The Benefits of Financial Automation in Your Balance Sheet Reconciliation Process

Blog post

Share

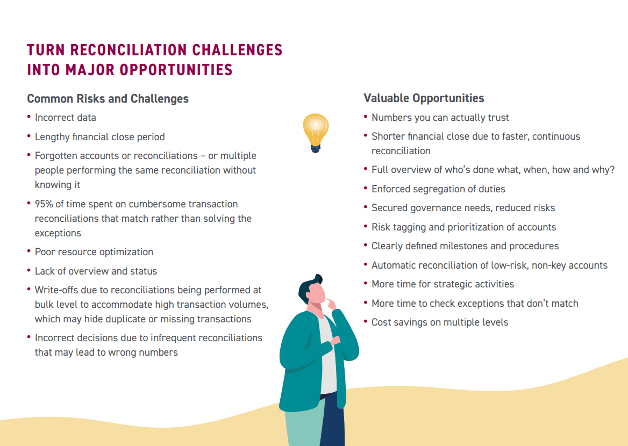

Accountants love spreadsheets. In fact, some finance and accounting teams still rely on a traditional close process made up of manual methods and spreadsheet systems. However, there are many risks and challenges that are introduced into the close cycle when these approaches are utilized. (See Blog 1 of this series where we dive into those risks and challenges in more detail.)

Fortunately, it’s possible to augment this love of spreadsheets with best practices for reconciliation management.

Optimizing The Reconciliation Process

The demand for fast, accurate reconciliations is always present for accountants, and automation can help produce reliable results. Many companies are investing in solutions to free up time for more value-adding activities, like drilling down on open entries or exceptions that require additional attention.

To secure a powerful reconciliation process, it is important to analyze it at a high level. Rather than looking at individual accounts or subledgers, it is important to constantly review all processes to improve their speed and quality. This requires prioritizing certain accounts, assigning risk levels, creating a clear segregation of duties —all with a transparent overview.

Adra Balancer provides the speed, accuracy and control needed for the balance sheet reconciliation process. By automatically reconciling low-risk accounts based on predefined business rules, Balancer lets preparers focus on high-risk accounts such as accounts receivable, accounts payable and other key accounts. Accounting managers can quickly identify bottlenecks and potential write-off risks, while housing all of the substantiation and documentation required to provide full visibility into your balance sheet. If a balance changes after it is certified, the preparer and approver are automatically alerted to re-validate the account. Instant tracking of each reconciliation creates an audit trail that is readily available to any internal or external reviewer.

With a modernized workflow, the right people will now have full control and visibility throughout the entire process. If there is a mistake, it is immediately flagged and corrected before the process continues. This greatly increases efficiency, which makes it much simpler to scale the business and its controls in the future.

Modernization Will Attract Talent

Today’s leading accountants are technology-savvy. Continuing to expect your accounting team to perform tedious, time-consuming manual processes prevents them from developing into strategic contributors for the company. It is important to remember that most of your team members chose the finance and accounting field because it challenged their creativity, problem-solving and communication skills. They didn’t become accountants to be consumed by painful, manual data entry on weeknights and weekends. It is important to find ways in which they can spend more time working on higher-level, value-added tasks. This is not only beneficial for their growth but also generates high-quality results for the company.

Conclusion

Balance sheet reconciliations are a main, important part of the overall financial close. With financial automation serving as a clear and reliable navigation map, it’s difficult to get lost. Leveraging modern technology can help you achieve a strong reconciliation management strategy and with that, you can manage the financial close process more efficiently and with full control.

“Before Adra, everything in our business was manual and based on spreadsheets. We had no visibility to easily see where a client was. Spreadsheets were constantly in different versions, and errors were common because people were getting locked out of the information they needed when they needed it. In our manual days, we dealt with far more errors. Employees would need to debit an account, but if they completed the debit or not was not immediately visible. With Adra, we took away many errors. I can see everything right there on the dashboard screen. It’s so much faster with a lot less room for errors. My accountants can see what they’ve done, and they can put notes on reconciliations that are ready for whoever needs to look at them. This is great for handing off accounts, as all the notes are ready and accessible. No more locked spreadsheets!” –Heartland Payroll Solutions

To learn more about how Adra Balancer can assist with your balance sheet reconciliations, talk to one of our experts.

Written By: Jose Alonso