How to Overcome F&A Challenges within the Insurance Industry Using RPA

Blog post

Share

Rise Above the Industry Stereotype

The insurance industry is well-known for long, complicated forms and processes for filing claims. However, that is just one facet of the back-end process that the office of finance maintains. And, as you know, the insurance industry must additionally remain compliant with a variety of regulations while handling sensitive customer information. All of this in an increasingly competitive and fast-paced industry, and one where the financial tasks are still primarily completed manually, despite the availability of technology1.

Fortunately, Robotic Process Automation (RPA) helps to address these problems. As F&A teams in the insurance industry are increasingly asked to do more with less, there are many benefits to implementing RPA.

1. Evolve Accountants’ Roles by Removing Repetitive Manual Tasks

The first and likely most apparent benefit of RPA is the removal of tedious manual processes. Currently, an insurance company’s accounting team’s time is often spent on tasks such as manually verifying journal entries or one-to-one matching – with processes like data analytics completed at the end of the close period when and if time is available.

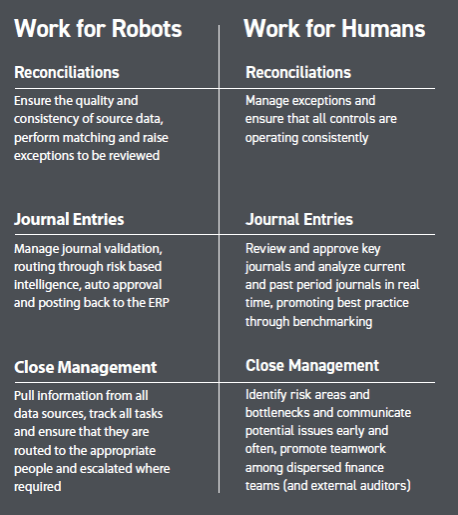

However, these manual tasks can be completed quickly and with more efficiency when handled with RPA. As can be seen in this graphic, after the implementation of RPA, accountants are available to spend their time acting as strategic resources by doing projects such as:

- Focusing on exceptions in Reconciliations

- Identifying and removing risk areas and bottlenecks in the Close process.

- Targeting specific customer claims for investigation and elevation

While the current “best-practices” of accounting dictate that accountants must spend their time manually combing through spreadsheets, doing so denies insurance organizations the long-term benefits that come from directing your employees’ time where it’s most impactful.

2. Cut Costs Now, and in the Future

The accounting departments of many insurance organizations find themselves in a “do more with less” environment. Despite rising expectations to complete the close process faster and more reliably, the budget for this department, and therefore additional resources to accomplish these goals, often remains stagnant or is even reduced in contradictory support of that goal.

To date, the solution to this close conundrum has typically been to hire temporary staff when the budget permits or, in some cases, cut corners throughout the close process. Both of which create significant risk and are unsustainable solutions to long-term growth. Especially hiring temporary staff, since the labor market is becoming increasingly competitive regarding insurance hires2.

However, through the implementation of RPA, the highly labor-intensive and risk-laden process of completing a close cycle can be handled in a more cost and time-efficient manner. And unlike hiring temporary staff to avoid misstatements on a single upcoming disclosure reporting, investing in RPA has proven to deliver cost control today, and cost avoidance tomorrow.

To learn more about the benefits of transforming the insurance office of finance with RPA, download the complete eBook, 4 Benefits of RPA for the Insurance Industry’s Office of Finance.

Written by: Chelsea Downey

[1] Heric, M. (August 1, 2018). Rethinking How Finance Uses Digital Tools. Retrieved November 26, 2019, Bain & Company.

[2] Insurance Journal. (April 1, 2019). Insurance Industry Facing Competitive Labor Market. Retrieved November 16, 2019, Insurance Journal.