Secure

Measurable

Accurate

Risk Eliminating

Time Efficient

Produce Reliable Financial Statements

Cadency customers around the globe benefit from its quantifiable results:

Reduction in Time to Complete the Close

Reduction in Time to Support External Auditors

Reduction in Time for Rework

SMART Data

Organizations now demand data to be integrated, real-time, and first-time right with volume capability. Data can move from Cadency to and from the ERP via connectors and from Cadency to Business Intelligence tools via Data as a Service.

SMART Data capabilities significantly reduce both the time spent on manual processing and the dependence on internal IT services and external developers. Trintech’s internal experts are able to handle even very complex situations and requirements.

Cadency ERP Connectors

Prebuilt dedicated connectors integrate your ERPs to Cadency, helping automate the information flow, and making the financial close much smoother.

Real-time movement of data with dashboard visibility makes it possible for teams to post Journals in real time, extract volume data for reconciliations and enable advanced automation with our purpose -built Smart Automation capability that will set up your finance teams to add value to the overall commercial organization.

With the confidence of ISO 27001 certification, Cadency connectors can support your transformation strategy for Finance.

Cadency Gateway

Cadency Gateway provides bi-directional connectivity between Cadency and your systems of record to move key data to help your R2R operation to perform more efficiently.

Supporting data transformation ensures smooth integration of data, thus removing all the challenges, resources and errors associated with manual data transfers.

Workiva API

The Workiva connected reporting and compliance platform can seamlessly integrate into Trintech’s Cadency solution to optimize reporting efficiency, improve collaboration, and provide stronger controls around the reporting process.

Cadency Data as a Service (DaaS)

Cadency DaaS makes accessing, managing and leveraging data easy and cost-effective while offering highly accurate and configurable controls.

Data is extracted and transformed for housing into a Business Intelligence tool of your choice.

Cadency Reporting

Cadency’s dedicated reporting platform enables users to design and schedule reports.

Cadency users can utilize standard reports or build custom reports to help measure the performance of the finance operation and in addition provide audit reports for all key changes.

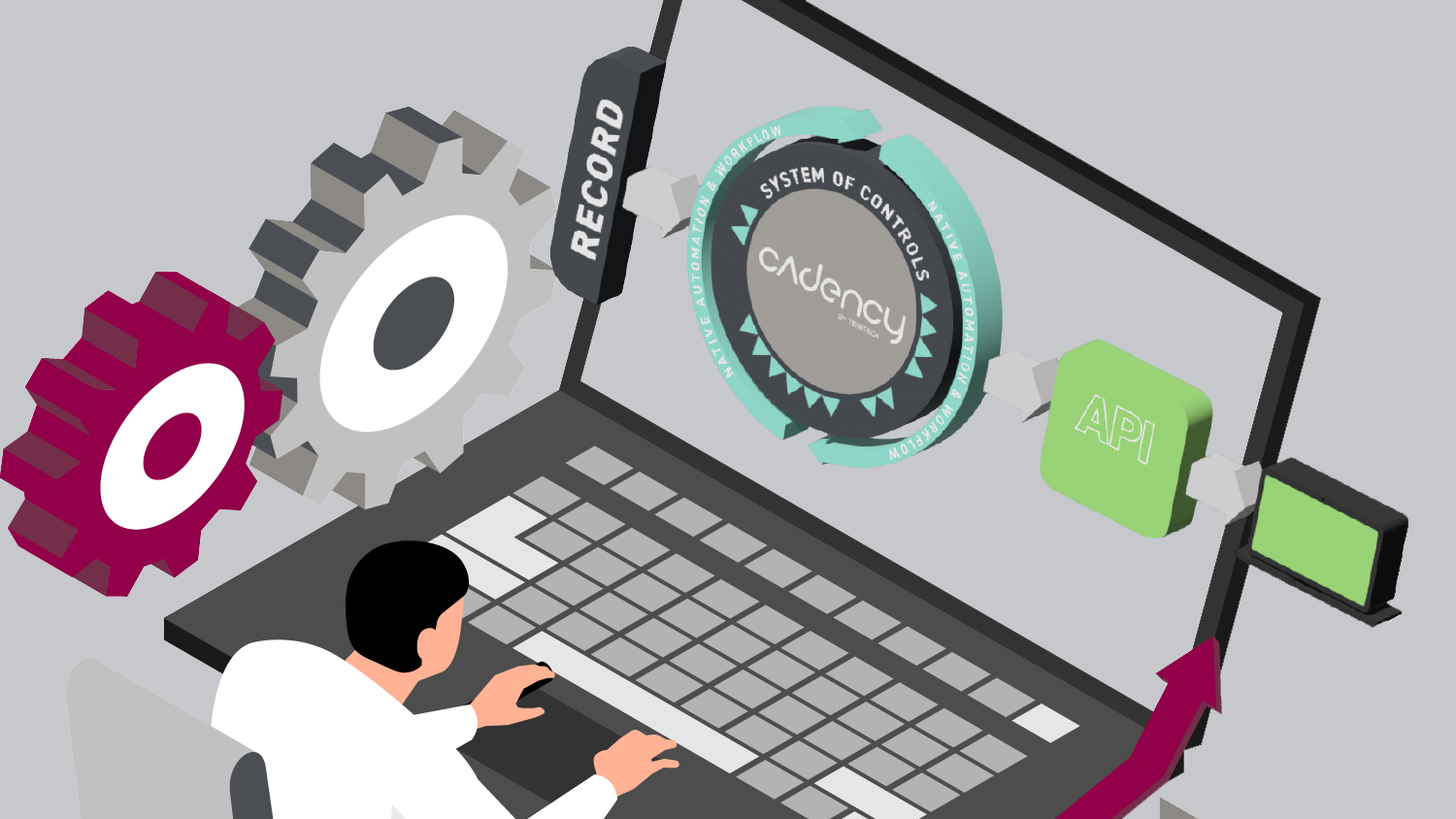

SMART Control

Cadency enables organizations to provide SMART Control, transparency and visibility with our native System of Controls where all R2R processes are standardized within a single holistic solution, ensuring effectiveness and reducing overall risk during your financial close.

Explore the PlatformSMART Automation

Process automation combined with risk-based capability in Cadency enables finance teams to focus on high-risk transactions or processes, add value to the finance deliverables and provide insight to help drive continuous improvement. Cadency’s SMART Automation enables the modernization and transformation of the Office of Finance.

Foundational Automation

Cadency delivers immediate automation.

Certification, Journal Entry, Match, Close and Compliance can all drive efficiencies and support policies and control frameworks. With real time data, teams can control their monthly processes with full visibility & transparency.

Risk Automation

Enable a risk-based approach to identify high-risk items and ensure appropriate actions will help drive a more efficient and effective close.

Risk automation takes a proactive approach to monitor, activate and mitigate transactions to ensure high-risk items are prioritized.

Utilizing risk automation, GSK was able to dynamically schedule reconciliations to reduce the volume of reconciliations performed monthly from 75% to 41%, while 32% of the reconciliations now only needed to be done on an annual basis, thus saving significant time throughout the year.

R2R Activities Automation

Transform your finance operation with purpose-built automation.

Configurable automations allow your team to eliminate mundane, rule-based activities, thus enabling teams to become true Business Partners to the organization.

Supporting your risk framework, the automation of activities drives for standardized processes and controls with the additional benefit of enhancing your working environment and supporting your team’s growth.

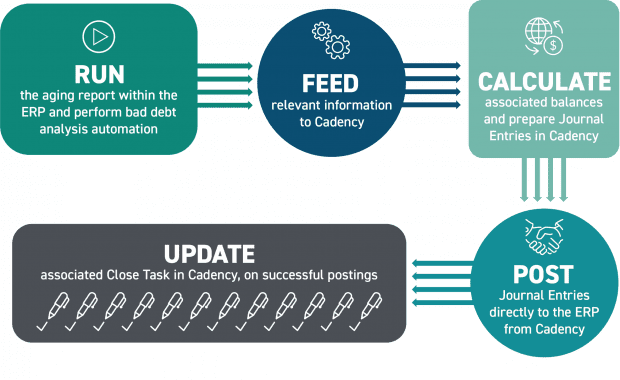

Task Automation

Even with R2R activities automation, your ERP systems often require one-off activities in order to trigger a process within the ERP such as tax postings, open/closing ledger or posting cycles.

These activities are often dependent on prior actions and require users to access the ERP to trigger the activity once notified.

Task automation, enabled via Cadency, allows you to automate activities directly in ERP instances, using native technology, thus increasing efficiencies.

SMART Workflow

If professionals in the Office of Finance have to rely on a mixture of internal emails, phone calls, and chat apps to get information from their finance teams, the monthly activities will never be done fast or even well.

Cadency provides extensive capability to enable teams in diverse locations and departments to collaborate and to enable the appropriate approvals to ensure data accuracy while providing full audit trails. Not only do teams get increased visibility and transparency, they are able to work more efficiently, no matter the location.