4 Best Practices to Enhance Your E-Commerce Reconciliations

Blog post

Share

The past year has forced businesses in all industries to drastically pivot their operations and embrace e-commerce shopping platforms. In addition, consumers have also changed their shopping habits, opting for online and delivery over traditional in-store shopping. This collective preference of online shopping has popularized contactless and online payment providers, prompting e-commerce businesses to accept more payment vendors.

The digital pivot to e-commerce has impacted how businesses and their back-offices operate. In order to remain competitive while keeping up with multiple payment vendors, e-commerce enterprises must rethink their manual reconciliation process and embrace process automation. Discover the four best practices to effectively enhance your e-commerce reconciliations and future-proof your Office of Finance.

1. Evaluate Your Existing Reconciliation Processes

Balance sheet reconciliations serve as the foundation of your financial close; although a repetitive and often tedious portion of the close process, reconciliations also present a high potential for risk and bottlenecks. By evaluating your existing reconciliation workflow, e-commerce organizations can identify potential challenges and correct them before they become far-reaching consequences.

Because e-commerce businesses often have a high volume of transactions rolling in, reconciling transactions without a standardized and automated solution in place inevitably leads to higher instances of data entry risk, misstatements, regulatory and compliance risk, and more. In addition, the tedious nature of reconciling transactions can result in workflow inefficiencies, bottlenecks, and delayed deadlines if still depending on manual methods and spreadsheets.

When analyzing your reconciliation process, ask your F&A team where they struggle most. Is it the additional hours needed to stay on top of reconciliations every day? Are they missing time-sensitive deadlines? Is the lack of visibility translating into excessive emails and status meetings? Pinpointing current challenges not only prevents them from compounding but also enables financial transformation to turn those challenges into opportunities.

2. Prioritize People Alongside Processes and Technology

While there is often an emphasis on Robotic Process Automation (RPA) and digital transformation, organizations must also prioritize their people. Implementing financial transformation technology without upskilling your F&A team beforehand further reduces the probability of success. Refining your talent and giving them the skill set to be successful drastically improves the return on investment in your transformation journey.

“While standardizing processes and adopting technology to automate those processes is extremely important — a huge component of financial transformation comes down to your most valuable assets — your people. It is critical to think about people, process, and technology in parallel because they are the key components to transform an organization’s Office of Finance.”

3. Embrace Financial Transformation to Meet Current Demands

As consumers embrace the usage of contactless and online payment providers, it is crucial that e-commerce retailers also keep up with the digital economy and transform their financial processes to meet the needs of their customers.

“Contactless is the present and future of in-person payments. 2020 brought with it a rapid acceleration of digitization and reinforced the importance of digital solutions — like contactless — to help meet our everyday needs.”

– Ajay Bhalla, President of Cyber and Intelligence at Mastercard

Third-party delivery providers, such as UberEats and GrubHub, and online payment vendors, such as Apple Pay and PayPal, have not only added a level of complexity for retailers, but retail accountants now have multiple vendors to reconcile on a daily basis. Previously, accountants were matching the point-of-sale (POS) transactions with credit card transactions to bank statements, with the biggest pain being managing the credit card fees. Now, managing credit card reconciliations alongside high-volume transactions has become too complex of a process for manual methods alone.

The acceleration of digital transformation and intelligent automation further reinforces the notion that manual, time-consuming Record to Report (R2R) processes have not only become obsolete but also highly inefficient in today’s growing demands. As a result, e-commerce retailers must realize that delaying financial transformation is costing their business more than the actual transformation project itself.

4. Standardize and Automate Your Reconciliations in Tandem

With the rise of different payment vendors in the current economy, e-commerce retailers are struggling to efficiently reconcile various accounts, providing the perfect opportunity for financial transformation.

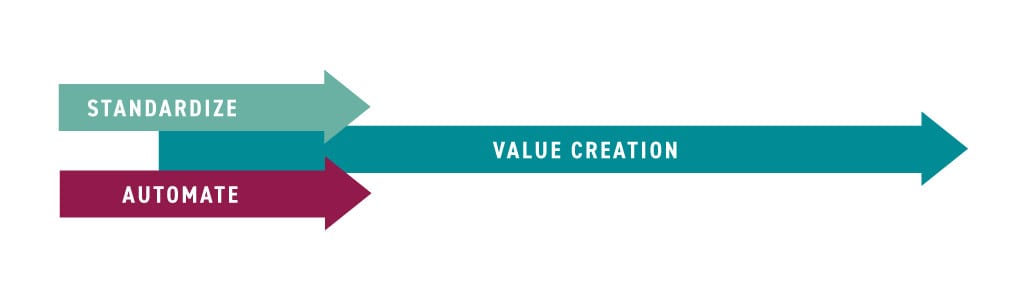

Instead of jumping at the opportunity to automate your reconciliations, organizations must standardize and automate their reconciliations in parallel. Leveraging technology to fast-track a flawed and disorganized process further exposes companies to additional risk. By laying down the proper foundation for financial automation, organizations can achieve a healthier and quicker return on investment.

By implementing these four best practices, e-commerce organizations can effectively turn existing challenges into opportunities, upskill their people alongside processes and technology, fully embrace the need for financial transformation, and standardize and automate their reconciliations in parallel.

[cta-content-placement]

Written by: Alex Clem