Continuing the Digital Transformation with Process

Blog post

Share

Today, the Office of Finance is ever evolving and expanding into areas of the organization that they have not been before. Previously, the month-end close, forecasting, and budget development consumed the Office of Finance but as the world has evolved, so have its day-to-day functions. The Office of Finance is becoming more accountable for providing insights promptly to help guide critical business decisions and identify future growth opportunities.

To meet the demands and expectations of today’s business climate, CFOs must widen their domain to include not just process transformation but also enterprise-wide digital transformation. Part of this transformation is ensuring that their people are ready to embrace change while maintaining their day-to-day activities without disrupting themselves and the organization.

Digital and Process Transformation

An objective of any process transformation project is to achieve process enhancements by improving the quality, effectiveness, and efficiency of financial information, ultimately enhancing shareholder value. Another objective that needs to be at the forefront when thinking about a process and digital transformation is ensuring the selected technology will aid employees in the organization in doing their job. According to a study by the Hackett Group, roughly 65% of the accountant’s time is spent on manual low-value processes.

The People

Employees are an organization’s greatest resource and are essential to its short and long-term success. The movement – nicknamed “The Great Resignation” – has caused organizations to examine their pay, benefits, and employee satisfaction levels — including how they can solve these issues. As the Great Resignation plays out, many employees are also looking for ways to advance their careers and want to change how they work by choosing companies with a technology stack that suits their working habits.

It’s no secret that the millennial generation is very different from more senior generations in the workforce. Technology was “born” into this generation versus “learned.” They are tech-savvy and equipped with fundamental tools to do complex jobs. As they quickly become the majority in the workforce, we must ask ourselves, “What does this mean within my organization?” and “Do I have tools to help attract and retain my current and future employees?” The technology solutions we utilize today and over the next few years must be holistic. With this shift, we can see why just purchasing technology solutions for the sake of technology does not lead us to a sustained effort and thus minimizes the likelihood of true transformation.

When we think about the technology involved in a transformation, we also need to consider the roles and responsibilities that this new transformation will bring to the organization, how that will impact the process of day-to-day activities, and if it will add value to the team and organization.

The Process

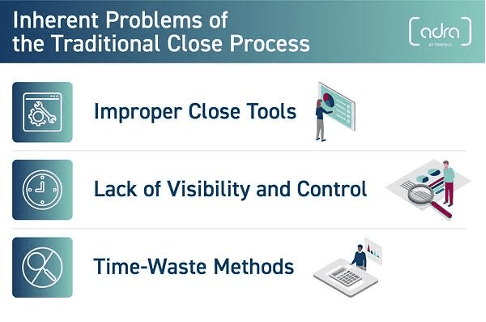

Leveraging technology to an already flawed process is a current and common mistake that large and small enterprises are making today. Specifically, many companies are trying to deploy automation for simplicity and expediency. However, majority are just making a bad process run faster – exposing them to severe risk. The lack of standardized processes creates what we call “noise” and leads to the types of manual activities teams spend more than 65% of their time doing, adding no strategic value to the organization. This approach also makes it incredibly difficult to focus on the ultimate goal of producing accurate financial reporting documents.

As we know, the Financial close process can be hectic. Clarifying roles and responsibilities well in advance, with the finance team and any management team leading operations, is critical; without this, understanding who oversees what pieces of the process quickly becomes lost. Your employees cannot effectively execute their role or support the team if they do not know what is expected of them and what they are responsible for. While many of those that are a part of the process agree that time is precious to them and their workday, they also agree there is never enough of it.

With a dashboard-driven management framework, the Cadency platform maintains a constant communication flow, significantly reducing missed deadlines and ensuring accuracy and completeness, allowing for better time management. Some teams complete the needed closing and reporting procedures but have little time left over to assist in the strategic projects that the organization requires of them. Teams that can maximize their time by automating repetitive tasks or integrating data and processes are in the best position to aid in strategic decisions.

By introducing Cadency Close Management module into your workflow, you will add a level of process allowing you to approach each period end with greater confidence and much more visibility into any future or current bottlenecks. Achieving a faster, more compliant close is vital to increasing the Office of Finance’s strategic value and rounding off a thriving digital and process transformation.

[cta-content-placement]