Efficiently Managing Your Financial Close Tasks While Outside the Office of the CFO

Blog post

Share

CadencyDirect® on the Now Platform® Enables Streamlined Task Management Related to Account Certification

When the Office of Finance champions financial transformation within the company, a primary goal is to reduce the complexity of the financial close, saving the organization time and money while simultaneously reducing risk and error. But solving the problem of close complexity requires understanding what exactly makes this process so complicated in order to effectively mitigate those risks.

The most common causes of financial close complexity usually boil down to three things:

- An overreliance on manual methods

- Disorganized methods for managing your financial close tasks

- A lack of a standardized process

In terms of the overall financial close process, leading companies must tackle these challenges by implementing a solution that provides valuable automation — starting with account reconciliation activities.

Most digital solutions for the financial close limit themselves to automation, task management, and process control exclusively within the Office of Finance. But merging your financial transformation into the company’s overall digital transformation requires a solution that extends past the often siloed Office of the CFO and brings key tasks and process management workflows related to the close to other departments. A true enterprise workflow software tool is needed to make that extension, while retaining the deep security, audit, task and process controls expected by the Office of Finance.

Here’s a common example: the preparation of consolidated financial statements.

While the Office of Finance is responsible for the period close, the act of certifying company accounts as a part of that close is also a critical milestone for the consolidation team — which often sits outside of the Office of Finance in large enterprises.

In addition to gathering financial data from various sources (Procurement, Tax, Treasury, Finance, etc.), building consolidated and accurate financial statements also mandates completed and certified accounts. Statement processors must know the balances they are working with are valid, accurate, and certified — a determination made by the Office of Finance.

Enterprise workflow systems connected to the Office of Finance can assist in automating this process, but the fact is that merely automating the process isn’t enough.

To ensure a successful process, oversight and real-time analysis availability must also be present.

Leaders within an organization should be able to easily determine how close processes are progressing throughout the period and quickly identify risk and exceptions, especially those that impact overall consolidation efforts. The identification of bottlenecks, such as a preparer who has not yet processed multiple available (and certified) account balances, or a managerial approver who has preliminary draft statements stacked up and awaiting approval before final consolidation can occur.

Managing Your Close With CadencyDirect® by Trintech In and Out of the Office of Finance

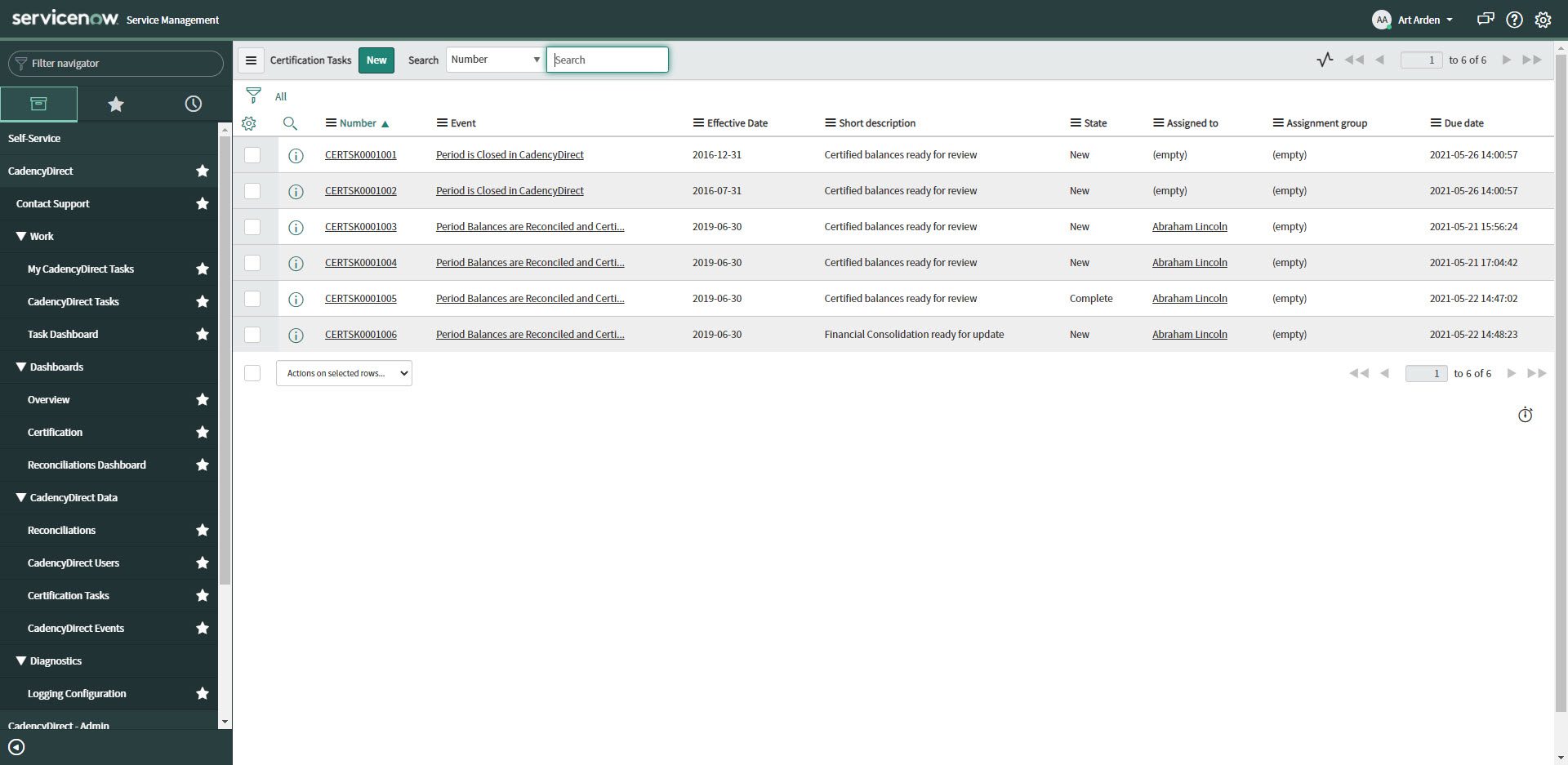

CadencyDirect (available on the ServiceNow® platform) leverages the power of ServiceNow® to link the account reconciliation process to the broader enterprise; where teams like Consolidation or FP&A can make use of automated workflows based on updates in the Account Certification process, whether those workflows are single-task events or multi-stage and complex efforts that involve multiple teams.

Within the Now Platform®, CadencyDirect drives best-practice processes for managing your financial close tasks in a standardized methodology that is shared across all other departments in the enterprise that also leverage ServiceNow® for workflows. Leaders in the organization — whether a part of the Office of Finance or not — can manage this automated and organized task process easily within the enterprise workflow software solution they’re already using.

Current state and a history of created workflows and tasks, drill-through capability, and real-time insight into complex workflow status are only a few of the benefits provided by ServiceNow®. Applying those same controls in the same way to generated, close-related tasks not only makes sense, but reduces the headache and frustration of managing multiple processes.

As the only native Built on Now® app for the financial close, CadencyDirect enables ServiceNow® customers to leverage the same process management capabilities they’ve come to trust in the industry leader for workflow.

An enterprise workflow software tool yields limited results unless it is truly applied to the entire enterprise. Ensuring that financial close tasks — that have traditionally been separated from the rest of the organization — and data are managed in the same enterprise system as everything else eliminates needless complexity, thereby reducing the risk by improving the accuracy of that data.

Only a comprehensive end-to-end financial close solution can enable the timely delivery of accurate financial data to inform critical business decisions based on the information provided by the Office of Finance. With CadencyDirect on the Now Platform®, your company can achieve the increased efficiency, reduced cost, and reduced risk of a true enterprise-level automated financial close solution.

To learn more about CadencyDirect — whether you are a current ServiceNow® user focusing on finance function transformation or are just beginning your digital transformation journey — download the solution brief.

Written by:

Written by:

Christopher Witt

Director of Product Management for CadencyDirect