Stress Less with a Strong Risk-Based Reconciliation Process

Blog post

Share

Financial compliance is a complicated, multi-dimensional source of risks of all kinds. Solid financial governance throughout the reconciliation process is crucial, and organizations must be able to consistently address risk without fail. Manual testing of your key controls will never be able to keep pace with the increasing speed and volume of business, and as the complexity and risk of financial compliance continue to rise, you can’t afford to fall behind in your controls testing.

The reconciliation process often takes too long for many companies. Their approaches to determine the frequency and timing of reconciliation vary greatly, and can range from fact-based and objective to purely speculative. Many finance and accounting teams don’t rely on modern tools and thus are reconciling too many items too frequently. For example, they reconcile items monthly that could safely be looked at annually. However, a strong risk-based approach to reconciliations can lead to huge returns for the Office of Finance.

Develop a Risk-Based Reconciliation Process

The critical first step to creating a risk-based approach to the reconciliation process is to come up with a strategy that is objectively measurable. The Hackett Group suggests using the criteria below to build a risk framework that is based on data and not merely opinion:

- Materiality: Dollar value

- Volatility: Balance changes (for example, shifts in debit to credit or vice versa)

- Activity: Number of transactions

- Subjectivity: Number of manual changes

- Susceptibility: The risk of material misstatement

- Complexity: Potential for the balance to be manipulated (for example, if there is a high chance of manual change)

Each of these criteria can be ranked as low-risk, medium-risk, or high-risk, and compiled to give an overall risk rating to a given account. Ideally, most accounts will come in as medium-risk and should be reconciled quarterly. These include accounts that still require some level of manual work, like accounts receivable and accounts payable. According to best practices, high-risk accounts—such as cash accounts or those with a high number of transactions—should make up roughly 10% of the account total and should be reconciled monthly. Low-risk accounts that frequently carry a zero balance only require reconciliation once or twice a year. It’s important to note that the risk rating of any given account can change, so conducting an annual reevaluation of the risk framework is needed to keep reconciliation efforts accurate.

According to the Hackett Group, “One important step is to ground reconciliation within an automated, risk-based framework, which improves controls and enhances process performance.”

Once you’ve assigned a risk rating to your various accounts, you can manage the reconciliation process using an automated solution like Cadency Compliance. Even if your company is comprised of multiple subsidiaries, geographies, and legal entities, Cadency Compliance allows potential areas of risk to be thoroughly evaluated by focusing your compliance efforts and resources on the most appropriate controls.

Benefits of an Automated Risk-Based Framework

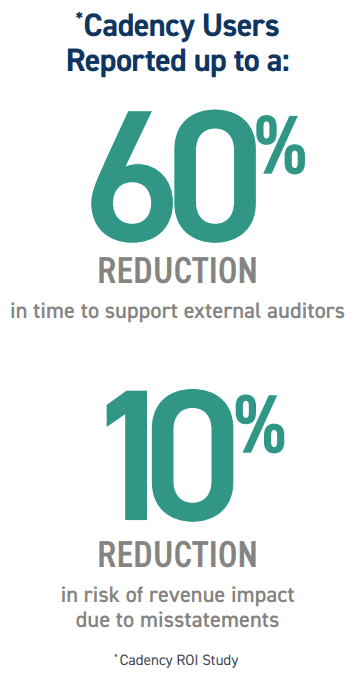

Existing users of Cadency Compliance have reported a number of benefits provided by the process, including:

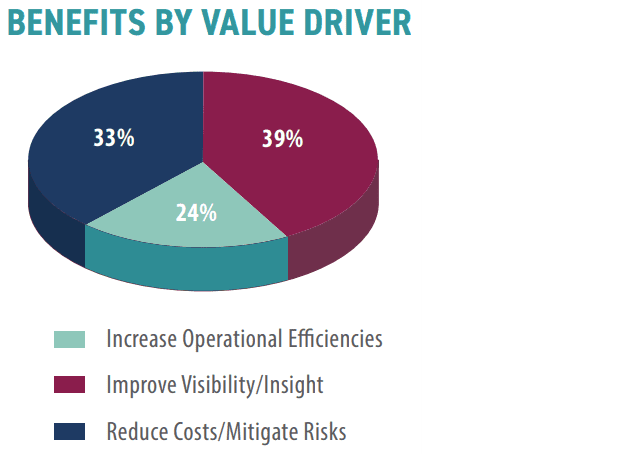

Improved Operational Efficiencies

Cadency Compliance can significantly reduce the number of hours spent testing controls each year. The solution’s formal workflow, control testing, and remediation management include attachments to guarantee immediate delivery and reference information that is correct and relevant; email task notifications and reminders ensure that required control activities are completed on time.

Improved Visibility and Insight

Controls, action plans, audit trails, and eBinders can be viewed by both internal and external auditors remotely via web browser in Cadency. The time spent testing controls is notably reduced because the solution provides easy access to a review of the walkthroughs, notes, audit trail, and results.

Improved Risk Mitigation

Cadency Compliance identifies risk early so that it can be investigated and resolved more quickly, reducing the likelihood of exposure. Cadency identifies potential issues, determines controls and workflows, and ensures all steps are complete before the auditors arrive. All information is validated and accurate in order to minimize the risk of a loss of investor and consumer confidence.

Risk-Based + Automated = Transformative

Setting up a risk-based approach within an automated solution like Cadency Compliance makes it possible to standardize risk parameters and dynamically update the risk factors and related actions required for each account throughout the system. Cadency also makes it possible for finance to quickly react to changing events.

Overall, a risk-based approach can improve compliance, better balance workloads during the financial close, support more efficient reconciliations, and leave the work for low-risk accounts outside the month-end window. By embedding the risk parameters within Cadency Compliance, finance teams can quicken the reconciliation process and deliver better, faster, and more insightful information to the greater business organization.

To find out more about Cadency Compliance, as well as its other processes, contact us to book a demo today.

[cta-content-placement]

Written by: Nathan Stabenfeldt