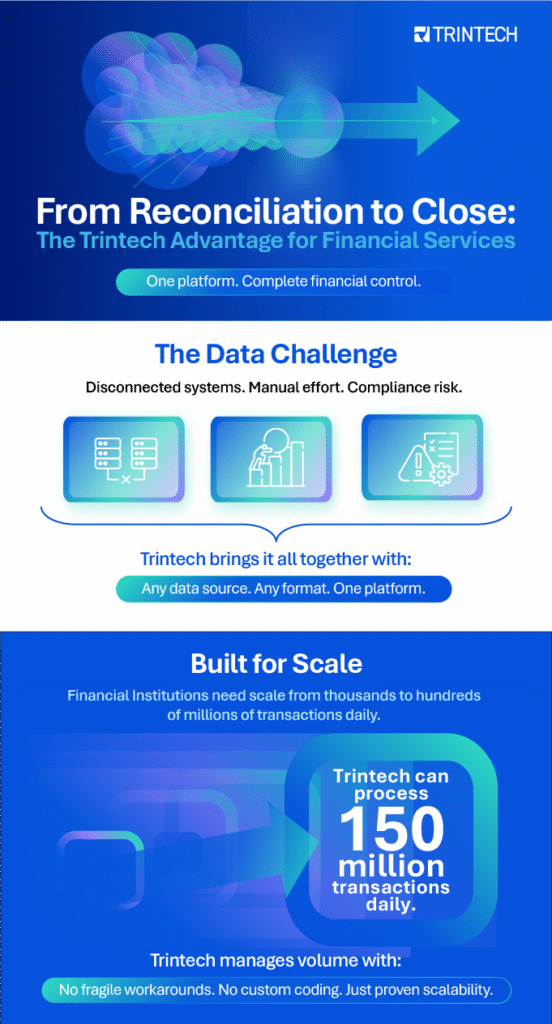

From Reconciliation to Close: The Trintech Advantage for Financial Services

Infographic

Share

One Platform. Complete Financial Control.

Trintech is the only reconciliation platform built for control, confidence, and scale for full visibility into the close.

This is just a preview! Download the full infographic for the full, clickable version.