Reduce Financial Risk With a Transformative Digital Strategy

Blog post

Share

Enabling a comprehensive approach with CadencyDirect on the ServiceNow Platform

Effectively managing risk is at the heart of the CFO team’s role and must be executed across the entire enterprise in accordance with their corporate risk profile. To ensure success, the Office of Finance must take a holistic approach that engages all facets of the enterprise (customer, vendor, employee) in rooting out and mitigating risks.

To achieve this in the most cost-effective and efficient way, leading global enterprises have turned to automation to implement standardized, digital workflows across all areas of the organization as part of their digital transformation journey. The end result is a decrease in their overall risk profile.

Managing Risk Goes Beyond the Office of Finance

Whether classified within the public or private sector, every organization’s goal is to produce accurate, reliable financial statements so that they never have to face the dangerous repercussions of restating their financials.

While managing the organization’s risk could be perceived as solely the responsibility of the Office of Finance, in reality, identifying and mitigating risk falls to the entire organization — whether that’s F&A, IT, HR or any other department.

“Financial integrity is the responsibility of every organization and member within it. All of us have a responsibility in ensuring the reliability related to the documents used to publish the performance and health of the company. And it’s from these statements of positions that decisions are made, either by external shareholders or our own internal management, thereby underlying the significance of our corporate citizenship.” – Syril Mathai, CPA, Vice President of Strategic Solutions at Trintech

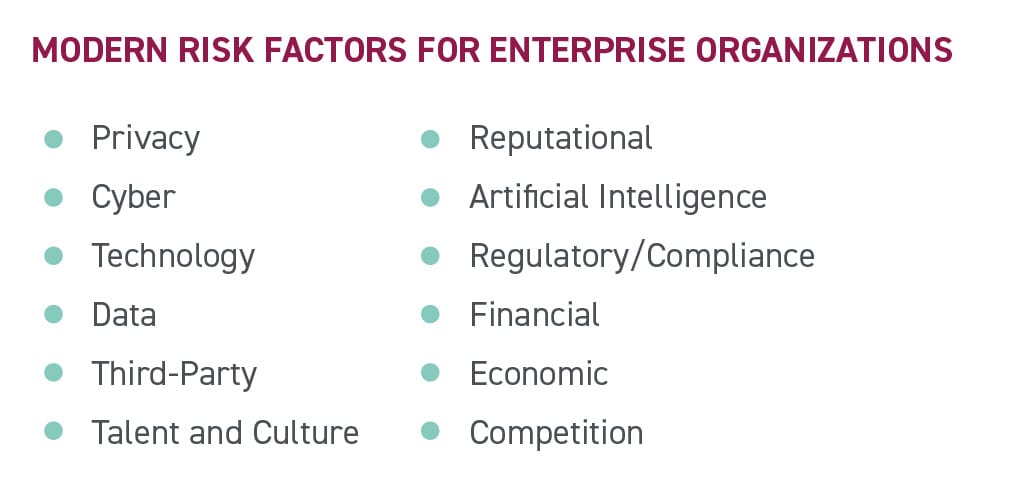

Modern Risk Factors

With the rise of advanced technologies comes more digital risk factors that the organization must address.

Though some of these factors are not new to the Office of Finance (such as regulatory and compliance risk) others highlight that the entire organization needs to be active and involved in preventing and addressing risk because of the direct, negative impact that can be inflicted on companies.

“At the end of the day, [the risk factors] all tie back to financial risk… privacy risk is the risk of having private information exposed. It could be the result of a data breach, or database failure or crash. If you haven’t built enough resilience [into your processes], it could result in a loss of revenue or reputational damage.” – Karel van der Poel, Senior Vice President of NowX Products at ServiceNow

Mitigating Risk through Enterprise-Wide Digital Transformation

Historically, digital transformation originated in the front-office functions due to the re-evaluation of customers’ needs and new technologies that can support those needs. But some of the exposure that organizations feel due to pandemic shutdowns are caused by back-office shortcomings. In fact, the pandemic globally revealed hardship, as companies had to establish working capital positions with the rapid need to answer ongoing business concerns raised by regulators, shareholders and financiers.

Addressing these shortcomings, often caused by missing and inefficient processes or systems, requires new technologies and enhanced processes to improve operational efficiencies that better identify and mitigate sources of risk.

Start at the Heart of Risk Management: The Office of Finance

For more than 30 years, the Office of Finance has been utilizing spreadsheets beyond their intended purpose to manage complex processes. The extended use of spreadsheets not only created more work for traditional finance and accounting professionals, but also instituted more time-consuming, risky manual processes, which are then followed by more manual remediation processes to address the original problems. Increased and unintended errors built on a fragmented, disconnected process and data environment expose the organization in more ways than failed adherence to compliance standards.

In more recent years, organizations have invested in ERP technology, which houses the organization’s critical, day-to-day data. While useful and important for many reasons, the ERP does not make up for the gaps in financial processes created by the extended use of spreadsheets — in reality, ERPs are responsible for these gaps in the first place many times.

Manual processes are still required to obtain data from the ERP to enable the necessary financial close workflows that lead to the production of financial reports. Ultimately, these manual processes jeopardize the accuracy and reliability of the reported financials.

More importantly, it is the inherent nature of a manual financial close that keeps highly skilled professionals from being able to actually perform what they need to do most: analyze financial data and help the business become more profitable, competitive and eventually, market leaders.

“Today’s technology allows companies to view their processes and workflows through broader lenses that are not limited to the historical deployments. I would offer that companies can move to a mindset of ‘I engage with technology in a context of what’, and that what is ‘what’s the larger purpose you’re utilizing the technology for?’ Previous investments in technologies like ERPs should not limit you to incremental change or to ask a system to do something it was not intended to do.” – Robert Michlewicz, Chief Strategy Officer at Trintech

In today’s environment, digital finance transformation is critical to reducing the risk profile of any organization. The first step is adopting newer technologies that work alongside the ERP to begin building an effective framework to measure where risk exists and improve it over time.

Enabling Comprehensive Digital Transformation

The full benefits and ROI of digital transformation cannot truly be achieved if it does not extend to all parts of the business (customer, vendor, employee). Similarly, driving finance transformation holistically to improve those three experiences is a key indicator of successfully creating an effective risk management and compliance framework.

Remember the entire organization shares the responsibility of managing risk, and there are more risk factors to address than the Office of Finance will handle alone.

“Finance transformation cannot be successful unless it is tied to an organizational success strategy.” – Syril Mathai, CPA, Vice President of Strategic Solutions at Trintech

Digital transformation should enable the concept of a connected enterprise. Dismantling the disjointed environments that organizations typically function in and connecting the members of an organization to each other significantly decreases the risk profile of an organization.

“Think about supplier resilience during the first few months of COVID. It became abundantly clear that we needed to connect the enterprise to suppliers and have a much better understanding of risk, and how organizations can actually get through a crisis when certain parts of the world were in lockdown, for instance.” – Karel van der Poel, Senior Vice President of NowX Products at ServiceNow

Building an effective risk strategy reliant on digital transformation for the entire organization can be complex and frustrating. ServiceNow and Trintech have partnered to help organizations build a connected enterprise with a team of finance and technology experts to deliver an unmatched solution to enterprise-wide digital transformation with CadencyDirect® by Trintech.

CadencyDirect is the only native Built on Now® application for the ServiceNow® platform that is designed specifically for the unique needs of the Office of Finance to extend digital transformation across the entire enterprise like never before. By expanding the optimization and connection of workflows across departments, including the Office of Finance the risk profile of the entire organization can be significantly reduced within the Now Platform.

Click here to learn more about how optimizing financial operations management allows CFOs and their teams to digitalize the financial close workflow within the Now Platform for the best enterprise experience.

Written by: Ashton Mathai