Effectively Driving Financial Close Automation with Shared Services

Blog post

Share

Recent studies show that financial Shared Service Centers are focusing on supporting enterprises in building resilient futures through the ‘future of work’ alongside accelerated automation. A 2021 study, conducted by the Shared Services and Outsourcing Network (SSON) found that the Shared Services model itself is expanding in order to meet the constantly changing demands of a global business environment that prioritizes digitalization. This shift is the result of the adoption of new technologies, such as financial close automation, in order for the Office of Finance to leverage increased focus on strategic, value-adding work rather than the tedious, manual and repetitive work they typically do — which consumes a significant amount of time.

3 Insights From SSON’s Report: How to Ace Financial Close Through Automation

#1: The Need for Improved Enterprise Agility is a Key Driver in the Growth of the Financial Shared Services Model

SSON’s report revealed that a key driver in growing the financial Shared Services model has been the need for improved business agility. The future of work is evolving as more organizations shift to a hybrid or remote work environment. The adoption of technology with the flexibility of remote working will become a potential threat to organizations that try to reintroduce “old ways” of working rather than shifting to embrace technology to support staff. The Office of Finance can only be truly agile when its focus shifts from manual work to more strategic work, such as providing data insights and analysis from the reporting.

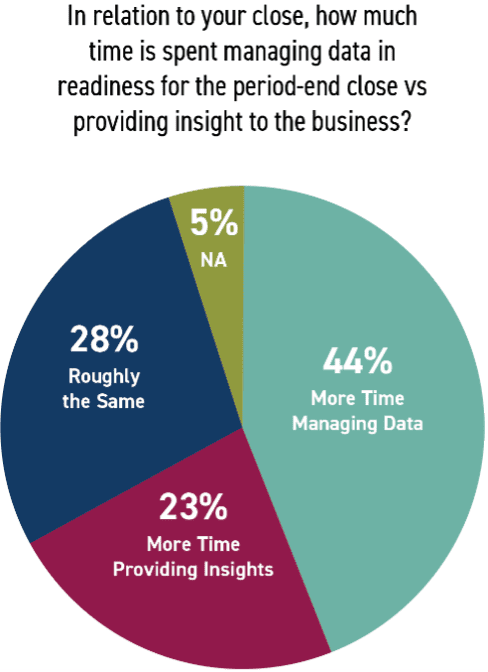

However, only 22% of Shared Service organizations are spending more time providing insights than managing data.

By implementing financial close automation, leading organizations are allowing their teams to spend time problem-solving or doing higher-value work as opposed to tedious manual tasks, such as data input or management.

#2: Record to Report is the Natural Next Process to Automate

Many organizations have focused on automating their Procure-to-Pay (P2P) and Order-to-Cash (O2C) processes. Naturally, Record to Report (R2R) is the next, most obvious opportunity to improve and automate in the Office of Finance. But SSON’s report found that, despite its ROI in increasing both cost-savings and efficiency, the Record to Report is largely still manual.

“R2R automation has the potential to add huge value, not just by ensuring the integrity of the balance sheet and critical period-end or year-end numbers, but also because the process is still largely characterized by manual and repetitive tasks that can be significantly improved.” – Barbara Hodge, Global Editor and Principal Analyst, Shared Services and Outsourcing Network

#3: Financial Close Automation Adoption is Increasing to Support Growth

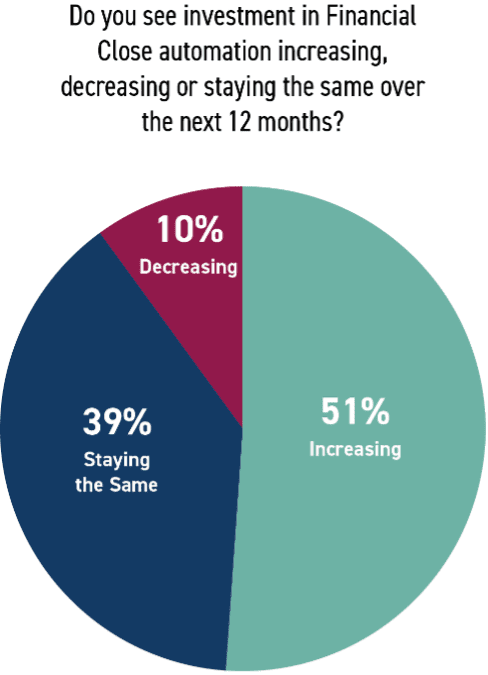

The Shared Services model is growing due to increased service lines, the need for improved agility and a surge in M&A activity. To scale with this growth, it’s important that organizations ensure their core finance processes are resilient and able to adapt quickly to support the growth of the business.

The most effective way to achieve proper scaling for growth, effective risk reduction and continuous improvement is by implementing the right technology platform for your organization.

51% of respondents stated in the SSON report that they were planning on increasing their investment in financial close solutions over the next twelve months.

Interview with David Woodall from Trintech: an Excerpt from the Report

[cta-content-placement]

“There is a significant opportunity and ROI that can be achieved by incorporating process automation across your financial close. The great benefit of financial close automation is that it allows you to increase your efficiency and effectiveness while simultaneously reducing your cost and risk. However, it is important to understand that this transformation doesn’t happen overnight and is often seen as a journey.

The first initial step an organization should take is moving away from those error-prone spreadsheets and single-point solutions to a standardized process. Once you have standardized your processes, it’s time to optimize them. During this step, your organization will use additional insights to refine your financial transformation and will most likely confirm and establish a process owner. Full standardization and optimization of your processes will better prepare your organization to deploy automation.

The third step is automation, which solidifies a standardized and ideally optimized process model for your Record to Report process. By applying risk-based automation across your balance sheet reconciliation and journals, you can ensure that risks are managed more effectively, and the work is both performed and approved by the appropriate person. From a high-volume matching perspective, automation allows you to put robust matching rules in place that increase your match rate for several types of reconciliations such as bank, retail operations, insurance, intercompany and supplier reconciliations. Along with the ability to track exception items, automation will continue to drive increased efficiencies that reduce the time needed to conduct the process. In return, your highly qualified employees can spend less time on menial tasks and more time focused on helping drive the strategic direction of the organization.

The final phase of the journey focuses on deploying advanced automation such as RPA, Artificial Intelligence and Machine Learning that can sit across your processes to add another layer of control in detecting unusual or missing information that may be the result of errors or potential fraud.

Whether you have automated none, some, or all your processes, my recommendation is to be proactive – invest in financial close automation that is not only going to improve aspects of what you have today but will also provide your organization with a platform that can support end-to-end process excellence in the future.” -David Woodall, Director of Product Marketing, Trintech

For more details, read the Shared Services & Outsourcing Network (SSON) Special Report: How To Ace Financial Close Through Automation.

Written by: Isabella Delgado