Detecting the Discrepancies in Your Trade Transactions

Blog post

Share

How detective controls can resolve the discrepancies between your subsidiaries’ trade transactions

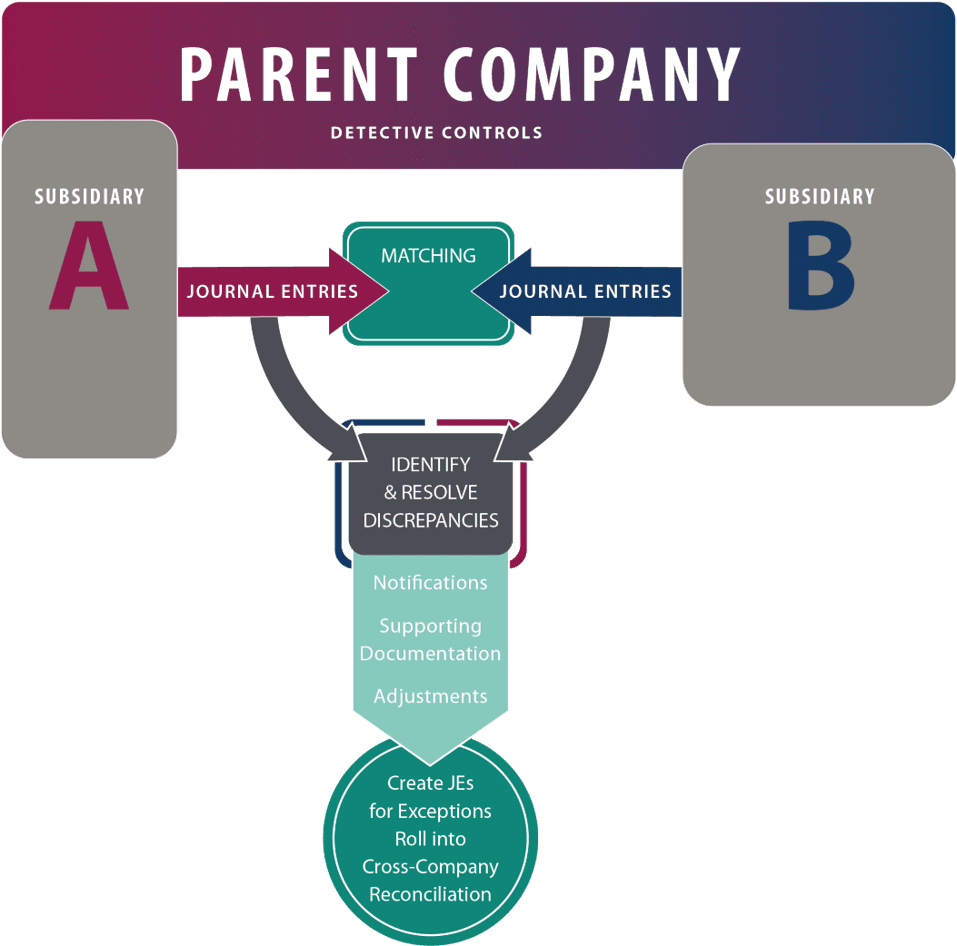

During the intercompany accounting process, auditors handle two types of transactions, trade and non-trade. For today, we’ll focus on trade and look at how detective controls can help you handle the process of reconciling these transactions with discrepancy management.

For example, let’s say that a transaction takes place between two subsidiaries of a Swiss Chocolate Ag, a company headquartered in Switzerland that makes candy bars. Almonds Inc. is located in California, and supplies the Swiss manufacturing entity with the almonds that are used in the final product. Invoices are made for all transactions, and the appropriate journal entries are posted in the general ledgers of each subsidiary once they are approved by each party.

Now imagine that some of the entries don’t match between the two subsidiary’s books. These issues can stem from a misunderstanding of the amount to be charged, the amount to be delivered or simply someone fat-fingering an extra “0” to the end of a transaction. If left undiscovered, this can lead to millions in financial exposure and a loss in consumer confidence due to issuing a restatement. Now the standard process for uncovering these discrepancies would typically be a one–to-one matching procedure where auditors switch between spreadsheets, verifying each individual transaction, but through detective controls, the issues are automatically identified, and the correct parties are notified of the problem.

Now imagine that some of the entries don’t match between the two subsidiary’s books. These issues can stem from a misunderstanding of the amount to be charged, the amount to be delivered or simply someone fat-fingering an extra “0” to the end of a transaction. If left undiscovered, this can lead to millions in financial exposure and a loss in consumer confidence due to issuing a restatement. Now the standard process for uncovering these discrepancies would typically be a one–to-one matching procedure where auditors switch between spreadsheets, verifying each individual transaction, but through detective controls, the issues are automatically identified, and the correct parties are notified of the problem.

After being notified, both subsidiaries are provided supporting documentation, such as contracts and invoices, and can work within a controlled environment to ensure that discrepancies for these trade transactions are quickly resolved.

By automating the intercompany accounting process and enhancing detective controls over the general ledgers for each subsidiary, multi-entity, global organizations are able to ensure that there is an error-free and painless process for identifying and resolving discrepancies within the intercompany reconciliation process. Ultimately this offers unprecedented visibility and clarity into your cross-company transactions, guaranteeing that all discrepancies are resolved before period end.

To learn more about how automation can help you achieve a best-in-class intercompany accounting process, check out our video, “How to Make Intercompany Accounting Predictable and Reliable.”

The Complete Series:

Making Non-Trade Intercompany Accounting a Non-Problem

Intercompany Accounting Series 1 of 3

Detecting the Discrepancies in Your Trade Transactions

Intercompany Accounting Series 2 of 3

Period End Reconciliation — Intercompany Accounting’s End Game

Intercompany Accounting Series 3 of 3

Written by: Caleb Walter