Reconciling Balance Sheet Accounts with Cadency® AI Risk Rating for Transactions

Blog post

Share

Organizations with large amounts of transactional data are in a challenging position to reconcile balance sheet accounts and transactions quickly and effectively while also identifying any potentially fraudulent activity. Performed manually, this can be very cumbersome and prone to errors.

The pressure of having to handle thousands or millions of transactions while ensuring accuracy can cause fraudulent items and patterns to be missed. New technologies, like Cadency® by Trintech, are being developed to help with this very process. Cadency enables high volume transaction matching at very efficient speeds and is now introducing technology to help with detective risk identification.

How Can the Office of Finance Resolve This Issue?

Artificial Intelligence (AI) and Machine Learning (ML) technologies are expanding in the Office of Finance and enabling technology to identify risk in a standardized way, find patterns, and make workflow recommendations. Seamless integration enables organizations to quickly introduce this technology into their ecosystem and start reaping the benefits immediately.

Over time, Machine Learning can build upon the information and the trends to learn and identify any changes that are happening as well as catch any new trends.

Reconciling Balance Sheet Accounts with AI Risk Rating for Transactions

Cadency’s AI Risk Rating for Transactions utilizes an AI-based engine called Risk Rating Engine (RRE), which is built to analyze large amounts of financial data and allocate risk ratings. The rating is based on the priority configured by the user to various AI control points.

First, the RRE first analyzes data to find any patterns that may already exist. With the power of computing, the RRE can analyze millions of data points over time. The analysis ultimately leads to trends being found and iterated upon. This is where any trends of fraud or data anomaly or segmentation is found, and the risk is rated according to those trends and information.

Ultimately, AI Risk Rating for Transactions helps improve your controls throughout the financial close process and detect fraud at all levels.

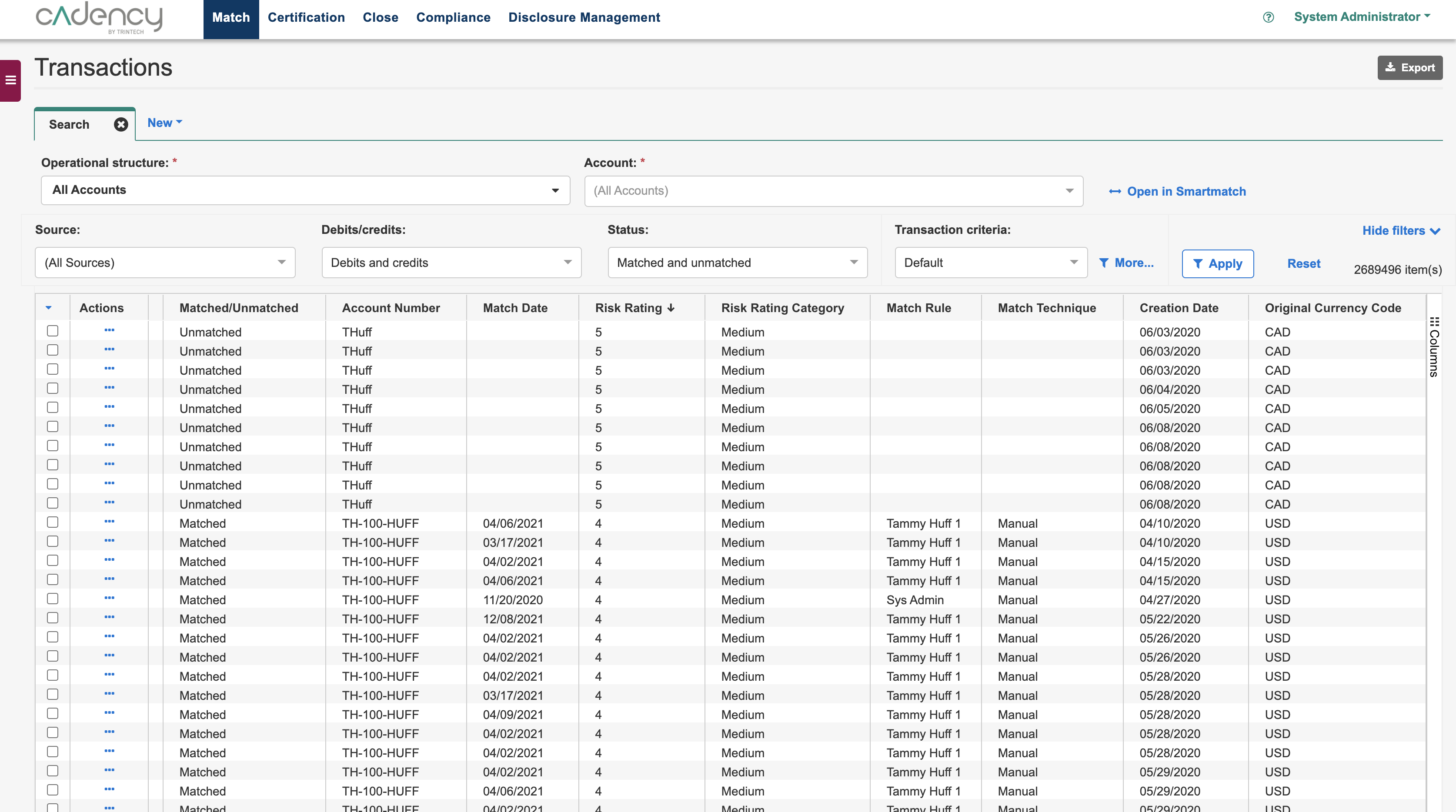

As you complete the transaction matching process, the Risk Rating Engine analyzes and learns about your transactional datasets. At a high speed, the engine can process thousands of transactions, recognize patterns and identify any out-of-place items. It then returns a risk rating value and category based on different criteria to determine those values.

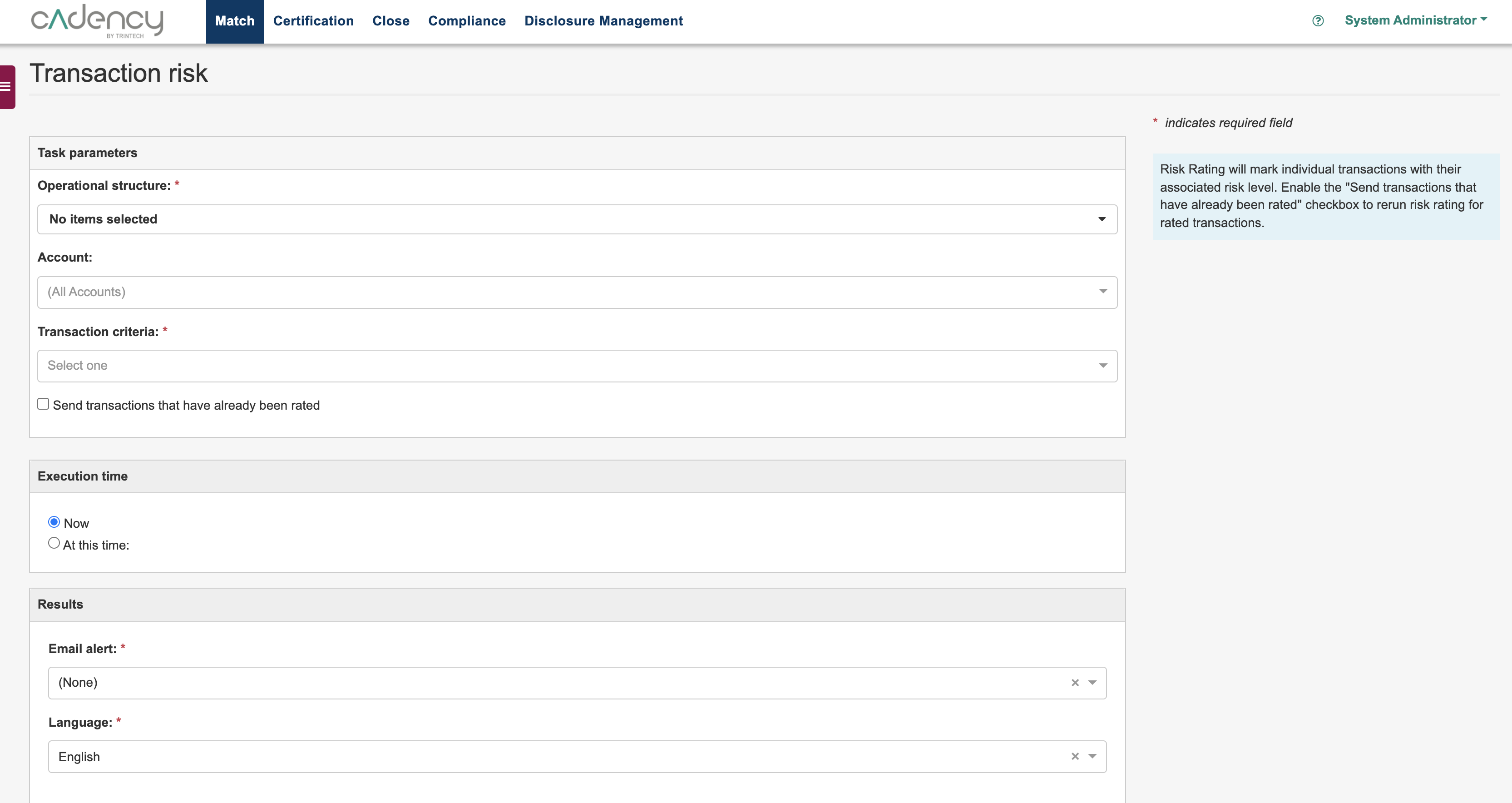

Administrators now can select transactions to send to the Risk Rating Engine for risk analysis. Admins will schedule a task and select the Operational Structure, Account, and Transaction Criteria and when run those transactions will be sent to the RRE via API for analysis. A checkbox allows admins to select whether they want already rated transactions to be rerated.

Once the RRE receives the transactions, it will leverage Artificial Intelligence and Machine Learning to compare the transactions using different criteria.

First, it will check the monetary value for transactions and accounts. After completing the trend analysis, the engine can then compare monetary values for transactions and accounts and find any anomalies and mark them as high or low value. This is helpful for items that may have been fraudulently edited somewhere along the transaction workflow.

Similarly, if any entries are found to be rounded off or changed somewhere to be rounded off those will be flagged as it may indicate fraud and should be reviewed prior to approval. Finally, taking into account the method of matching (manual or auto) helps the engine determine risk level as manual matching and changing of match rules can indicate fraud.

The RRE uses these criteria identify the risk range for each transaction. After processing, each transaction is given a Risk Rating Category of High, Medium, or Low as well as a Risk Rating Value (from 0-10), which can then be used by organizations to take a risk-based approach to operational matching.

AI Risk Rating for Transactions introduces a new detective control with Cadency Match. Leveraging AI and Machine Learning, high volumes of transactional data can be analyzed, and fraudulent items identified. Integration and setup are simple, and administrators can configure scheduling for risk analysis.

Organizations looking to reconcile their balance sheet accounts more effectively with less risk will benefit immensely from this new technology. Handling large volumes of data more efficiently and effectively not only helps lower risk in the financial close process but allows finance to focus more resources on supporting the business as a strategic partner.

[cta-content-placement]