Financial Transformation Meets Digital Transformation in a Post-COVID World

Blog post

Share

The shift in business operations due to the pandemic created new paradigms for the Office of Finance. Because of the business adaptions and a heightened need for automation in the last year, there is now a new broad level of acceptance and expectation for digitization across every aspect of an organization: what McKinsey & Company recently referred to as a “quantum leap in digital adoption.”

Across industries, what began as necessary steps to effectively implement emergency practices and processes, to help the business survive the pandemic, have now become required best practices for ongoing operations. Even as organizations begin to leave the initial challenges of pandemic operations behind, what has been borne from these changes is an accelerated path to transformation going forward.

For finance teams specifically, financial transformation is no longer an aspirational goal but instead is a requirement to building resilience and effectively connecting with the wider organization like never before.

“The COVID pandemic has been a huge catalyst for transformation projects. Expanding digital services became an imperative when it became impossible to engage … in an analog way.”- Kai Bender, Oliver Wyman

Financial Transformation Hurdles with the Broader Digital Transformation

In a recent McKinsey study, finance’s potential for inefficiency based on a lack of automation was rated one of the highest areas for potential company disruption. The study indicates “manual operations” are a big roadblock for the Office of Finance’s role in the greater digital transformation lens, even with a healthy financial transformation initiative in progress.

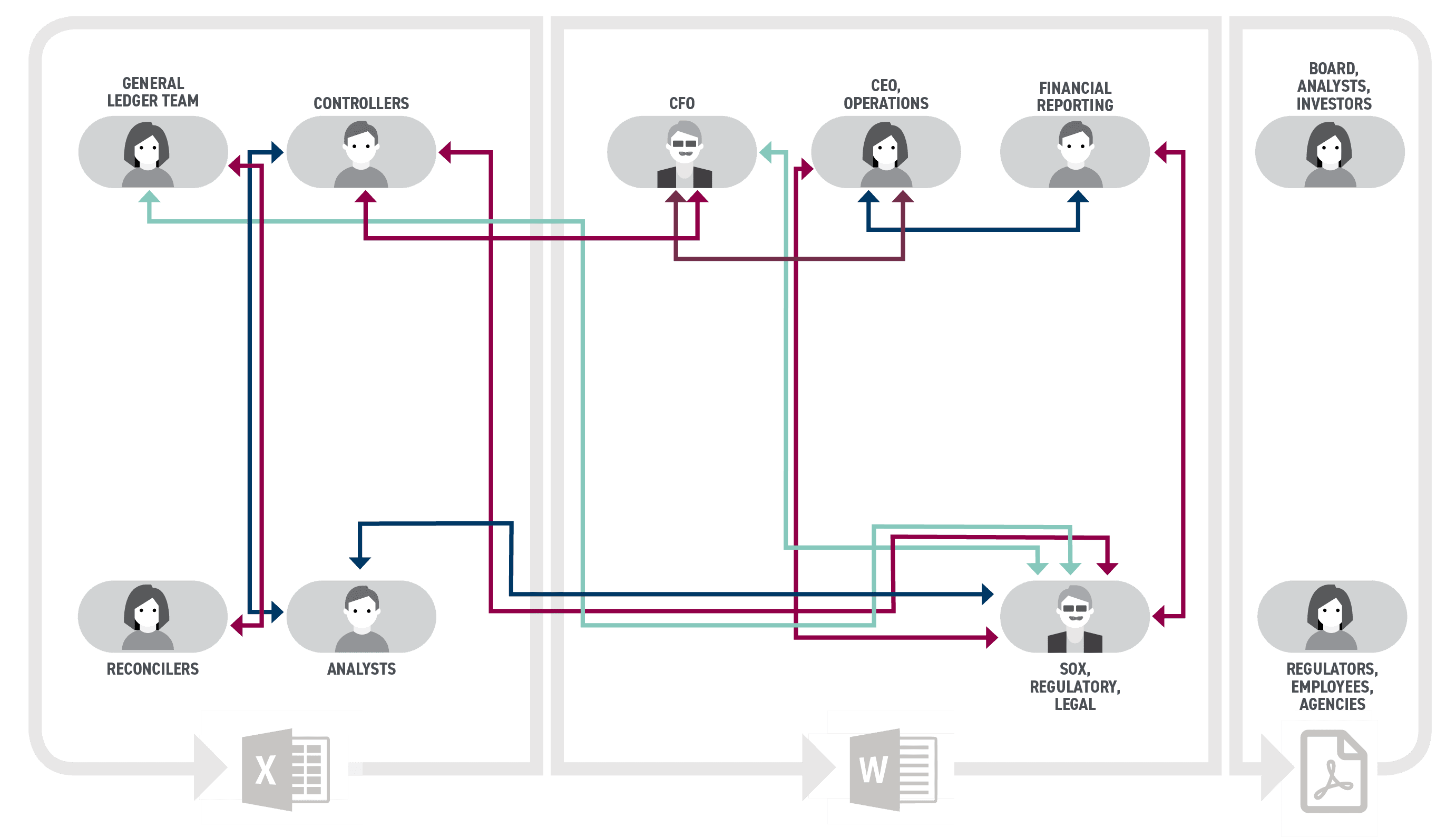

For CFOs, the need to improve efficiencies across the Record to Report (R2R) process has long been acknowledged. And, because the Office of Finance plays a critical role in an enterprise’s success, they require the same level of connection as other departments like IT, HR, Legal, and Procurement.

Simply put, despite the technological solutions and process improvements within financial close, the Office of Finance is still typically siloed from other company operations.

Organizations that have improved efficiencies across the R2R process often find that things can significantly bottleneck when a process must extend outside of the Office of Finance. Whether it’s certified account balances that need to be communicated to FP&A or Consolidation, high-risk intercompany Close tasks that need fast status updates to Tax or GRC, or transaction match exceptions that mandate further detail from local offices and team members — very rarely is there a process that occurs entirely within the jurisdiction of one team.

To truly achieve transformation, the traditionally siloed processes and controls of the Office of Finance must seamlessly extend to the broader organization in a connected, collaborative ecosystem. That ecosystem must not only communicate critical financial data and status across the enterprise, but also gather details that inform R2R activities, adding digitization to what are often inefficient manual communication and tracking methods.

https://www.youtube.com/watch?v=6_uRbWeeAuI

“It isn’t sufficient for companies to have a single technology leader responsible for driving a top-performing and digitally enabled business strategy.”– Evan Williams, McKinsey

Delivering Transformation without Sacrificing Risk Management

The worry around (and common reason for) siloed Office of Finance operations, in terms of technology, is the inherent risk and the compliance needs which are associated with an accurate R2R process:

- Continual oversight

- Detailed audit tracking capability

- A powerful System of Controls

Additionally, the prioritization of financial transformation initiatives for the CFO can vary drastically from those of the CIO who is guiding the enterprise-wide digital transformation.

To meaningfully merge the organization’s financial transformation with its overall digital transformation (such as a connected financial ecosystem) requires the broad reach and fungibility of enterprise-level workflow tools and processes while retaining the audit traceability, controls, risk management, and oversight that the Office of Finance requires.

Achieving these needs requires technology solutions that provide the expected level of financial controls, while still seamlessly integrating into the broader enterprise’s workflow and systems of record (ERPs, etc.) and providing further expanded business insights and visibility on the consolidated process.

Deloitte’s recent Finance 2025 report analyzed the likely outcomes of these blurring boundaries, emerging technologies, and blooming trends. In their estimation, this transformation will necessitate even stronger continued quality insights and automated digital oversight.

“With operations automated, finance will double down on business insights and service. Success is not assured.” –Susan C Hogan, Deloitte

Achieving World-Class Enterprise Transformation

Truly merging your financial transformation initiatives with your company’s digital transformation strategy can seem like an uphill battle.

With the right solution, CFOs can prioritize the benefits of financial transformation (such as improved risk management, error reduction, and improved control across the R2R) while integrating financial close technology to the wider organization. At the same time, CFOs can focus on supporting the digital transformation goals for the entire enterprise through connected workflows with high levels of audit traceability and visibility for leadership.

To create this fully connected organization, Trintech and ServiceNow® have partnered to help enterprises open the door to enterprise-wide transformation. CadencyDirect® by Trintech, a Record to Report and financial close automation solution, is a native Built on Now® application for the ServiceNow® platform. Designed specifically for the unique needs of the Office of Finance, CadencyDirect is powered by the same mature and deep System of Controls, System of Integration, and System of Automation within Trintech’s leading solution, Cadency®, and provides the added capability of extending financial operations to the entire ServiceNow® workflow ecosystem.

As a “workflow-of-workflows” platform, ServiceNow® is an industry leader in automated and systematic process management for every aspect of company operation. Combined with CadencyDirect®, enterprises can connect their R2R processes and leverage workflows in ServiceNow® based on triggers and events within the financial close — extending necessary processes across the enterprise through a platform designed for overall digital transformation. All while retaining the audit traceability and controls expected by the Office of Finance.

In addition, CadencyDirect® provides R2R dashboard views through its native ServiceNow app to increase visibility for leaders throughout the company and illuminate key financial data that helps drive confident decision making, promoting long-term organizational growth through a healthier operating structure.

With the continually accelerating drive for digital transformation in a post-pandemic landscape, financial transformation can not only be an integrated part of the larger transformation, but also enhance digitalization efforts through extending processes that bridge the manual gap and tear down the silos which have kept the financial close locked within the Office of Finance.

“CadencyDirect complements and extends financial operations management so that CFOs and their teams can digitize workflows across the financial close process, reducing complexity and risk, accelerating the overall process, and driving a greater experience for finance teams.”–Karel Van Der Poel, ServiceNow®

Learn more about unlocking your potential for transformation here.

Written by:

Christopher Witt

Director of Product Management for CadencyDirect