A History of Robotic Process Automation

Blog post

Share

Many great inventions have been left to linger in obscurity until a visionary saw a new use. Similarly, the recent emergence of Robotic Process Automation (RPA) has brought to light the interesting journey this innovation has undergone. To elaborate, this blog post goes through the history of robotic process automation, from the isolated craftsmen of old to the specialized accountants of today. Before delving into this metaphor, let us agree on one thing…

Reliable, non-restatable financial statements are the “end product” of Finance and Accounting in the same fashion that a completed and market-ready product would be for a manufacturer.

The responsibility of finance and accounting professionals is not just to reconcile accounts, post journals and help to prepare the narrative around their organization’s financial condition. Their mission is, in fact, to do their part to ensure that the final output, the financial statements themselves, accurately reflect the current condition and future prospects of the business. The financial statements represent their “finished product”; the accuracy and reliability of the data in these reports is a direct reflection of their process efforts, competence and commitment to quality. The roots of current standards and process will help F&A teams pave the way for a more efficient and effective future.

The responsibility of finance and accounting professionals is not just to reconcile accounts, post journals and help to prepare the narrative around their organization’s financial condition. Their mission is, in fact, to do their part to ensure that the final output, the financial statements themselves, accurately reflect the current condition and future prospects of the business. The financial statements represent their “finished product”; the accuracy and reliability of the data in these reports is a direct reflection of their process efforts, competence and commitment to quality. The roots of current standards and process will help F&A teams pave the way for a more efficient and effective future.

Walking the Ground Floor of Automation

Prior to the Industrial Revolution, craftsmen handled all phases of manufacturing in isolation; production was single-threaded, and items were produced one at a time in a serial fashion. Visit any historical reenactment or colonial village and you can meet the silversmith, the candle-maker and the cobbler.

Prior to the Industrial Revolution, craftsmen handled all phases of manufacturing in isolation; production was single-threaded, and items were produced one at a time in a serial fashion. Visit any historical reenactment or colonial village and you can meet the silversmith, the candle-maker and the cobbler.

The forthcoming notion of the assembly line allowed for process specialization, increased throughput and provided portability of labor as people did not need to know the entire process, only their specific areas of responsibility. Following the assembly line, the term “workflow automation” dates back to that industrial revolution era and became more frequently used in the 1990s, eliminating the need for manual data entry1.

Automation drove assembly line manufacturing, providing a means to reduce error rates on highly repetitive, predictive processes. In addition, configurable automation allowed for improved precision in these activities, reducing the number of errors, re-work and supporting the overall quality of the deliverable.

Moving Along the Line

The Finance and Accounting Profession is currently in the midst of this very same transformation.

In many respects, today’s accountants resemble the “craftsman” of old, in that their day-to-day activity is generally bound to tools like Excel and email, where they “craft” the narrative around a reconciliation, journal entry or close task. They are retrieving the source content themselves, rationalizing the data, loading the information into a spreadsheet, performing the task at hand and then “checking it off” as complete.

The fundamental flaws with the notion of a “craftsman” approach to finance and accounting (F&A) are profound: (a) quality may differ between respective experts, (b) throughput will vary widely based upon the capabilities of any one person, thus there will be an uneven distribution of labor and most importantly, (c) because these “craftsmen” maintain the vast majority of their institutional knowledge and expertise in their heads, when they leave…the knowledge leaves.

Even the current “assembly line” is still thoroughly dependent upon human beings at all levels to perform their little bit of work, before passing it on. Think of the spot welder who simply ensures that the fender is welded to the frame on an automobile before the frame continues on its path.

The modern assembly line really came into being as shop-floor robotics were introduced. The emergence of automation has allowed for unmatched levels of productivity, while simultaneously improving the quality of the output. Consider the previous example of the spot welder—this individual, no matter how capable, is subject to natural human error and, whether, by distraction or mental lapse, mistakes do happen. Furthermore, when this welder decides to retire they take with them, as mentioned previously, the cumulative knowledge of thousands and thousands of preceding spot welds.

Leading the Way with RPA

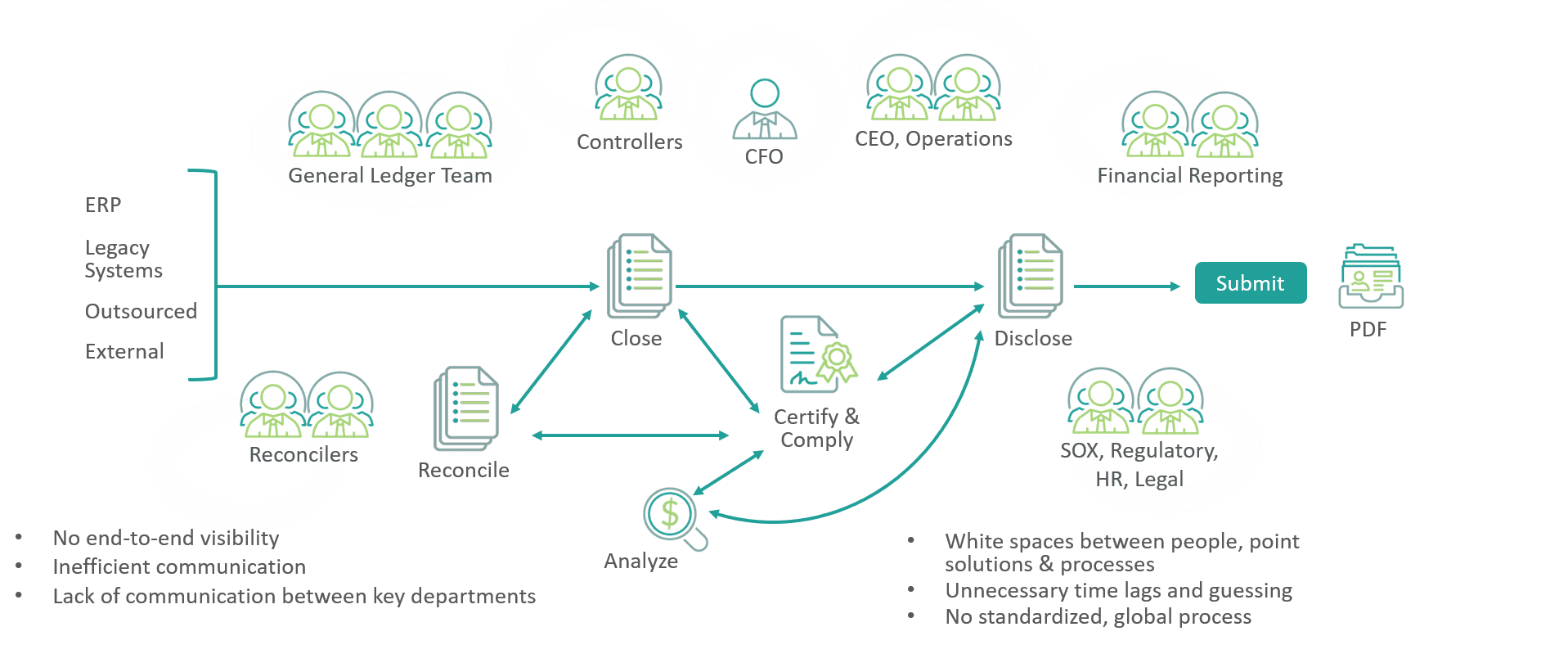

Now, how can the inclusion of modern RPA help improve the “assembly line for financial statements”? Accountants expend inordinate amounts of time engaged in individual manual processes instead of developing as value-adding resources.

Making use of configurable robotic process automation would relieve accountants of the mind-numbing prospect of having to manually match data or expend precious time during the close reconciling an account which did not have any material change period over period. RPA is analogous to the shop floor robot—as it specializes in highly repetitive, predictable and very precise activities.

One might ask, well why can’t the robot just do all of the work, if it is predictable and rules-driven? Maybe…someday, but the plain truth is that although current US GAAP and IAS are largely rule-driven, they are not completely so, and narrative explanation can be a necessity. It is within these circumstances where a business’ most valuable resource, the finance and accounting experts, become critical. More often than not, when an exception requires an explanation or interpretation, the “assembly line” will need highly skilled, knowledgeable and engaged professionals.

One might ask, well why can’t the robot just do all of the work, if it is predictable and rules-driven? Maybe…someday, but the plain truth is that although current US GAAP and IAS are largely rule-driven, they are not completely so, and narrative explanation can be a necessity. It is within these circumstances where a business’ most valuable resource, the finance and accounting experts, become critical. More often than not, when an exception requires an explanation or interpretation, the “assembly line” will need highly skilled, knowledgeable and engaged professionals.

In the assembly line analogy, companies now have the human being who acts as a quality assurance check-point checking the “spot weld” of the robot from time to time, or who must perform a given task that requires just too much nuance for the robot.

Look to the Robots

As Robotic Process Automation become more and more sophisticated, accountants will be poised to hand off more and more of the day-to-day work. RPA can free F&A teams up to focus on exceptions, more thorough analysis and reducing the risk footprint for their business while shoring up the reliable and non-restatable nature of financial statements.

Visionary companies are actively accelerating their investment in RPA technology toward complete “assembly line” technology integration. When combined, these investments are providing the basis for the “shop floor” of future finance and accounting. The history of manufacturing led organizations to robotic process automation, and now the finance and accounting profession can turn the next page.

To learn more about how robotic process automation can help you achieve greater efficiency in your F&A processes, check out our solutions.

By: C. Ben Cornforth and Chelsea Downey