Take a Holistic Approach to Strengthening Your Financial Controls Framework

Blog post

Share

More and more, the Office of Finance is expected to be a true value-adding partner when it comes to operating a successful business in today’s economic landscape. However, Finance and Accounting (F&A) teams can’t do that if they’re constantly bogged down in completing the month-end close. Worse than that, predictive modeling and plans to scale the business become much harder to rely on when F&A doesn’t feel confident in the numbers that they’re reporting. In both cases, the key to freeing the Office of Finance is to strengthen the existing financial controls framework.

Every company should already have some sort of framework for their financial controls in place. This is a requirement for doing business in most countries and for complying with regulatory requirements like SOX in the U.S. One of the best ways to ensure the integrity of those financial controls is to align people and processes with best-in-class technology. Once processes have been standardized and people within the Office of Finance have been empowered, the natural next step is to strengthen that framework through automation.

Leverage Software to Improve Financial Controls

Manage Time

Closing the books and reporting results is a complex array of tasks that needs to be completed in a short amount of time, while also meeting strict compliance standards. Writing a to-do list, working out timings, splitting up tasks and hosting daily meetings only goes so far, especially when time is limited. To complicate matters further, as soon as something in that well-crafted plan changes—a missed document surfaces, someone calls in sick or a mistake is made—everything comes crashing down.

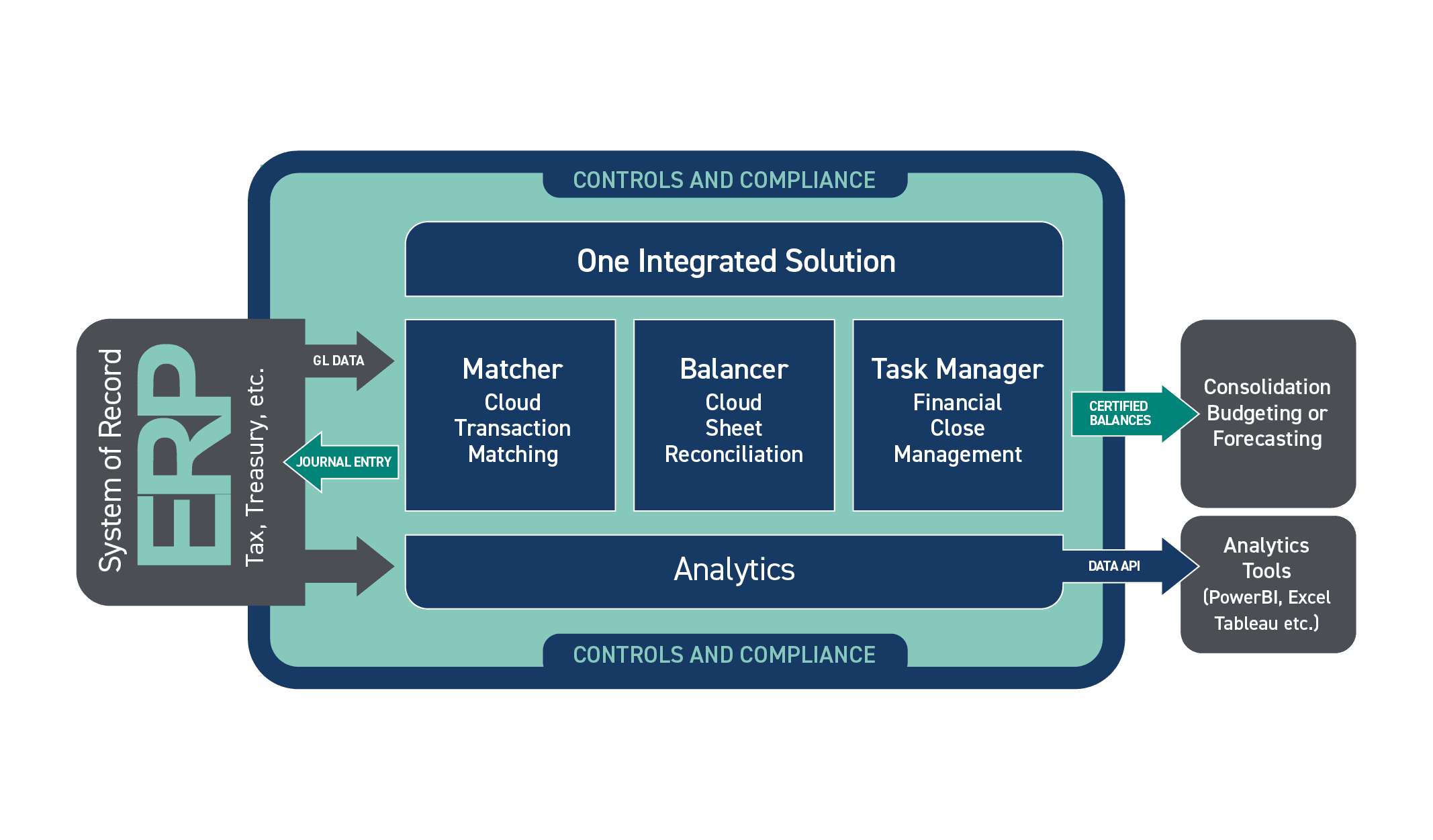

Luckily, software that centralizes tasks lists and controls and documents the progress of each item on the project’s to-do list is available: Adra Task Manager. Automatic notifications and alerts help keep everyone on task. And perhaps most importantly, embedded workflow and audit trails provide water-tight governance for financial controls.

Quicken Transaction Matching

The first task in any financial close is to match transactions from a given period. When completed manually, this is one of the most time-consuming parts of the month-end close, even when everything fits neatly into the financial controls As a business grows, so too will the complexity and effort needed to keep the books under control. Savvy organizations are now making use of automated matching systems, like Adra Matcher, to run this task behind the scenes on a daily basis. The process is completed at a fraction of the speed, so teams can spend more time investigating the unmatched transaction exceptions, improving the accuracy and reliability of the overall close.

Remove Reconciliation Repetition

Balance sheet reconciliations are not complicated tasks, but substantiating the balances and adding supporting documents can become a repetitive process with a large margin for error when done manually. More often than not, spreadsheets are re-saved versions of original documents created years ago, littered with broken links and macros that no one can make sense of. Imagine how much teams must enjoy picking their way through these documents when under pressure to complete the financial close. However, using software like Adra Balancer automatically reconciles low-risk accounts so preparers can focus on balances for accounts receivable, accounts payable, and other key accounts. It also lets the accounting manager quickly spot bottlenecks and potential write-off risks while housing all of the substantiation and documentation required to provide full visibility into the balance sheet. If a balance changes after being certified, the preparer and approver are automatically alerted to re-validate the account. Instant tracking of each reconciliation creates an audit trail within the financial controls framework that is readily available to any internal or external reviewer.

Adra by Trintech provides finance professionals with the tools that they need to not only boost the integrity of their financial reporting but also to gain critical insights into bringing true value to the organization as a whole. To learn more about the benefits that Adra provides, check out what some of our most successful customers are saying.

[cta-content-placement]

Written by: Nathan Stabenfeldt