Account Analysis and the Data Management Strategy Challenge

Blog post

Share

Data, and account analysis in general, is a key challenge for the Office of Finance today — especially when it comes to implementing a data management strategy to gain control of the huge volumes of data that flow through finance.

Different stakeholders across the business require that data with differing standards dependent on their business needs. As a result, Record to Report finance teams need accurate and clean monthly data to complete activities such as:

- Accurate recording of the outstanding bank reconciling items

- Updates on provisions for obsolete stock from 3rd-Party data

- Fully compliant statutory reporting

- Timely intercompany reconciliations

However, compliant statutory reporting relies on accurate data produced from a suitable system of controls, with all outstanding items correctly accounted for whilst the finance business partners drill into how the business has performed in the prior period. Then, that data feeds into their forecasting models. Additionally, treasury & intercompany teams need to finalize the intercompany reconciliations in a timely manner to settle the accounts, thereby freeing up cash and reducing the exchange gains and losses.

What’s the Challenge With Organizations’ Current Data Management Strategy?

Concerns around improper data management strategy and inaccuracies arise from the perfect storm of: the number of demands on finance, along with the volume of data to handle and the deadlines imposed.

Deadlines cannot be moved out, and finance teams actually face significant demand to accelerate deadlines in order to complete the monthly close earlier. The second demand — which is more complicated and time-consuming than most organizations know — is to deliver high-quality data to commercial teams for forecasting and planning purposes. The volume of data cannot be reduced due to the nature of the processes involved, and increased data is an effect of organizational growth. In addition, this data may be from multiple sources, thereby increasing the complexity of manipulating and loading data into any data tools that increase the risk of inaccurate data.

The result of these demands, coupled with volume and deadlines then creates significant pressure on the finance teams — resulting in poor data quality within the month end close and for the commercial teams. Poor data quality can result in Control failures and transactions landing on the balance sheet that are not appropriately validated, therefore increasing risk of write-offs, the potential for misstatements and threats to the future of the business.

The result of these demands, coupled with volume and deadlines then creates significant pressure on the finance teams — resulting in poor data quality within the month end close and for the commercial teams. Poor data quality can result in Control failures and transactions landing on the balance sheet that are not appropriately validated, therefore increasing risk of write-offs, the potential for misstatements and threats to the future of the business.

So now that we understand the challenges around a data management strategy and the impact of poor data quality, let’s look at the tools available help improve the efficiency with our reconciliations.

Solving the Data Management Strategy Crisis

#1: Smart Data

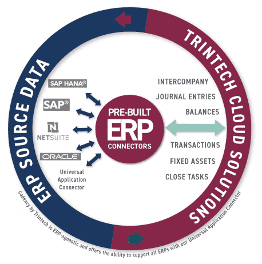

The ability to seamlessly integrate your data from multiple sources will give you the assurance of integrity of data as well as real-time data feeds that ensure you can perform reconciliations in good time. This integration can function both internally from your multiple ERP instances and externally from 3rd-Party providers such as banks, insurance agents, warehouses, suppliers and service providers. Direct, automated ERP integration enriches your data and will also increase your matching rates with the result of minimizing the number of exceptions to then manage. In addition, data enrichment prior to loading can ensure the data is categorized according to an organization’s business rules. With this capability, it allows data ownership to be efficiently identified without the need for digging into the detail that often results in a communication chain to find the data owner.

Cadency® by Trintech is a Record to Report solution that integrates with any major ERP (including SAP, Oracle and NetSuite instances) as well as any other ERP using our universal connector. These pre-built ERP connectors are designed to reduce the cost, time and risk of data integration by eliminating the need to develop custom code. Automation with both an ERP connector and a Record to Report platform is one of the first steps to building an effective master data management strategy.

#2: Automated High-Volume Matching

It’s critical that your digital platform can manage significantly high volumes of data and is scalable as your business grows. Retail and B2C enterprises especially need to reconcile significant volumes of data daily in order to identify any potential data fails from outlets and to ensure transactions are posted to the General Ledger in a timely manner. And, more importantly, these organizations must ensure the cash is reaching the bank. Global organizations with complex supply chains need to be able to reconcile significant volumes of intercompany data, and driving this activity to an automated, daily occurrence can then increase the frequency of settlements with the benefit of reducing exchange rate risk and increasing cash flow. It also takes the pressure off the key month end cycle as the volume of outstanding mismatches is significantly reduced and allows for quick judgmental decisions to be made for material items.

Organizations that utilize Cadency to automate their high-volume matching process see a high return on investment up to:

- 80% reduction time spent on the transaction matching process

- 75% reduction in the time spent researching financial exceptions

They also see long-term ROI in more areas up to:

- 62% reduction in write-offs related to reconciliations

- 14% reduction in the risk of revenue impact because of misstatements

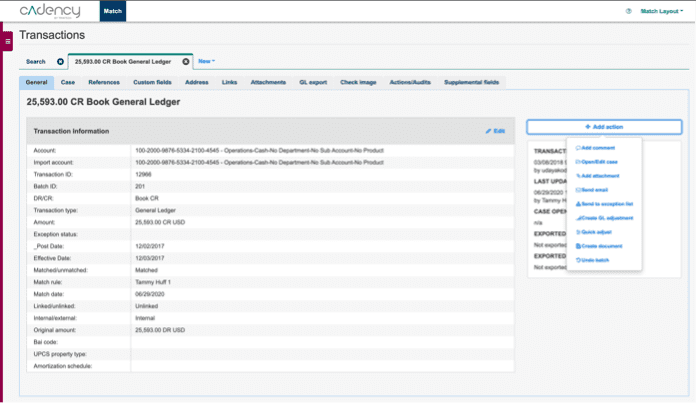

#3: Account Analysis in Cadency

Data enrichment, as detailed in Smart data, enables teams to effectively identify the potential ownership of items for investigation and resolution. This useful capability helps teams when dealing with large volumes of detail to be able to direct cases to the correct team quickly without the need of trying to understand the transaction in order to identify ownership.

Data enrichment, as detailed in Smart data, enables teams to effectively identify the potential ownership of items for investigation and resolution. This useful capability helps teams when dealing with large volumes of detail to be able to direct cases to the correct team quickly without the need of trying to understand the transaction in order to identify ownership.

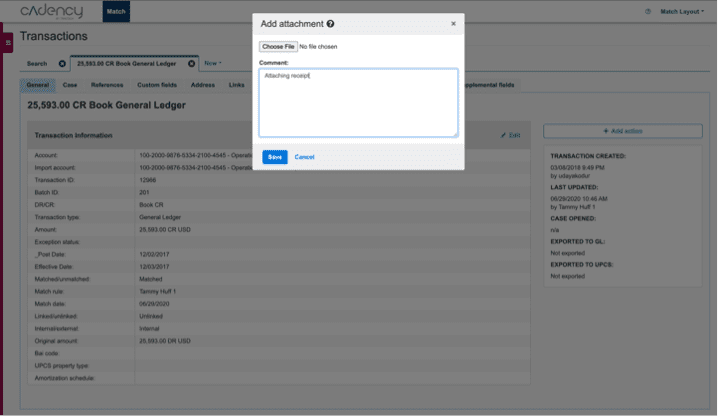

With account analysis, they can then effectively manage these exception items within the matching tool with integrated escalation and item tracking to ensure accountability for outstanding items.

This eliminates the use of emails and online messaging to manage these exception items, ensures full accountability for outstanding items and a complete audit trail. Integration of high-volume transactions with seamless integration into a risk-based journal entry process ensures the appropriate controls are in place for any items that need to be moved out of the reconciliation for the period.

Cadency clients, such as LKQ Corporation, have seen significant success in taking a risk-based, account analysis approach to their reconciliations. With the Record to Report automation platform, they are able to develop effective risk-based reconciliation policies that both boost efficiency while promoting data accuracy.

#4: Control in the Audit of Period End Reconciliations

Typically, daily reconciliations result in a period end reconciliation process that provides the final balance sheet position. Cadency provides direct integration of outstanding open items into the period end reconciliations, reduces any duplication of work and demonstrates a strong control with a review and approval capability to sign off the period end reconciliations.

This seamless integration in Cadency also facilitates the audit process as it logs everything to an automatically generated audit trail and allows the auditor to see the open position as at the effective date, and then subsequently drill down into the data to then see the clearing date for that item as a significant number of items would be expected to clear within a reasonable time.

Future-Proofing Your Master Data Management Processes

Spreadsheets are still frequently used to reconcile datasets. However, finance organizations are now driving towards improving data processing methods to increase the time spent analyzing the data rather than preparing it.

The first step is to move towards a digital cloud finance platform such as Cadency. The second step in this process is to use integration and automation to start streamlining a master data management strategy. As organizations embrace this new technology, there is also an increasing awareness that Artificial Intelligence with Machine Learning is also on the horizon to help further enhance the process and the additional layers of control that AI will bring into the finance operation.

Written by: David Woodall, Director of Product Marketing, Trintech