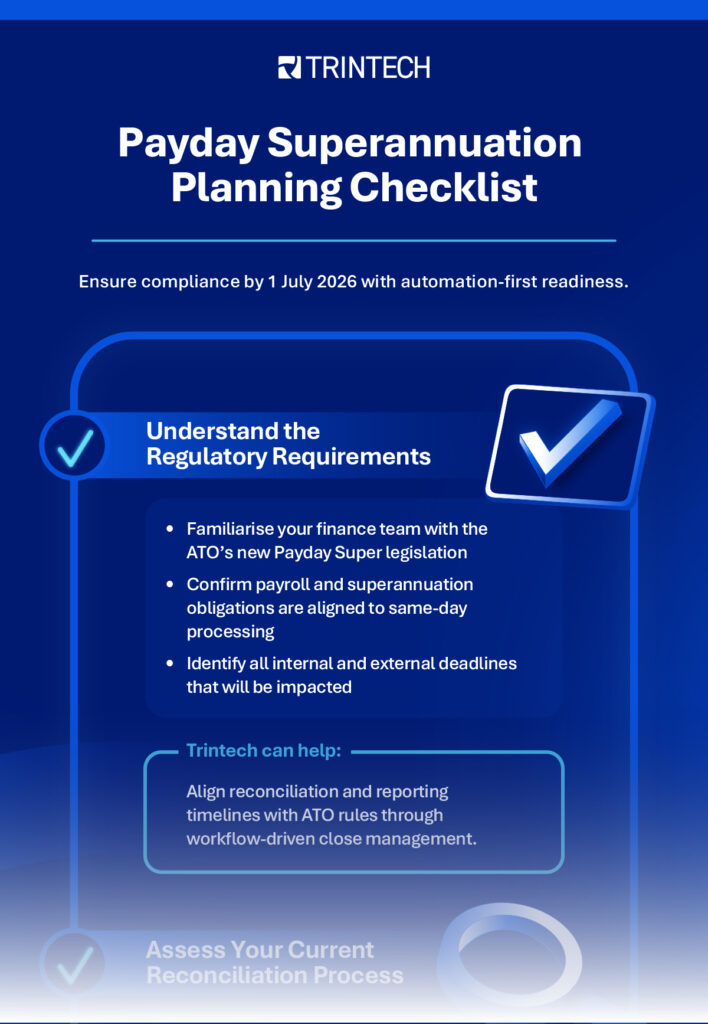

Payday Superannuation Planning Checklist

Infographic

Share

Beginning 1 July 2026, the Australian Taxation Office (ATO) will implement a significant reform: superannuation contributions (retirement funds) must be remitted to employee funds on payday rather than quarterly.

This initiative—known as Payday Superannuation—aims to enhance employee retirement savings by giving them a more accurate and real-time view of their fund’s performance. However, it also introduces a substantial increase in reconciliation volume, compliance obligations, and operational challenges for finance and payroll teams.

Depending on your organization’s pay schedule, payday superannuation could increase reconciliation workloads by as much as 13x. Download our free checklist to prepare your accounting team.

Want to learn more about Payday Superannuation, what it means to F&A teams, and how to prepare? Read also: