The Financial Transformation Journey to a World-Class Close

Blog post

Share

Despite the digital age we all live in, it is not uncommon for enterprise-class organizations to rely on spreadsheets, emails and phone calls to manually manage tasks critical to the Close, but it does create potential high risks across the organization. The benefits of a financial transformation project are endless in today’s complex, compliance-focused world. Do we want highly skilled people managing menial, manual activities or do we want them to focus on delivering valuable insights to the business?

Despite the digital age we all live in, it is not uncommon for enterprise-class organizations to rely on spreadsheets, emails and phone calls to manually manage tasks critical to the Close, but it does create potential high risks across the organization. The benefits of a financial transformation project are endless in today’s complex, compliance-focused world. Do we want highly skilled people managing menial, manual activities or do we want them to focus on delivering valuable insights to the business?

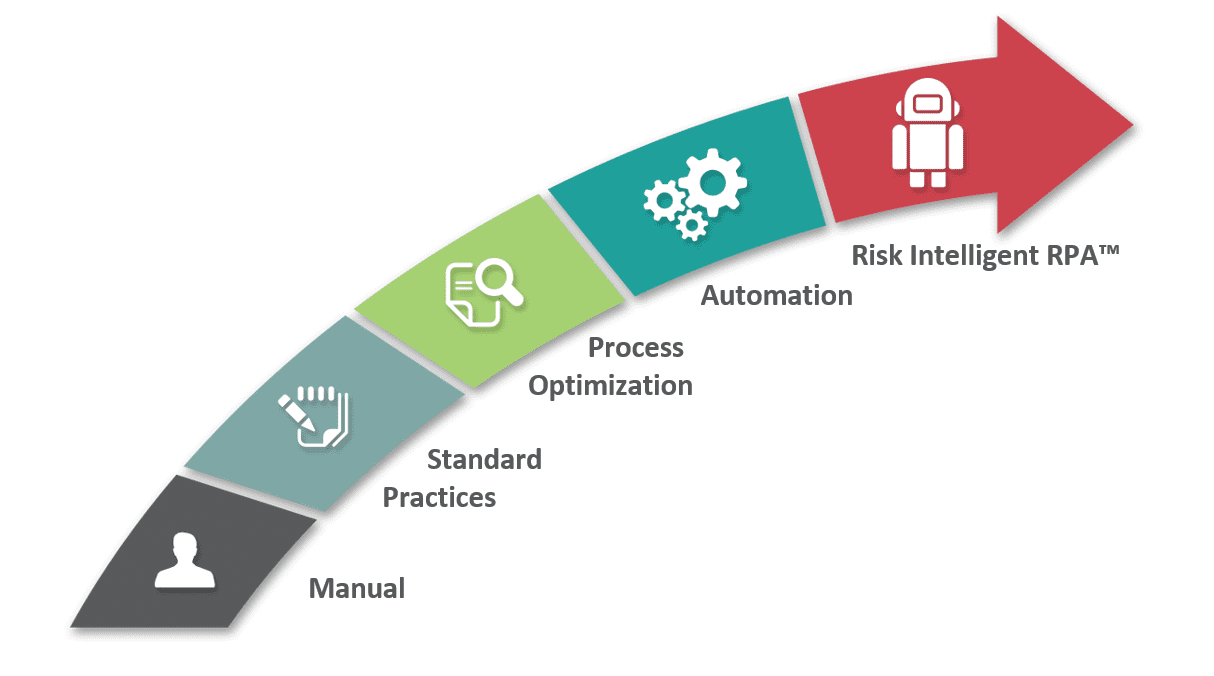

• Yesterday – Manual and Internal: Growth through mergers/acquisitions and historic local purchasing decisions means that the technology landscape for most finance organizations has become a blend of ERPs and other point solutions. This leads to increased risks and sleepless nights for both the C-Suite and the employees tasked with manually delivering the numbers each period end.

• Today – Outsourced: Several organizations have come to the realization that using its highly qualified employees to manage these menial, manual Close tasks is an inefficient way to ensure compliance over the period end numbers. They have then, in turn, outsourced these tasks to Shared Service Centers or BPO partners, only to be exposed to the same human-error risks in their period end numbers. Although there could be some single-point solutions being used to manage specific processes, the overall compliance framework in regards to the appropriate controls is often still manual.

“RI RPA allows an organization to live in a risk-based world. One where the robots know the tolerances that are allowed according to the organization’s policies and automatically runs activities, only notifying a person when there is a core issue to be resolved.”

• Tomorrow – Risk Intelligent Robotic Process Automation™ (RI RPA): To drive further efficiencies, world-class companies are now realizing that Trintech’s RI RPA can be utilized to not only lower costs and reduce errors, but also improve compliance by inspecting, automating and triggering remediation. RI RPA looks to optimize the process, so that users can go beyond balancing the workload and eliminating manual work, to analyzing the data and applying creative intelligence to tasks such as problem solving and evolving the business. This not only delivers improved value to the business, but is also the type of high value work most likely to attract and retain high quality people.

For more information on a journey to a world-class close, download our eBook, “Enabling Financial Transformation through Technology.”

Written by: Kelli Shoevlin