Optimizing Your Finance Organization – Doing More with Less

Blog post

Share

Technology and data are identified as two of the key issues impacting the effectiveness of finance in providing the quality of decision support needed. For many finance functions, there is no single interpretation of the available data across the organization, making the governance process a continued challenge.

The Hackett Group, along with our own customers, consistently report that best-in-class companies who have automated the financial close process are able to achieve more accurate and timely reporting, and do it faster, for less money, and with fewer FTEs.

Doing It Faster:

Automating the financial close process from manually updated spreadsheets and databases to an automated solution delivers clear benefits to the speed and quality at which you can undertake your financial close. At Trintech, our customers reported a 99% reduction in time to complete reconciliations and we have numerous examples where companies have been able to reduce their days to close while simultaneously improving the quality of their data.

For Less Money:

Management of the organizational cost base is a key priority for the finance function. Many CFOs will continue to undertake significant cost reviews to identify which costs can be cut and which expenditure is necessary to ensure ‘business as usual’ operations.

Financial close automation delivers key savings through improvements in the efficiency and effectiveness of IT, FTEs, audit, and other process costs. Trintech customers have reported a 76% reduction in losses and a 62% reduction in write-offs by automating key financial close processes.

With Fewer People:

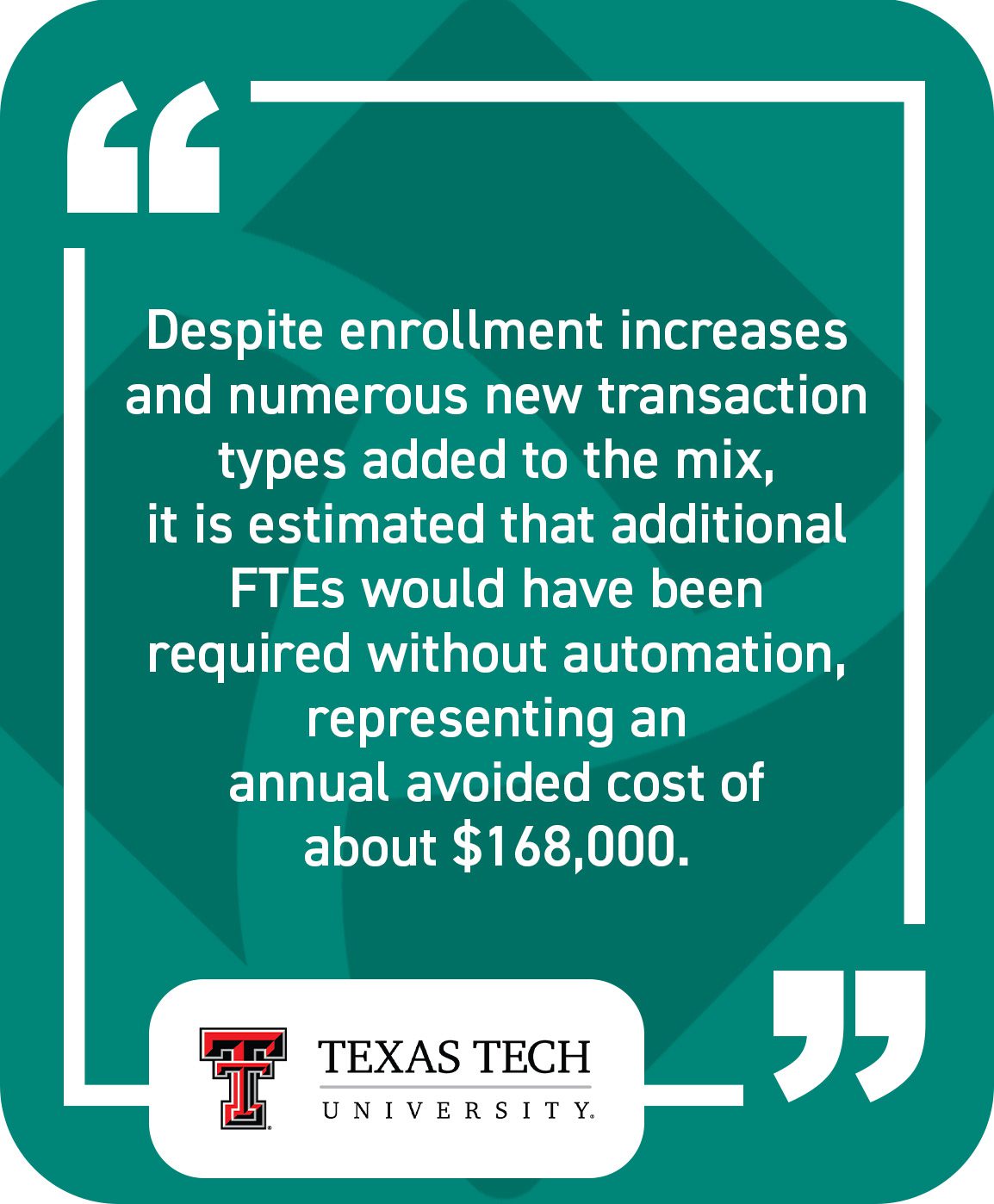

Through an automated financial close process, not only do you need fewer people undertaking manual work, but it also allows your organization to grow and expand without the need to add additional headcount. This leads to reduced costs, ensuring efficiency and accuracy across consistent practices spanning all business entities.

Leveraging Existing Investment:

Leading finance functions need to place a higher priority on investing in technology to remove the risk of inaccuracy and increase confidence in the numbers. Financial close automation allows processes to be streamlined, providing one version of the truth, and significantly reducing the risks of costly, manual errors.

Retaining Knowledge & Talent:

By eliminating repetitive manual work, you not only require fewer people, but you also attract and retain the most talented. Automation enables people to focus on higher-value, analytical work and complete it within reasonable working hours, increasing overall job satisfaction. It is, however, inevitable that people will leave, especially in outsourced and SSC positions where high churn rates of 25%-50% are common. Automation and standardization are key to ensure that when they do, the next person is clear as to what has been done, what still needs to be done, and how to do it.

Manual methods and outdated tools are no longer sustainable in today’s economic environment. Automating your reconciliation and financial close processes is a critical investment for the survival and growth of your organization.

Written by: Lauren McCrohan