Trusted By:

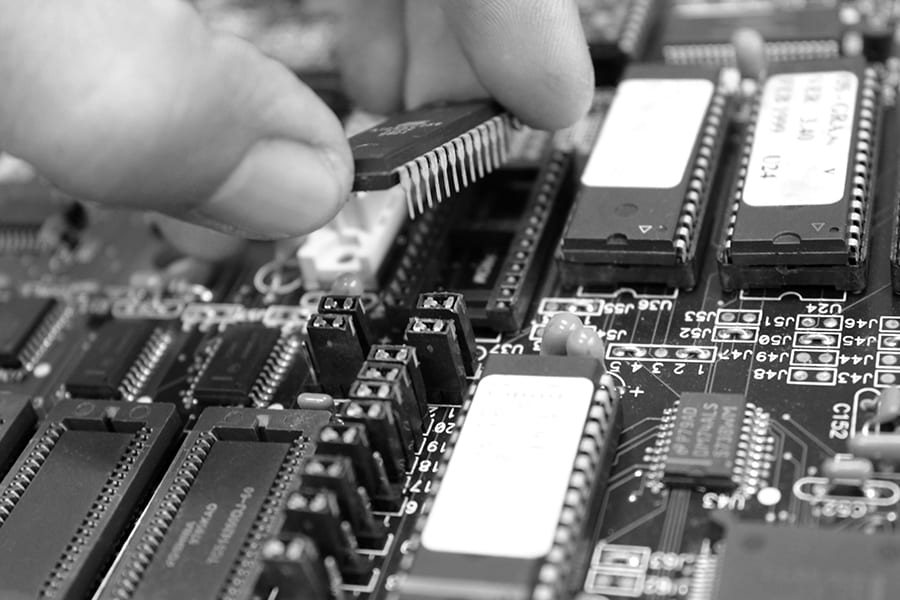

Manufacture an Efficient Financial Close

The reconciliation process for manufacturing businesses is an essential part of the accounting process, and many tasks specific to the vertical must be performed on top of the standard close tasks that all organizations handle. For example, determining what new standard costs should be entered for the upcoming year and discussing cutoff dates for removing archived bills of materials and closed or canceled manufacturing orders are all special challenges for the office of finance in the manufacturing industry.

See why leading companies like ABB, Siemens, and Boston Scientific trust Trintech for reconciliation and financial close automation, visibility and control.

62%+ Reduction in Write-Offs

99%+ Reduction in Time to Complete Reconciliations

76% Reduction in Losses

Enforce Compliance and Reduce Risk

Decrease risk and ensure compliance by having standardized and automated reconciliation and financial close processes that ensure the correct controls are in place.

Ease Intercompany Headaches

From the initial invoice and journal entries all the way to the final settlement value, establishing a predictable and reliable intercompany accounting process is critical to ensuring the integrity of any and all reported financial documentation.

Ensure Business Continuity

No matter what the climate, the pressure to meet deadlines, producing accurate financial reporting, and staying on top of the organization’s financials is always existent, if not increased today.

See What Your Colleagues Are Achieving

Three Steps to Engineering a World-Class Financial Close

Read Case Study- Reconciliation of 100% of GL accounts and sub ledgers

- Decrease in resources required to support the account reconciliation function

- Automated creation, review, and approval of journal entries

In the world of Sarbanes-Oxley, it is very important to have a well controlled process for managing your balance sheet. This goes way beyond checking a box in an Excel file indicating you have completed a reconciliation.”

HANZA Gains Greater Visibility and Control Over Financial Close Process

Read Case Study- Reduction in time spent preparing for audits

- Used real-time dashboards to monitor financial close progress

- Gained greater control over their internal processes and data

Everyone at the Shared Service Center was very pleased with the solution and found it very easy to use – much easier than having to manually print out documents and insert them into a binder each month.”

Gaining Full Oversight and Control Over the Financial Close Process

Read Case Study- Time savings throughout the month-end close

- Dashboards provide visibility and control of the month-end close, especially with a remote workforce

- Improved morale and productivity across accounting team

With all the steps documented within Adra, the team is now confident that nothing critical will be missed in the close process. I can now focus the majority of my time and energy on strategic initiatives that help drive our business forward.”

Workday Packaged Solutions

Packaged Solutions automate complex account reconciliations and high-volume, multi-source transaction matching based on deep Industrial Manufacturing industry knowledge and experience to streamline the financial reconciliation and close process within Trintech while optimizing planning and consolidation in Workday.

Connect Your Data With Our Universal Plug-and-Play ERP Integrations

What is needed to transform and revolutionize the office of finance is an enterprise system of controls that enables an efficient close with accurate and reliable reporting. This system of controls needs to work closely with your financial system of record, for example, your ERP system, to enable Record-to-Report (R2R) activities such as transaction account matching, GL reconciliations, close tasks, journal entries, or even compliance testing while extending into your office of finance’s ecosystem for controls in treasury, tax, reporting and more.

Trintech has created the first and only financial close solution embedded in Microsoft Dynamics 365 to help enhance your operations and financial close management processes.

Trintech has created the first and only financial close solution embedded in Microsoft Dynamics 365 to help enhance your operations and financial close management processes.

Trintech’s certified technology partnership with SAP® solves unique problems for SAP® customers by automating critical financial close activities that typically sit outside of the ERP.

Trintech’s certified technology partnership with SAP® solves unique problems for SAP® customers by automating critical financial close activities that typically sit outside of the ERP.

Trintech’s industry leading NetSuite ERP connector allows you to seamlessly connect and use your data in Adra and Cadency. You’ll now have real-time visibility within a single console.

Trintech’s industry leading NetSuite ERP connector allows you to seamlessly connect and use your data in Adra and Cadency. You’ll now have real-time visibility within a single console.

Gain Insights From Our Latest Resources

See how we serve your industry through our thought leadership, events, and more.