Bill Marchionni, Account-to-Report Advisory Global Program Leader, The Hackett Group

2024: The Year of Opportunity and Disruption for Finance

Blog post

Share

The Hackett Group’s® 2024 Finance Key Issues Study surveyed CFO’s, Controller’s, Chief Accounting Officers and other Finance executives about their priorities and initiatives for 2024 including (1) business trends and strategic priorities, (2) enterprise objectives, perceived risks, and planned mitigation strategies, and (3) planned investments and possible uses cases for generative artificial intelligence.

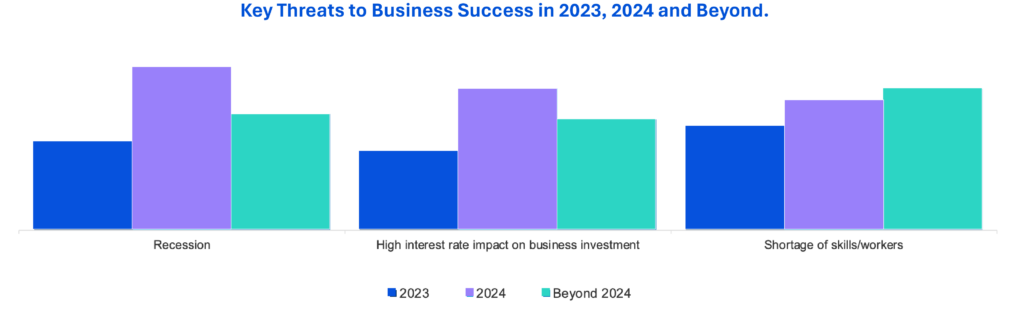

Headwinds and risks continue, as do concerns regarding inflation, skill gaps, supply chain and geopolitical uncertainties; yet these are tempered with optimism around the possibilities associated with improved decision making, digital technologies and generative artificial intelligence.

CFO’s Expect Business Disruption. Both Positive and Negative.

CFO’s and their teams are expecting and planning for opportunities resulting from disruption:

• Innovation is fundamentally changing the way business decisions are made (96%)

• Innovation has/is fundamentally changing the way work is executed (91%)

• Generative AI or other AI (90%)

• Finance services can be fully automated and delivered via digital technology channels (85%)

• Access to new markets (80%)

There are significant potential and existing disruptions that must be managed and mitigated:

• Cyberattacks (92%)

• Shrinking worker supply (90%)

• Geopolitical risks (88%)

• Supply chain challenges (87%)

• Persistent, structural skills gaps that prevent execution of the digital transformation (85%)

Finance Organizations Lack Value Delivery Maturity.

As Finance looks to become a source of intelligent influence, a gap in enterprise strategy enablement persists. More than half of Finance organizations do not deliver value regularly. On the value maturity scale:

- Administrators (18%)

o Least mature; focus is on historical financial data

o Characterized by multiple ERP instances, disaggregated processes, manual work - Efficient Operators (35%)

o Focus is on standardization

o Characterized by mostly automated processes, a strong control environment - Valued Business Partners (41%)

o Focus is on business partnership culture

o Characterized by a mature digital process, analytics skills, business acumen - Catalysts for Enterprise Change (6%)

o Most mature; focus is on enterprise strategy enablement

o Characterized by intelligent automation, integrated data, advanced design thinking

2024: The Year for Core Finance, Business Performance, and Talent.

Finance must evolve, and has mandates to support enterprise growth, continue digital transformation efforts, and drive cost reduction while improving business partnering. The top 10 Finance planned objectives, which are all aligned to these mandates, are:

Top core objectives:

• Containing cost

• Optimizing cash flow performance

• Enhancing data quality and usability

• Regulatory compliance

• Reliable forecasting

• Optimizing capital investments

Top business performance objectives:

• Supporting profitability goals

• Digital transformation

• Business partnering with other functional groups and stakeholders

The top talent objective:

• Upskilling existing talent

Highly Focused Initiatives. Increasing Technology Spend.

Effectively and successfully meeting these finance objectives requires surmounting significant challenges, including continued staff constraints, lower finance operating budgets, and overcommitments.

Finance executives are expecting a 5% increase, at least, in workload. At the same time, they expect reductions in staffing and in finance operating budgets, resulting in 6% productivity and efficiency gaps. In response, CFOs are increasing their year-over-year technology spend. The need, and the opportunity

to implement leading technologies has seldom been this pressing. Skills shortages demand that Finance organizations eliminate, simplify, standardize, and automate. And that they do so smartly and aggressively.

Funded initiatives will be laser-focused on continued digital transformation, standardizing, and automating processes, and effective business partnering. 2024 finance initiatives are centered around standardizing processes at scale:

• Implement digital technologies while improving reporting, analytical and modeling capabilities

• Optimize the close and consolidation processes

• Develop and enhance an integrated planning process

• Improve and expand master data management governance

• Adopt a customer experience framework that supports better business partnering

Legacy Technology Complexity Persists. Generative AI is on the Radar.

Most finance organizations continue operating in multiple technology environments. They struggle with this. Nonetheless, getting core technologies to scale directly supports process standardization, the development of enterprise-wide capabilities, and it reduces the reliance on labor for finance, accounting, and compliance tasks. Many companies sub-optimize their technology investments. Forty-one percent (41%) of companies do not have their core legacy finance application suites deployed commonly across the business. Only 30% are using point solution technology across most of the business.

Business leaders are exploring Gen AI. A majority are developing a Gen AI strategy. While some Finance organizations are piloting projects (33%), few have pursued deployment, indicating experimentation rather than structured enterprise-level adoption plans. They are waiting for the Gen AI market to stabilize before considering investment. For the organizations already evaluating Gen AI in finance, the majority are looking at its potential across record to report (56%), management reporting, and planning and forecasting.

Perennial Challenges to Transformation Persist.

The top impediments to Finance transformation success in 2024 are expected to be:

• More initiatives on the agenda than can realistically be executed (Overcommitment)

• Budget constraints, inadequate resource allocation and staff turnover

• Deficiencies in data quality, data security, master data management and data governance

• Mixed technology environments; excessive legacy organizational and process complexity

• Lack of critical skills in emerging technologies, analytics, process redesign, design thinking and change management

Final Thoughts:

Finance and accounting leaders face mandates: How to do more with less? How to use technology seamlessly? How to better support strategic business outcomes?

Consider the following as you chart the course for success for your finance team in 2024:

• Maintain and improve profitability through intelligent cost reduction: Deploy this discipline, but with a dual eye on growth and broader enterprise support

• Continue digital transformation: Finance must continue digital enablement; it must get the right digital portfolio provided by ERP, point solutions, and intelligent automation

• Chart your Gen AI roadmap: explore opportunities to harness the potential of Gen AI, especially in Record to Report, Planning, Forecasting, and Reporting/Analytics

• Enable actionable insights and partnering: Finance is a crucial part of securing complete, timely and accurate data, and leveraging it for improved decision making and analytics

• Revisit the finance operating model and talent strategy: transform the finance operating model to reflect the changing nature of work; create a purposeful finance talent strategy

Finance teams must focus on cost reduction, profitability and working capital. Yet, there is and should be optimism. Finance teams are seeing an opportunity to improve the operating model and critical processes, and to realize the mandate of both profitability and improved support of the business.

Bill Marchionni, Account-to-Report Advisory Global Program Leader, The Hackett Group