Identify and Solve Your Greatest Intercompany Accounting Challenges

Blog post

Share

In a global 2020 Trintech study comprised of enterprise organizations across the globe, intercompany was the third most identified challenge within their Record to Report process — a greater issue than transaction matching, journal entry and compliance.

In order to understand why intercompany accounting is a significant issue for organizations, it is important to recognize the main challenges involved and how to resolve them.

“The effectiveness of a company’s intercompany accounting process has an impact on its speed to close, the complexity of its accounting practices, and its exposure to regulatory risk; it can create an administrative burden for accounting staff for what is essentially an internal, non-value-creating process from the shareholder perspective. Getting it wrong can have serious financial implications.”–Optimizing the Intercompany Accounting Process, The Hackett Group

Intercompany accounting is easily one of the most complex and complicated challenges the Office of Finance is required to handle. However, it is often not given the support and attention it deserves, which creates many issues for the Office of Finance that affect the integrity of the overall Record to Report.

Challenges of A Typical Intercompany Accounting Process

The concept of intercompany accounting seems simple enough — organizations operate as usual and when resources and goods are exchanged between entities, the invoices are sent and the transactions are recorded. But because these activities are typically performed manually, issues arise.

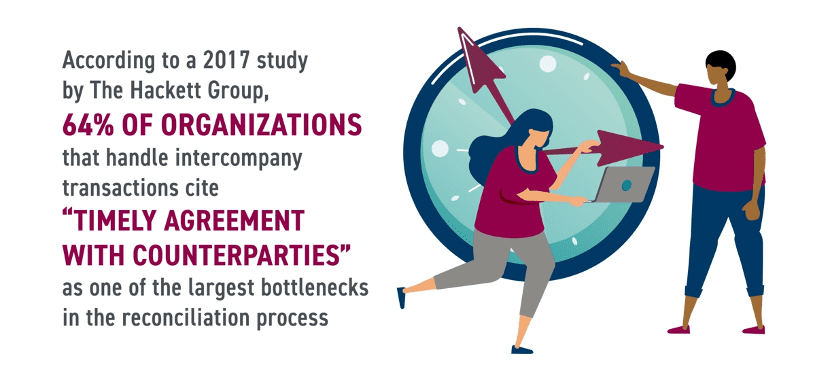

Timely Agreements Between Counterparties

To an outside party, it might seem fairly straightforward that when a resource is exchanged between entities, an invoice is sent and they each reconcile it in their own books. But what if there is a dispute between the two entities about the transaction? An ongoing intercompany balance that is unconfirmed for several days can result in greater implications, it if it is ever discovered at all, such as the increased chance that it will end up as a write-off.

Absence of Visibility and Control

Because intercompany accounting rarely gets the amount of attention it deserves, the process likely lacks standardization across the entire organization. The resulting deficit of visibility and control into trade and non-trade transactions creates unnecessary risk. Also, the over-reliance on key people throughout the reconciliation process causes an absence of defined ownership, and the transaction might never make it into the general ledger. This erases the existence of a single source of truth for the Record to Report process, compromising the integrity of the data that is fed into the Office of Finance.

Leading Intercompany Best Practices: An Intercompany Reconciliation Tool

A financial automation solution that effectively supports intercompany reconciliation, like Cadency by Trintech, enables organizations to establish an overarching system of controls to resolve these challenges.

Establish One Source of Truth

Standardization is an important element to establish across the intercompany reconciliation process, especially when it comes to data. Recording the intercompany transaction in different ways through different ERPs— especially if the ERP vendors differ — will no doubt compromise the accuracy of the reconciliation process, as well as the entire Record to Report. It is important that there is one central place to record and refer to data.

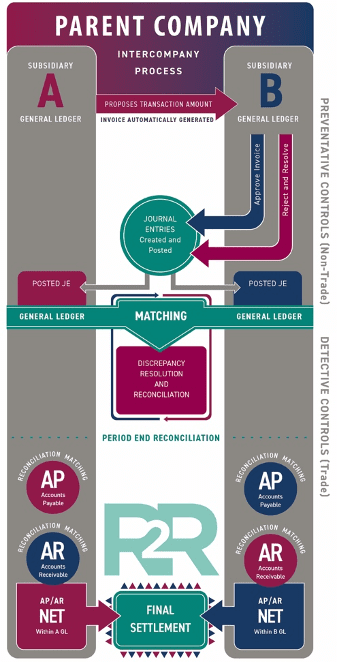

Implement A Standardized System of Controls

Though standardizing data is important, standardizing your process is equally critical. Cadency implements a System of Controls across your Record to Report to maximize the controls involved in the intercompany process. This diagram demonstrates how Cadency utilizes purpose-built preventative and detective controls to provide assurance on intercompany positions. Part of the Cadency platform is a pre-defined workflow that helps to standardize and facilitate the intercompany process from initial transaction to final statement.

Though standardizing data is important, standardizing your process is equally critical. Cadency implements a System of Controls across your Record to Report to maximize the controls involved in the intercompany process. This diagram demonstrates how Cadency utilizes purpose-built preventative and detective controls to provide assurance on intercompany positions. Part of the Cadency platform is a pre-defined workflow that helps to standardize and facilitate the intercompany process from initial transaction to final statement.

Cadency has reduced the number of write-offs for organizations by up to 62%.

When an intercompany transaction needs to be reconciled, Cadency notifies the appropriate parties and enables the submission of supporting documents while enforcing a controlled environment to ensure that the transaction is reconciled between both parties accurately and on a timely basis. After both parties agree on the transaction, journals are automatically generated and posted to each respective ledger as originally planned.

Cadency reduces preparation time on reconciliation for approvers and reviewers by up to 75% with its dashboard that shows when a reconciliation is due, who is responsible for its review and approval, as well as shows where it is in the system.

Organizations can finally have the visibility and control throughout the intercompany accounting process that they require.

Learn more about how Cadency can transform your intercompany accounting process to best-in-class.

Written by: Ashton Mathai