System of Controls for Financial Consolidation

Blog post

Share

One of the major goals of all accounting groups across every organization is to produce accurate consolidated financial statements at the end of every accounting period. This task may seem straightforward, but in reality, it is highly complex with financial data gathering and transformation from multiple sources across various departments and business entities within an organization and rolling up into combined results of the overall organization or parent company, all the while ensuring it’s accurate and properly reviewed before finalizing it for financial reporting. It becomes even more challenging when departments and entities are using disparate systems to record General Ledger data and related transactions. With these challenges and complexities, how do financial leaders ensure that the statements they are signing off on are accurate, and mistakes have not occurred during the data consolidation and normalization process?

There are several solutions available for Financial Consolidation and Corporate Performance Management (CPM) which make these processes much easier, automated, and relatively accurate. These systems also connect to multiple data sources, have proper audit trails, and can map accounts from various GL systems into one holistic chart of accounts. While these solutions are immensely helpful in reducing the time needed for producing consolidated statements, how do financial leaders ensure that these systems are also accurate, there is full visibility across the process, proper reviews involved with related audit trail, and necessary adjustments are made directly into the ERP, ensuring that there is no risk in the process?

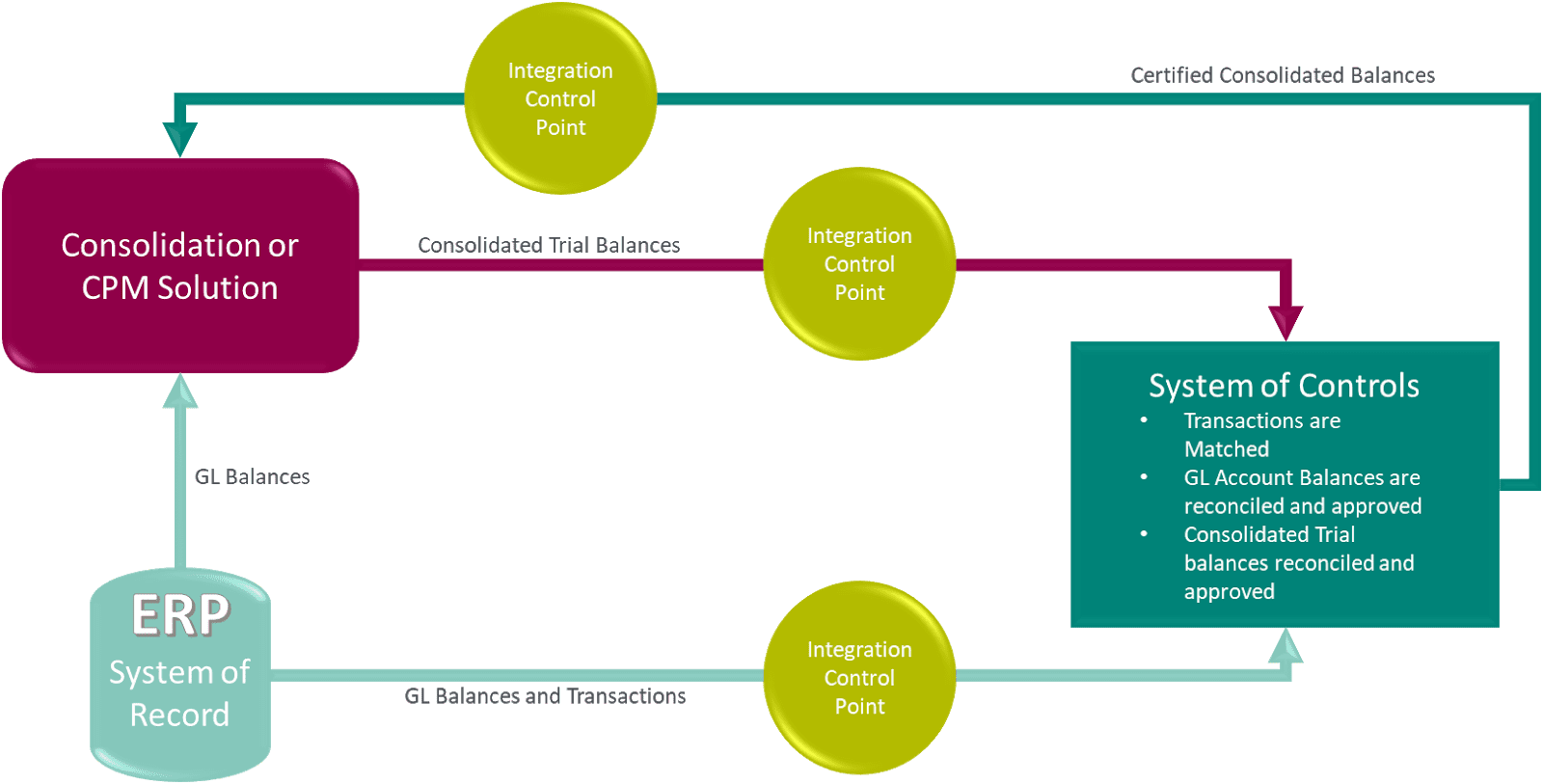

This is where a System of Integration that enables controls comes in, to provide proper checks and balances, necessary reviews and approvals, and the ability to make adjustments before finalizing the consolidated statements.

A complete System of Controls paired with a System of Integration for Consolidation needs to have the ability to pull all the consolidated trial balances in it from a CPM or a Consolidation system for various subsidiaries or business entities, give key people in accounting the ability to review these balances, catch any errors and anomalies, make the necessary adjustments and then sign off at the Group Account or Entity level, ensuring proper review before finalization, along with audit history to capture the entire workflow. This System of Controls should also be able to provide easy collaboration throughout the entire process with reports and dashboards for necessary global visibility. Once the group balances are reconciled and confirmed, this system should also be able to feed the data back to the CPM and Consolidation solution, while ensuring any adjustments are accounted for directly within the system of record, before finalizing the financial statements. It should, ideally, add an automated check that these balances are certified by authorized people in the Office of Finance, even before the true consolidation process begins.

Cadency can meet the needs of various CFOs and accountants across large enterprises with its strong compliance framework and the ability to easily integrate with any CPM and Consolidation systems via APIs. Cadency also can make necessary period-end adjustments directly into the system of records (e.g., ERP).

Let’s review a typical use case to see how Cadency can help with the accuracy of consolidated financial statements, working seamlessly with a CPM system to fully automate the process, while significantly reducing the risk and improving CFO’s confidence.

In the below use case, the GL data (including balances and transactions) is fed directly into Cadency with our connectors, and any necessary transformation occurring during the extraction and load process via our integrations. These transactions and balances then flow through the workflows and Cadency’s RI RPATM algorithms for efficient and accurate reconciliations at the various account levels. Cadency can also pull in trial balances from the Consolidation or CPM system and reconcile them at the Group and Entity levels, ensuring that the underlying data ties to the consolidated data and proper reviews and approval processes are followed before certifying these balances. Also, the entire process has global visibility via dashboards and prebuilt reports and can be automated with necessary human reviews for efficiency and accuracy. This results into the certified consolidated data being seamlessly fed to a Consolidation system, ensuring that everything is rolled-up properly, and the prepared financial statements are accurate.

Additionally, Cadency also provides complete visibility, governance and management over Intercompany transactions (including foreign transactions, currency exchanges, etc.) ensuring that there is significantly reduced risk in data integrity and accuracy when multiple disparate source systems and related General Ledgers are involved in the overall consolidation. These controls become especially critical, when the transacting entities have a controlling or vested interest in each other, and there is an added risk in data aggregation.

An overview of System of Controls and Integration for Financial Consolidation

An example of a complete balance sheet overview with proper System of Controls in place:

With our robust integration and data transformation capabilities, our customers can not only use Cadency to manage their financial controls during the Reconciliation and Close process but can also leverage our global control capabilities to make sure that their Consolidation process is smooth, efficient, and accurate.

Our goal here at Trintech is to reduce risk in all aspects of the Record to Report process and help drive best practices within various Offices of Finance, helping them become a key strategic partner for the business. We enable our customers to drive an efficient and effective Close process, and also create an accurate and streamlined Consolidation process, increasing their confidence in their period-end Financial Statements and freeing up their valuable resources to focus on key long and short-term high impact business initiatives.

With Cadency, it is not just about doing things efficiently to reduce costs, but also about doing them effectively to reduce overall risks within the entire global R2R process.

Written by: Dhawal Godhwani – VP of Product Management, Trintech