) or acquire (set expectations and deadlines to comply with your close).

Additionally, these controls can be pressure tested at any point in order to ensure effectiveness, most commonly, this is performed during an organizations close period. Possibly a greater benefit is the bridge that a single System of Controls becomes to the multiple SORs an organization will require.

System of Integration

Once you have established the System of Controls, the System of Integration (SOI) can be implemented in order for your System of Record (SOR) to communicate with your System of Controls (SOC). The System of Integration (SOI) consists of APIs, ERP Connectors and Robotic Process Automation (RPA) Connectors. These technologies enable systems to communicate with one another in order to remove additional manual processes. For example, the SOI removes the need for accountants to pull data out of the SOR to manipulate it and upload it back in for others to perform the next step in the R2R process.

This approach not only gives accountants some of their time back by removing manual aspects of their job, but also helps to promote the integrity of the data as the centralized SOR is involved with, and has a record of all data processing. Even better, this SOI begins to address IT’s specific role in the financial close process so they too can focus on high value-added activities to support the organization.

Conclusion

As time goes on, the pressure felt by the office of finance (and the CIO’s team) to provide new levels of value to the organization will increase. In order to not only perform the historical duties expected of accountants but to rise to the new expectations placed upon them, change needs to take place.

The Cadency System of Accounting Intelligence combines advanced automation technologies, such as Artificial Intelligence (AI), Robotic Process Automation (RPA) and Bots and strategically applies them to support the often complex and complicated R2R process from end to end. These technologies offer unique, powerful solutions to some of the most complex accounting challenges and readily scale as the financial transformation journey evolves and businesses grow.

To learn more about how the Cadency System of Accounting Intelligence can benefit your organization, check out our webinar.

Explore the Full Series on Cadency’s System of Accounting Intelligence

- Part 2 – System of Automation

- Part 3 – Financial Controls AI

Written by: Caleb Walter