Health Checking Your Financial Transformation

Blog post

Share

It’s no secret that best-in-class organizations close faster with increased efficiencies, reduced costs and lower audit fees. The challenge is understanding how this is achieved, and how you can continue to build upon these improvements moving forward.

All best-in-class companies are focused on two key activities— standardization and automation. This is why so many organizations have made the decision to move away from disparate, manual processes to transforming their Record to Report process with technology. But, how can you continue to evaluate opportunities for ongoing improvements in your financial close process after the implementation?

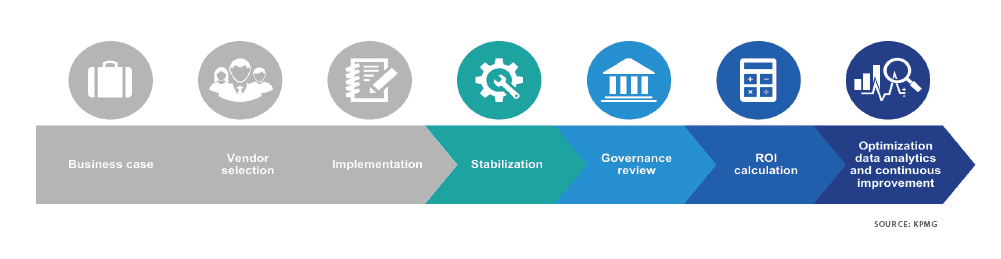

As you can see below, KPMG has created a timeline that highlights a financial transformation project from the time you build your business case for investment all the way through optimizing your data analytics for continuous improvement. Visually, it looks like a seamless process, however the main challenge for most organizations lies after implementing the software.

Below are some quick tips on how to continuously improve your financial transformation post-implementation:

Stabilization: Create a set plan for change. There will be a period of time that processes may take longer due to user adoption, however it is important to continue to maintain open communication with users to identify any potential areas for additional training.

Governance Review: Ensure your initial project objectives. It is key to have a team in place that is focused solely on reviewing the data coming out of the solution to ensure your data is clean, your users are using the tool correctly, and that you are reporting on the items most critical to your business.

ROI Calculation: Compare your expected ROI from your business case to your resulting ROI after the implementation. By quantifying your Record to Report investment, you have proof that you can deliver on your projects, allowing you to invest in other emerging technologies to better equip your finance organization to be a strategic asset to the business.

Data Analytics: It’s never too earlier to start looking at the data. As you begin to analyze your data, you can start to see the trends that are impacting your financial close. Regardless if these trends are positive or negative, a Record to Report solution gives you the necessary visibility and transparency into your process, allowing you to identify where improvements need to be made.

For additional information on how to continuously improve your financial transformation project, view our recent webinar with KPMG, Health Checking Your Financial Close with Risk Intelligent RPA™.