How a Global System of Controls Can Move Your Financial Reporting from Flipping a Coin to a Sure Investment

Blog post

Share

A recent EY survey of over 1,000 CFOs found that half are not even “somewhat confident” in their degree of financial reporting. In order to solve this challenge for CFOs, investors, pensioners and more, we must move financial reporting accuracy from a coin flip to near certainty. To do this requires us to revolutionize our Office of Finance with technology that not only handles workflow and automation, but also provides a global system of controls to ensure the reliability of our financial reporting.

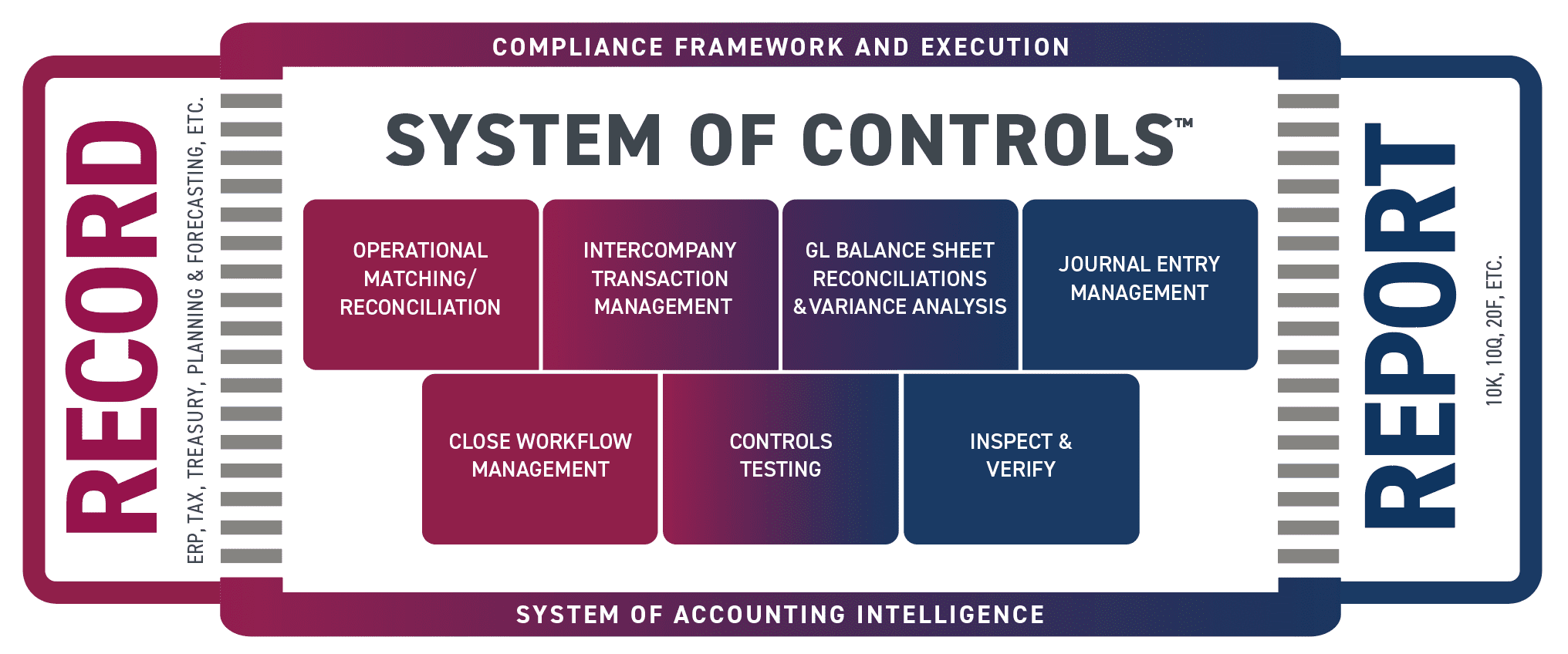

As organizations begin to take the initial step towards automation, many often look to the basic core processes of a Record to Report workflow: account reconciliation, journal entry adjustments and close workflow management. Although each of these processes are critical to the financial close, especially with account reconciliations considered the largest control for most companies, one major component is still missing – compliance.

Trintech uses intelligent automation to ensure key controls that exist in that system can integrate and interact with one another. As an example, a GL account reconciliation which is a key control to validate your balance sheet. As a part of performing that key control, users might identify adjusting items. If you just stop the process there, we aren’t going to produce reliable financial because we haven’t addressed those risks. Utilizing a system of controls, you are able to take those adjusting items (the risk) and actually populate a Journal Entry voucher. That Journal Entry voucher will collect the information, validate it (is it compliant with your system of record?) It will put it through an approval workflow and post those correcting entries back into the system of record (ERP). It will then close those reconciling items out and then realign your financial statements. So, these 2 key controls, the interactions between the GL reconciliations and the journal entries, ensures you have an auditable, traceable activity trail. So, when it comes to your auditors, they can actually form an ad-hoc judgmental journal that can be posted back to the source.

Trintech’s system of controls anchors within your compliance framework to enable you to cover your environment and ensure that capabilities like the following can be included, managed and audited:

- Intercompany Preventative Controls allow you to raise a request for an intercompany transaction, negotiate and approve it and then post it to your system of record (ERP). This complete set of activities (requests, edits, and approvals) are all logged and auditable. Even more importantly, there is no requirement to move financial records from your ERP to another system of record. Instead, we manage these updates regardless of the number of ERP systems or type.

- Intercompany Detective Controls ensure all IC transactions are posted according to a preventative control format and remediation capability, and when it doesn’t, within an account reconciliation.

- RPA Tools deploy and perform activities defined by controls. Through our Close APR API you can define these controls and close tasks and update them as any of your RPA bots run (UIPath, BluePrism, etc). In the future, link them to compliance checks so when RPA bots are updated, this triggers a compliance review to ensure the control is still valid or even necessary.

- Disclosure Management or Statutory Reporting are linked into your solution so those activities are visible, managed and controlled. In addition, financial information will be linked in those reports via APIs so they can be validated against your financial information, which is control validated before reporting.

- And many, many more…

By leveraging your existing natural system(s) of record, such as your ERP/financial systems for account and journal entries, treasury management system for your cash information, tax systems for your tax transactions, inventory management for your physical assets, etc., you can maximize your ROI on those investments by keeping those systems as the vehicle to create the permanent record of all business activity as you run your financial controls, close and reporting. Trintech then provides a verifiable and permanent record of all your system of controls, as defined by your compliance framework, including; what they are, when they are run, their results and any remediation required when a control fails. By utilizing a system of controls that enables integration with any system of record (ERP, treasury, tax, etc.) all controls in your office of finance are in scope, auditable and reportable. This provides the ability to identify opportunities to remove the bottlenecks in the process where the path to effectiveness or efficiency are impacted.

So once you have a system of controls in place, how do you continue to make the most of your investment? Read through our blog series to discover how Trintech’s Record to Report Automation Framework can help.

Written by: Michael Ross, Chief Product Officer at Trintech

Explore the Full 7-Part Series on Trintech’s Record to Report Automation Framework

Part 2 – How to Improve Controls, Reduce Risk and Lower Costs with a Record to Report Automation Framework

Part 3 – R2R Automation Framework: ERP Connectors

Part 4 – R2R Automation Framework: APIs

Part 5 – R2R Automation Framework: ERP Bots

Part 6 – R2R Automation Framework: Risk Intelligent RPA

Part 7 – R2R Automation Framework: Artificial Intelligence

Additional Resources: