Intercompany Accounting Best Practices

Blog post

Share

Managing Challenges of Intercompany Accounting

Handling intercompany transactions while successfully managing financial risk in the Record to Report process is not easy. The intercompany accounting process spans across the organization and across business units that might be located in different regions, countries or continents.

This creates a web of conflicting policies and processes when handling intercompany transactions that results in a very inefficient, costly process.

While the intercompany process adds no value to an organization’s revenue, it can certainly impact the bottom line as the P&L is impacted by high costs, regulatory fines, currency exchange risks, poor utilization of cash & potential risk of write-offs.

Additionally, this inefficient process often creates additional pressure on the month end close, as well as adding frustration for the finance team who must resolve these challenges knowing that it adds little or no value to the organization. The downsides of a poor intercompany accounting process are significant.

Organizations can only put off transforming the intercompany accounting process for so long — and the longer organizations delay solving their biggest intercompany challenges, the higher the chance that they will be caught in this continuous cycle of high costs and inefficiencies.

What a Best-in-Class Intercompany Accounting Approach Looks Like

The best way to solve your intercompany challenges isn’t by looking at just the intercompany piece of the financial close. In fact, leading organizations — such as LKQ Corporation — simultaneously managed financial risk and alleviated their intercompany issues by taking a holistic approach to their Record to Report process.

A best-in-class approach to solving intercompany problems begins with taking a step back to:

- Standardize the account reconciliation, close management and journal entry processes

- Optimize these processes with a framework of key financial controls and policies

- Automate the resulting improved processes with financial automation software to enforce the system of controls that has been created, and further improve efficiency by reducing workload

Implementing these steps before designing a customized approach to intercompany transaction management identifies and simplifies the underlying complexities of the Record to Report that are often the source of common intercompany challenges — rather than only fixing these challenges on the surface with point solutions as other methods do.

“Today, we are loading about 100,000+ records and auto-reconcile over 90% of those intercompany reconciliations, which has been a significant win for us.” –LKQ Corporation

After streamlining the account reconciliation, close management and journal processes as a whole, how can you now layer in a risk-based, intercompany best practice approach with financial automation software like Cadency?

How to Implement 5 Intercompany Accounting Best Practices With Cadency

Intercompany Best Practice #1: Establish and Enforce Intercompany Policies

Managing risk within the intercompany accounting process starts with developing and enforcing intercompany policies that are specific to the organization. Preparation and approval workflows can be designed and enforced within financial automation software, along with transaction controls.

When companies are in different regions, countries or continents, having these foundational policies for intercompany reconciliation streamlines the process, and reduces the risk of error, as well as the chance that these intercompany transactions end up as write-offs.

How This Works In Cadency

Once Trintech’s Record to Report experts help the organization develop cohesive intercompany policies and procedures, automatic workflows are set up within Cadency to enforce those policies and begin actively mitigating risk. For example, Cadency will carry out transaction preparation and approval workflows, along with any associated requirements (like requiring attached invoices).

Intercompany Best Practice #2: Standardize the Initiation and Booking of Intercompany Transactions

An enforced, standardized approach to initiating and booking intercompany transactions is critical to effectively managing financial risk in the Record to Report, especially if the company is global, or steadily growing (perhaps through M&A events). When the proper initiation and booking of intercompany transactions is recorded, it reduces risk because entities will no longer leave critical data fields out of intercompany recordings.

How This Works In Cadency

Cadency has configurable workflows to support the standardized and documented initiation, booking and posting processes. These workflows are designed to support the intercompany transaction exchange processes, as well as the desired workflow threshold approvals.

Template-based transaction initiation can be configured for the following:

- Supply chain entities: inventory and fixed assets, royalties and commissions

- Corporate entities: pay on behalf/reimbursements, service agreements, loans, corporate allocations, and dividends

After the transaction is initiated and ready, the following best practices can be applied to the booking process inside Cadency:

- Requirement of attachments in the transaction (transactions can also be rejected upon review of the attachments)

- Mandated approval of transactions for processing and posting entries back to the ERP automatically after approval (or without approval, depending on the case)

- Collaboration between teams such as the tax team to ensure that tax codings are correct

- Automatic triggering of intercompany invoices

- Ability to review generated intercompany transactions

Intercompany Best Practice #3: Automate Intercompany Matching and Reconciliation Processes

Automating the overall matching and reconciliation processes reduces the workload of finance and accounting teams to be able to focus in on specific areas like intercompany accounting. Whereas before automation, accountants would spend time manually matching transactions and reconciling accounts evenly across the board — regardless of the item’s level of importance (such as a high-risk account, or a disputed intercompany transaction, which could end up as a write-off).

How This Works In Cadency

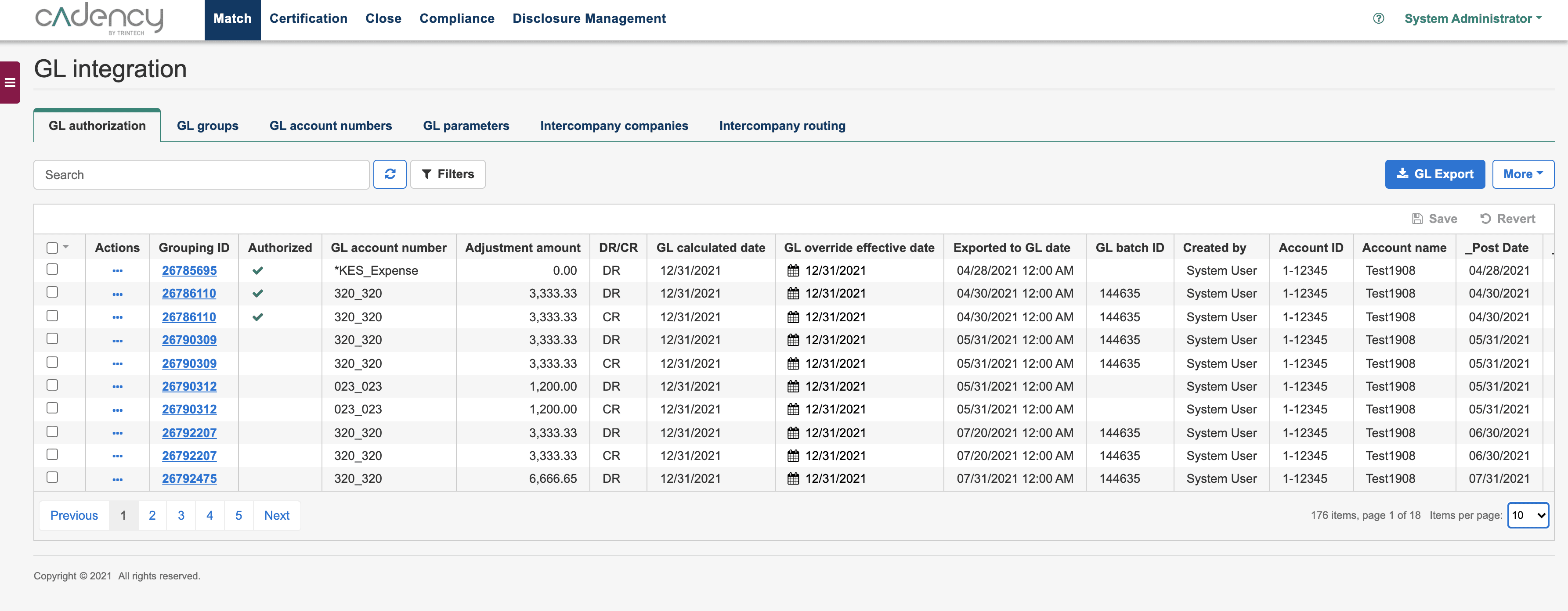

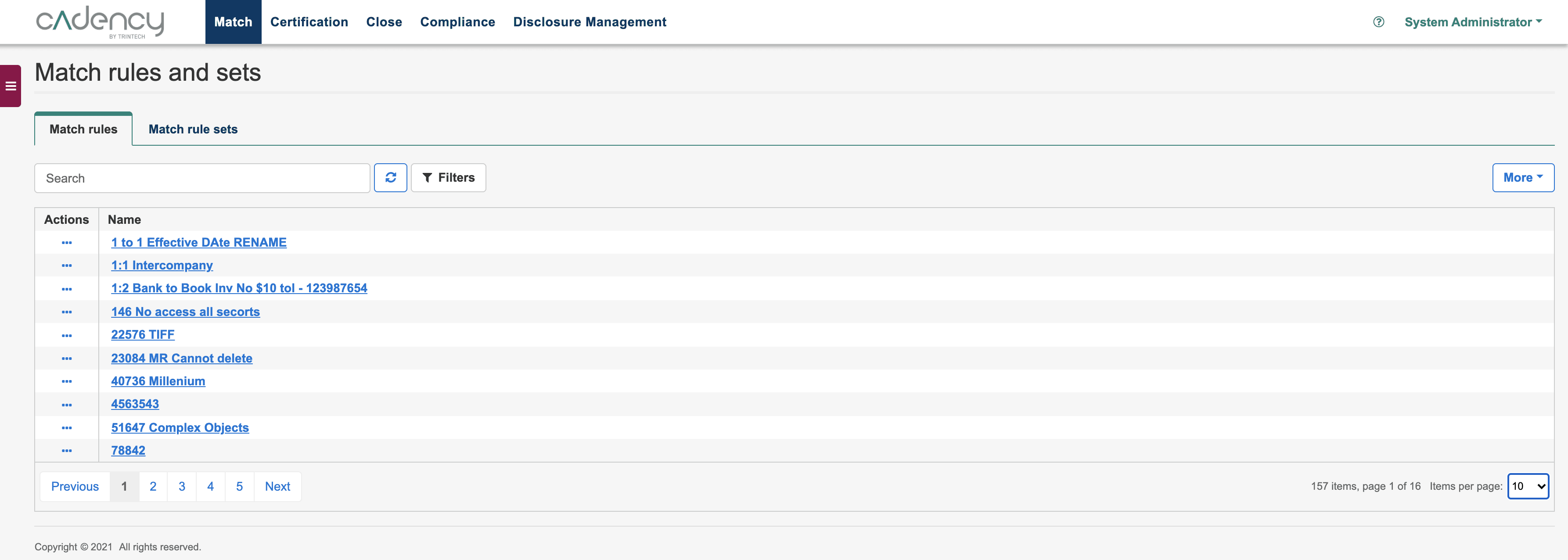

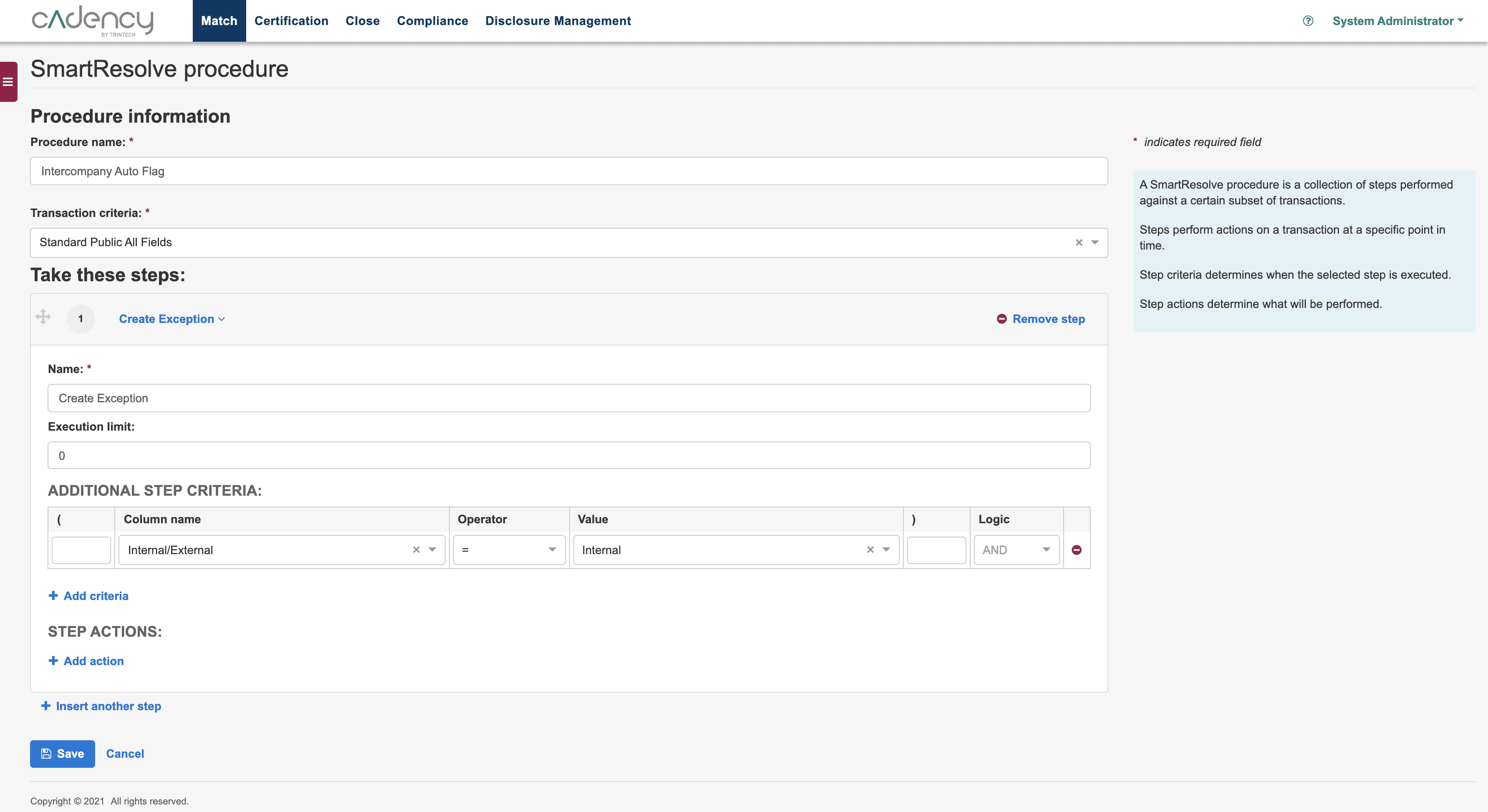

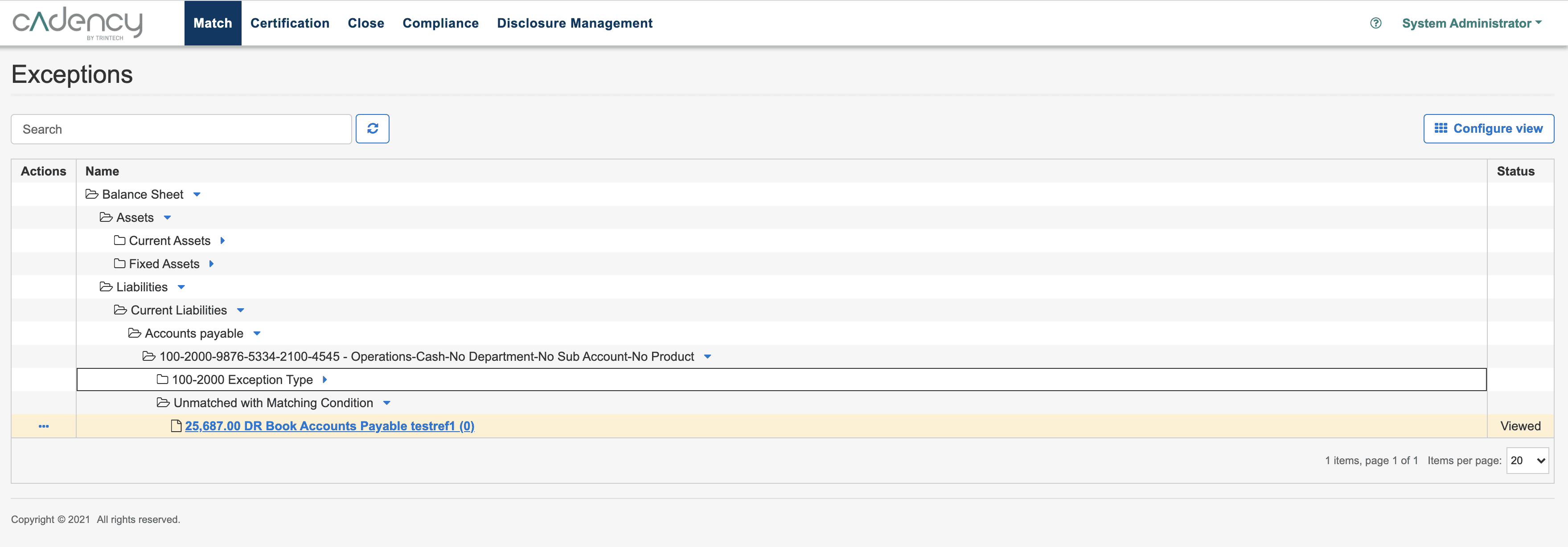

Leverage customized rules and key financial controls for automated matching and reconciliation items, including intercompany transactions, within Cadency. Exceptions can be identified, flagged and managed through an interactive dashboard in order to reconcile and investigate further for research or variance analysis reporting.

Cadency customers have experienced time savings of up to 80% in transaction matching, and up to an 81% reduction in the number of accounts to be reconciled. Instead, they’ve been able to allocate that time to other higher priority tasks, like reducing write-offs from reconciliations by up to 62%.

[cta-content-placement]

Intercompany Best Practice #4: Streamline Consolidation, Reporting and Intercompany Elimination

When organizations prepare their consolidated financial statements, many activities arise that would be less time-consuming and easier within a financial automation software solution like Cadency:

- Converting Foreign Exchange (FX) to reporting currency

- Reversing intercompany sales, cost of goods sold (COGS), accounts receivable and accounts payable

- Consolidated results

How This Works In Cadency

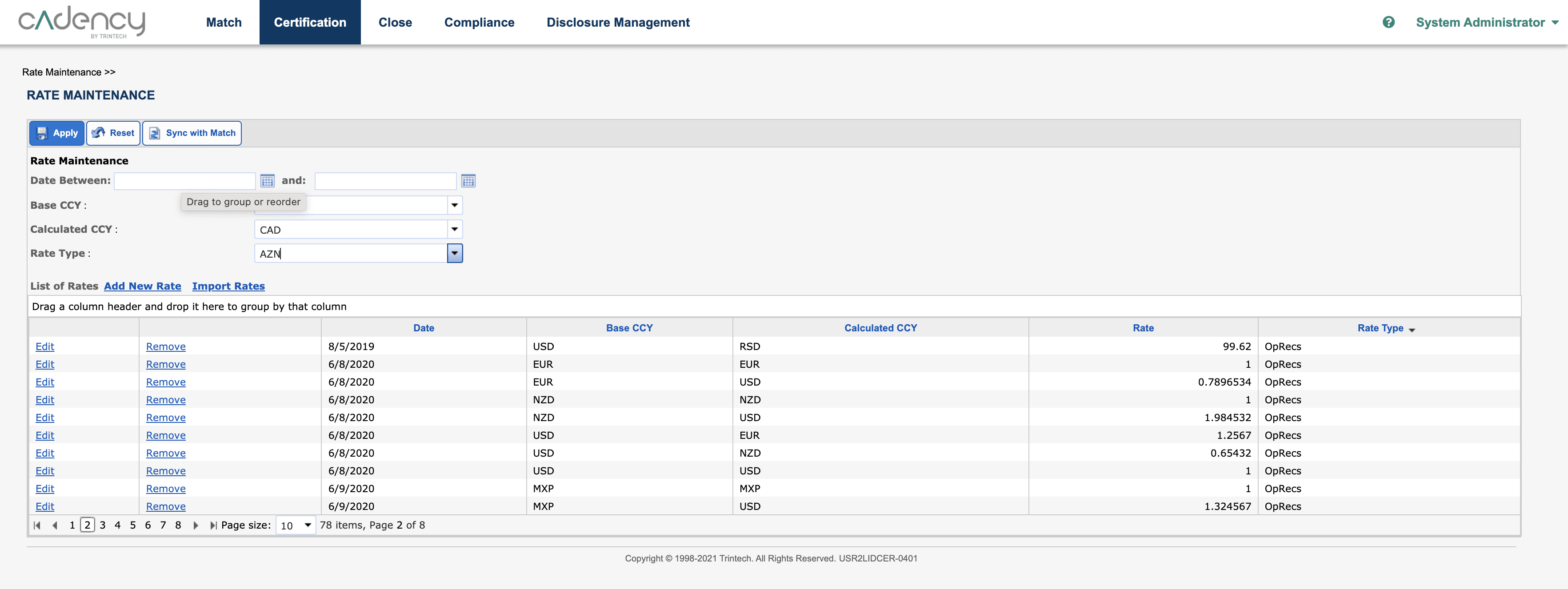

- FX rates can be maintained and integrated for processing and reporting

- Reversal entries can be performed within Cadency

- Reporting can be leveraged to provide overall out of balance reporting

Intercompany Best Practice #5: Drive an Optimized Dispute Resolution Process

A study from The Hackett Group found that 64% of organizations that handle intercompany transactions state one of their biggest bottlenecks is “timely agreement with counterparties”. Delays increase even more when that timely agreement morphs into a dispute of an intercompany transaction. So how do organizations optimize these challenges with key financial controls so they don’t bottleneck the entire process and end up as write-offs?

How This Works In Cadency

Cadency has the capability to research past intercompany disputes in order to create an associated workflow to manage any future disputes. This includes driving workflows even outside of Cadency when required, documenting the status and finalizing the resolution of the dispute with any required supporting documentation attached. Items are also tracked within Cadency for escalations.

Think about your current intercompany accounting process. How many of these intercompany accounting best practices do you currently apply? How many could you put into practice with a financial automation software solution like Cadency? What could a standardized, optimized and automated Record to Report save your entire organization?

Without a holistic approach to not only intercompany accounting, but account reconciliation, close management and journal entry processes, finance and accounting won’t be able to meet compliance standards AND the strategic, analytic needs of the organization.

Learn more about setting up a System of Controls within Cadency to solve your biggest intercompany challenges.

Written by: Ashton Mathai