5 Best Practice Financial Close Tips

Blog post

Share

A recent report from Forrester Consulting revealed that 90% of the surveyed organizations struggle with their financial close process. This isn’t surprising, especially since the Office of Finance has been tasked with more responsibilities critical to the health and success of the organization. Once, accountants were underappreciated within the organization; now, they are essential to support the organization and provide guidance through business-critical insights to leadership that are based on timely and relevant data.

Though their duties have evolved, the Office of Finance’s approach to the financial close in many organizations has not. As a result, they struggle with finding the time and resources to effectively deliver what the organization expects from them. Here are some best practice tips for the financial close process that will enable your organization’s Office of Finance to complete the close more efficiently and effectively.

Though their duties have evolved, the Office of Finance’s approach to the financial close in many organizations has not. As a result, they struggle with finding the time and resources to effectively deliver what the organization expects from them. Here are some best practice tips for the financial close process that will enable your organization’s Office of Finance to complete the close more efficiently and effectively.

Best Practice #1: Eliminate Error-Prone Spreadsheets

When you’re evaluating sources of inefficiencies and inaccuracies in your financial close processes, it is important to know that spreadsheets and manually-driven processes are hotbeds for error. 88% of spreadsheets are inaccurate, and this is partly due to manual processes that drive them. Small mistakes that occur due to copy-and-paste instances or overlooked typos compound into apparent inaccuracies that are hard to trace back to the source. And when your team is saddled with deadlines, these data errors may not even be caught until after the reports are filed, resulting in a restatement. Not only that, but spreadsheets offer no visibility or control into the close process itself.

When your Office of Finance operates with manual processes and spreadsheets as the primary close tool, accuracy will always be a concern.

Best Practice #2: Standardize Your Processes

Another reason that finance and accounting teams struggle with close deadlines is due to the lack of a standardized workflow. Many organization’s close cycles have been built on institutional knowledge, the idea of “that’s how we’ve always done things” rather than a carefully planned workflow execution. This mindset leads to accountants using their own personal spreadsheet layouts which consumes even more time if they have to pass their work onto another accountant and causes even more problems if the team is working virtually without immediate communication access to each other.

A lack of close standardization also leads to other time-consuming bottlenecks such as rework and audit confusion— as multiple different versions of the same document exist with no clear indication of which is the most recent. Finance leadership also has no visibility into the current status of the close.

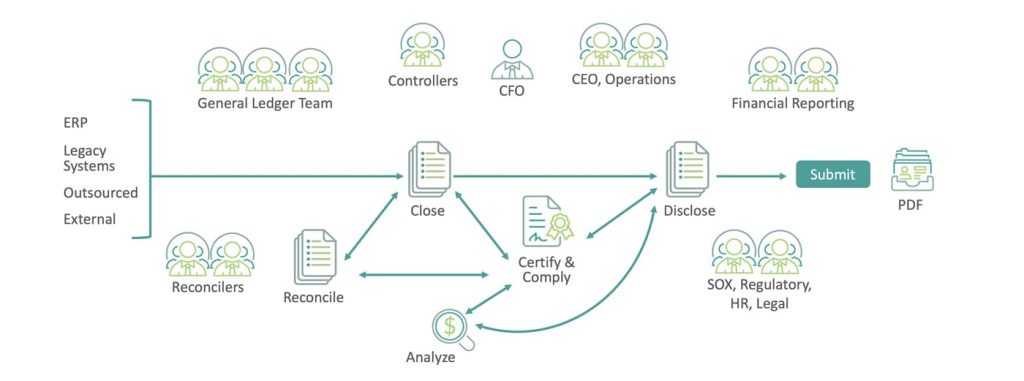

If you were to map out your current close process, it might look something like this:

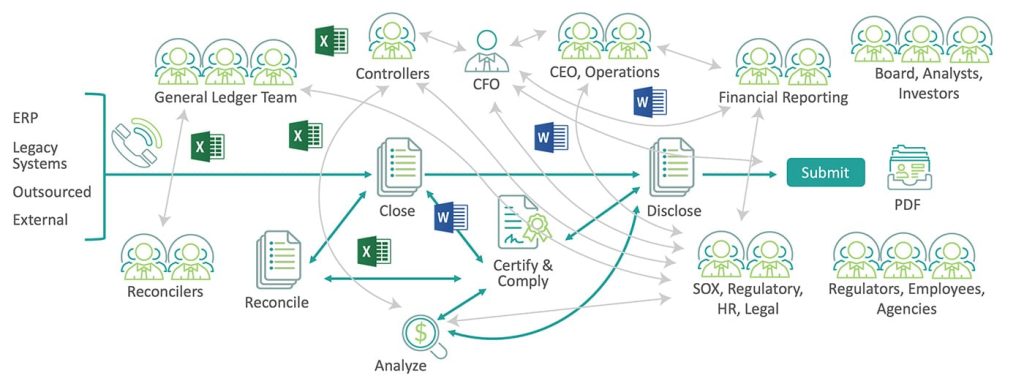

However, factor in the constant updates, approval requests, data corrections and other aspects of the financial close that occur through emails, phone calls, meetings and other communication platforms. Your close probably plays out more like this:

Imagine how much time and frustration organizations could save by standardizing their close process.

Best Practice #3: Implement Financial Close Automation

Once you have standardized your processes, financial automation software can help further streamline your close. Automation can significantly reduce the number of manual tasks your finance and accounting teams must perform in addition to enhancing the accuracy of your overall financial reporting. For example, Trintech’s Risk Intelligent Robotic Process Automation™ (RI RPA) uses rules based on the customer’s specific risk tolerances to automate the account reconciliation process by automatically reconciling low-risk accounts so accountants can focus on the high-risk accounts, instead of evenly spreading focus across all accounts.

Financial automation can also enforce your organization’s policies and procedures for the financial close across all organizational entities so that the close is being performed the same way across the entire organization, regardless of where they are located geographically. Additionally, financial automation software like Cadency® by Trintech directly integrates with your systems of record— such as ERPs, payroll, FP&A software— to ensure the data in your financial processes is as accurate as possible.

Best Practice #4: Align People, Processes and Technology

One of the most important factors of your close process is the people involved. Technology such as advanced automation and artificial intelligence exists to empower the people performing the financial processes. The alignment of people, processes and technology becomes increasingly more important when working virtually and accountants are no longer able to walk over to another team member’s desk and ask a question.

One of the most important factors of your close process is the people involved. Technology such as advanced automation and artificial intelligence exists to empower the people performing the financial processes. The alignment of people, processes and technology becomes increasingly more important when working virtually and accountants are no longer able to walk over to another team member’s desk and ask a question.

Additionally, an effective close process not only supports the direction and goals of the organization but also sets the tone for your team. One of the benefits of automation, referenced before, is that it saves your team significant amounts of time. Imagine what it would do for employee morale if they didn’t have to work long nights and weekends frequently. Invaluable benefits, such as productivity and company loyalty would increase.

Best Practice #5: Future-Proof Your Processes

When finance and accounting teams are functioning with manual methods and spreadsheets, there are very few resources left over for strategic activities. One of the most critical strategic activities, that is often skipped over due to time crunch, is data analytics. Organizations need actionable, accurate insights to drive decisions and direction for the future. Investing in automation will provide your Office of Finance and CFO with the necessary resources to drive strategy. This becomes especially important when the organization hits a period of economic instability or general uncertainty. Future-proofing your financial processes now places your organization on a path for success in the future.

Conclusion

Implementing these best practice tips into your financial close process will revolutionize your Office of Finance. But you don’t have to do it alone— Trintech’s experienced Record to Report experts can help you optimize your processes for the ultimate efficiency and effectiveness. We’ve helped guide many organizations to a world-class Record to Report process and have the expertise to assist your organization. Organizations that close with Cadency by Trintech have seen:

- Up to an 80% reduction in time spent on transaction matching

- Up to a 90% reduction in the number of accounts to be reconciled

- Up to a 62% reduction in write-offs

Discover how an automated approach to your financial close can benefit your organization today.

Written by: Ashton Mathai