Take Your Financial Close to World-Class

Blog post

Share

Despite the digital age we all live in, it is not uncommon for enterprise organizations to rely on spreadsheets, emails and phone calls to manually manage tasks critical to the financial close process.

Despite the digital age we all live in, it is not uncommon for enterprise organizations to rely on spreadsheets, emails and phone calls to manually manage tasks critical to the financial close process.

Still, this approach is not a strategic, beneficial, growth-oriented, or long-term solution. Should your highly skilled people be focused on managing menial, manual activities? Or should they deliver valuable real-time financial insights to your business so it can grow and adapt as required?

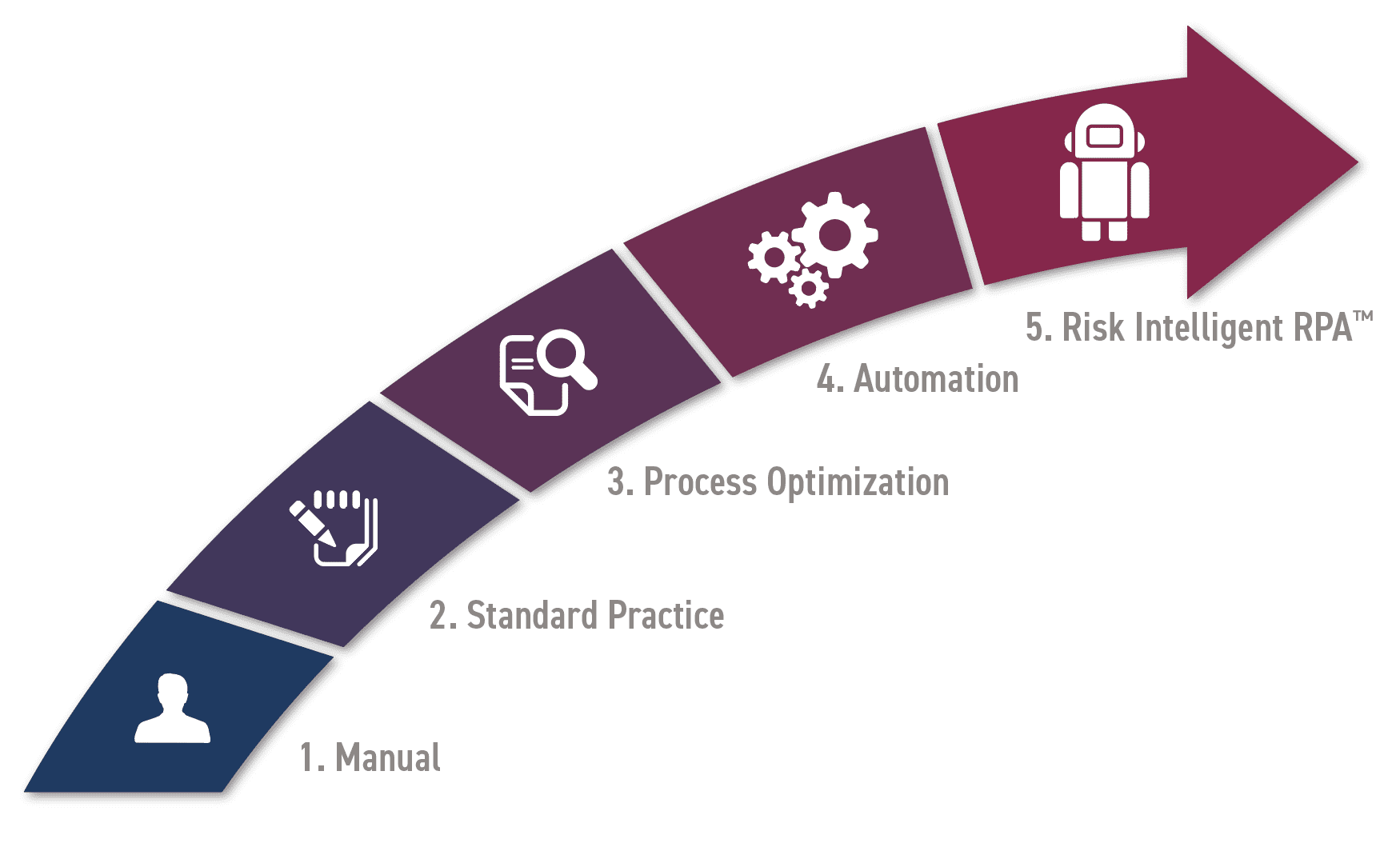

Many enterprise organizations don’t fully realize the value of beginning the journey to a world-class financial close, and instead only modernize pieces of the close process, such as balance sheet reconciliations. But to truly support the organization, the Office of Finance must take several process improvement steps, rather than limiting efficiency gains to one part of the close process.

By moving from a mostly manual process to a world-class financial close with modern technologies, finance and accounting (F&A) professionals are able to shift their focus to strategic, value-adding initiatives, allocating time to evaluating new opportunities and genuinely impacting their organization.

4 Process Improvement Steps to Reach a World-Class Financial Close

Step 1: Standardize Financial Processes

Simply applying finance automation technologies won’t help the organization on its own. A System of Controls must be set up to ensure that the right close activities are being performed correctly, and that starts with evaluating and standardizing the close processes your organization is currently completing.

-

- Develop standard reconciliation templates configured for accounts, based on the type of account

- Determine allowable dollar or percentage variance, and automate those that don’t necessitate intervention by a team member

- Establish a process for the documentation of SOX key and non-key controls, along with testing and remediation of failures

Step 2: Implement Finance Process Optimization

After your processes are standardized, it’s time to ensure that all the data coming out of the financial close process is accurate and high-quality.

Here are a few finance process optimization steps to get your organization started:

-

- Combine your quantitative financial close tasks to allow a single, consistent review of aggregated data

- Consolidate your 3rd-Party systems

- Create a chart of all your tasks for the period, and use it to track the progress of the financial close (i.e. identify close days with unusually high activity of late tasks)

Step 3: Leverage Automation for a Faster Close

Financial automation should enhance a high-quality process to make sure accurate reporting is produced in a timely manner. Now that you have set up a System of Controls that guarantees all processes are standardized and all the resulting data from those processes are accurate, it’s time to layer speed into the processes.

-

- Integrate existing ERPs to reduce the cost, time, effort and risk of data integration and review

- Refine the routing of tasks to appropriate individuals, including use of groups and queues

- Ensure that control test failures automatically trigger the control to go through remediation prior to being able to be tested again

- Leverage the capabilities of dynamic account maintenance for jobs, which can change assignment, input metadata, and/or complete account reconciliations, and identify a schedule for their completion based on frequency or activity

Step 4: Mitigate Risk in Accounting

Risk should be at the core of all activities and decisions within the Office of Finance, which includes taking a risk-based approach to the financial close.

Trintech’s Risk Intelligent Robotic Process Automation™ (RI RPA) operates to improve efficiency and effectiveness while mitigating risk in accounting processes. With RI RPA enterprises can:

-

- Identify amount and/or number of reconciling items and route approval to additional reviewers or a higher authority

- Employ machine learning of the work performed by users so the system can learn the standard workflow a user takes to reduce time moving between processes

- Link processes to automatically create a journal entry based on reconciling items and/or complete financial close tasks based on the performance of a journal entry.

World-class companies are leveraging Trintech’s RI RPA to not only lower costs and reduce errors, but also improve compliance by inspecting, automating and triggering remediation. RI RPA takes a continuous approach to finance process optimization, so that users can go beyond balancing the workload and eliminating manual work. Instead, F&A professionals can analyze the data and apply creative intelligence to tasks that require advanced problem solving and focus on evolving the business. This not only delivers improved value to the business but will also help attract and retain high-quality personnel.

Be Proactive in Your Financial Close, Not Reactive

Whether you have automated none, some or all of your processes, our recommendation for you is to be proactive. Investing in a proven financial automation solution to supplement these month end best practices will not only improve aspects of what you have today, but will also provide your organization with a platform that can support continuous, end-to-end finance process optimization in the future.

Starting on a financial transformation journey to a world-class financial close is key to success in a constantly evolving business environment; quick wins like automating one part of your financial close process won’t sustain your organization in the long term.

Learn how to start your financial transformation journey today.

Written by: Ashton Mathai