Avon’s Finance Transformation: Scaling Compliance and Automation with Trintech

Case Study

Share

Overview

As one of the most iconic beauty brands in the world, Avon has always been in the business of transformation—and not just for its customers. Over the past decade, Avon’s finance organization underwent a significant evolution, centralizing operations and modernizing its record-to-report (R2R) processes.

The goal? Enhance compliance, simplify global operations, and automate at scale. At the heart of this initiative was Cadency by Trintech, a solution that has empowered Avon to optimize performance, reduce manual work, and strengthen internal controls across its entire finance ecosystem.

The Challenge: Disconnected

Systems and Compliance Risks

Before partnering with Trintech, Avon faced a common challenge in large multinational enterprises: fragmented finance processes across multiple markets and heavy reliance on manual work. This created inefficiencies and made consistent compliance difficult.

Two major transformation drivers emerged:

- Centralization & Outsourcing: Around 2010, Avon began consolidating finance operations via a shared services and BPO model.

- Compliance Reinforcement: More recently, the company doubled down on strengthening internal controls and governance frameworks across the board.

The Solution: Trintech as the Backbone of Finance Automation

Avon deployed Trintech’s Cadency Platform in two key phases:

- Initial Rollout with BPO Integration: The initial implementation featured Cadency’s Journal Entry, Certification, and Close modules, providing robust support for outsourced operations within a centralized, streamlined platform. Each month, approximately 4,000 reconciliations are managed through Cadency, achieving an impressive 50% auto-reconciliation rate. Additionally, around 7,000 journals are processed monthly, with fewer than 0.5% requiring rework, reflecting high accuracy and efficiency.

- Global Expansion & Automation: Avon expanded Cadency internally, tightly integrating it with automation tools and aligning it with evolving compliance standards.

Key capabilities included:

- ERP Integration: Avon successfully integrated it with Oracle Enterprise One, overcoming early challenges to create a seamless flow between systems.

- Automated Workflows: Using Trintech’s AI Agents, journal entries and reconciliations are now processed automatically, reducing manual input.

- Access Governance: Integration with other systems ensures access controls and user provisioning are managed through secure, automated workflows.

- Tracking KPIs: Monitors automated reconciliation and journal volumes, tracks reworks and rejections, and identifies overdue tasks to manage workflow pressure.

Results: Real, Measurable Impact

Avon’s commitment to automation and process

excellence delivered significant benefits:

- 10–15 FTEs eliminated in journal processing through automation alone

- Recurring cost savings and consistent productivity with no additional headcount despite steady workloads

- Stronger internal controls, central visibility, and reduced audit risks

- Reduced manual intervention, with preparers accessing the process through workflows while approvers and reviewers use Cadency directly

- Scalable solution that aligns with Avon’s continuous improvement strategy

Looking Ahead: Continuous Improvement at the Core

Avon is not stopping here. The finance team continues to explore:

- Expanding into new Cadency modules, such as Cadency Compliance and Cadency Match

- Further ERP automation, embedding certification-relevant data into Oracle processes

- Full API connectivity, especially for access management and account creation

Conclusion

Avon’s journey with Cadency by Trintech is a blueprint for global organizations seeking to modernize finance. By combining strategic centralization with powerful automation, Avon created a lean, compliant, and scalable finance operation that’s built for the future.

Read the Full Case Study

Discover key insights and actionable strategies by downloading our full case study.

See Trintech in Action

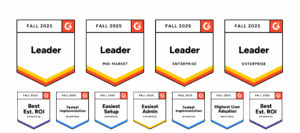

Seeing is believing. Discover why Trintech is the real leader in financial close automation.