Why Transformation Directors Should Focus on the Office of Finance

Blog post

Share

As the impact of COVID-19 was felt throughout the world, F&A teams were tasked with providing business-critical insights and helping guide the organization through such an unprecedented event. However, due to the manual processing typically associated with traditional accounting work, the Office of Finance was quickly overwhelmed when it attempted to provide these critical insights alongside their historical work.

Accounting teams handled these new requirements to varying degrees, but two things were clear:

- If given the proper time, the Office of Finance could provide business-critical insights

- A manual approach to the Record to Report process stifles the value that finance and accounting teams could provide the organization

With that in mind, transformation directors have recently put an increased level of focus on empowering the Office of Finance with a complete financial automation solution.

In fact, Trintech’s 2021 Global Financial Close Benchmark Report discovered that over the next 5 years, standardization and automation are going to be the biggest priority for the Office of Finance.

However, transformation directors can find it difficult to get the buy-in of the necessary internal stakeholders when they start pushing for financial transformation. How accountants work has largely been unchanged since the adoption of spreadsheets in the 1980s, and because accountants are risk-averse by nature, the department as a whole can be resistant to change. To help secure buy-in, the benefits that come from a financial transformation need to be put in front of the key stakeholders with a strong ROI-based business case.

[cta-content-placement]

Below are 4 long-term benefits that transformation directors can leverage to build a better business case and secure internal stakeholders buy-in across the organization.

Eliminating Manual Processes

The Office of Finance has historically relied on very manual tools and processes to complete the financial close process. One of the greatest benefits of moving to an automated financial close process in the Office of Finance is the increase in speed and quality of the work that is performed – allowing accounting staff to spend their time on more value-adding tasks.

The efficiency and effectiveness benefits that finance functions see after introducing best-in-class automation to their financial close are proven and repeatable and can serve as the cornerstone of a business case created by transformation directors. For example, organizations that have automated their close with Cadency have seen up to a:

- 90% reduction in the number of accounts to be reconciled

- 80% reduction in time spent on financial transaction matching

- 50% reduction in time to review JEs (for approvers and reviewers)

- 60% reduction in time to support external auditors

- 30% reduction in time preparing and completing close tasks

Additionally, after the above benefits have been achieved, their impact has a ripple effect across the rest of the organization. Once accountants have their time freed up by automating their manual work, they are free to spend their time on higher-value tasks such as exploring “what if” scenarios, accessing cash liquidity, and providing real-time business-critical insights to drive confident decision-making in the company. While the Office of Finance has historically been siloed from other departments, financial transformation allows accountants to provide new levels of value to their organization.

World-Class Service Standards

When looking at financial software providers, transformation directors should also focus on the quality of service they offer. At its best, customer support can deliver an outstanding experience when the provider feels like an extension of the in-house IT team.

Best-in-class financial close automation providers have customer success and value optimization teams. These teams are designed to ensure that their clients not only see an initial ROI, but that their solutions can continue to have an increasing level of impact as the years go on.

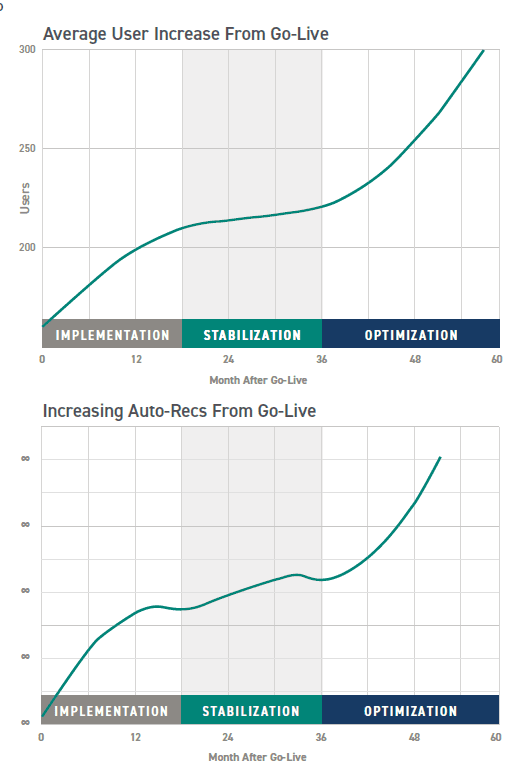

For example, the two “S” charts to the right demonstrate the ongoing optimization that we see within organizations using Cadency after their initial project roll-out success — both in terms of the increase in the average number of users from the Go-Live date and the increase in automation in the reconciliation process. Additionally, each chart is broken down into three sections: initial project implementation, a brief stabilization period in which the initial project is being fully adopted, and the optimization period for future projects.

The first implementation section sees a sharp increase in users and the number of reconciliations that are being automated. There is then generally a solidification period as companies reap the benefits from the initial project goals and underpin their standardization and efficiency improvements.

After that, there is a second peak of benefits as organizations work with Trintech to look to further optimize their processes and find other uses cases for the technology. An example of this would be an organization looking at their journal entry process and adding additional automation – enabling more people to get value from their technology.

The best way that transformation directors can check on the service capabilities of any software provider is to read case studies, check online reviews and evaluate their Service Level Agreement (SLA) to understand the terms.

IT Legacy Connectivity

As an organization grows, or makes numerous acquisitions, the Office of Finance typically builds up a very complex IT environment with different ERPs, multiple instances of the same ERP and other silos of information.

The lack of connectivity between business entities and sources of information can drastically slow down the financial close process and increase the risk of financial inaccuracies. Inaccuracies that if not caught can lead to a costly material weakness in any reported financial documentation – ultimately requiring a restatement that negatively impacts both the financial standing of a company, but also the public perception of the company.

Connecting systems of information into a financial close automation solution allows accountants to remove the inherent risk of any dysconnectivity and the time-consuming nature of manual processing to ensure the accuracy of any reported financial documentation.

By looking at your current tech stack and examining the available IT integrations and connectors of a financial automation solution, transformation directors can build a business case that shows how the solution would fit into the existing IT landscape and the benefits it would bring.

Conclusion

As time goes on, accountants will continue to be relied upon to deliver business insights – and transformation directors will be tasked with leading that charge. While transforming the finance function will be key to gaining these insights, the ability of transformation directors to convince stakeholders of its importance can be difficult if they are not familiar with the inner workings of the finance teams. The proven ROI that Cadency provides for the Office of Finance allows for a solid business case to be built that can prove both the value and the pressing necessity for a financial transformation.

Read the business case for an automated R2R solution to learn more about the benefits that come with transforming the Office of Finance with Cadency.

Written by: Caleb Walter