A Risk-Based Approach to Balance Sheet Reconciliations for Global Organizations

Blog post

Share

What goes through your mind when you certify the balance sheet? Most likely there are two points that you think about:

- The amount of risk in the numbers, and

- How much it actually costs to get to the final answer

There are no compromises in producing reliable financial statements, and the balance sheet reconciliation process is one of the most important internal controls over financial reporting. Finance and accounting teams are being pushed more than ever to achieve greater efficiencies at a lower cost with better output. However, delivering ‘more with less’ is a tricky job, given that risk and efficiency counterbalance each other in the financial close.

The Importance of Balance Sheet Reconciliations

Internal controls, including balance sheet reconciliations, prevent and detect errors or fraud as well as provide vital insight to help you understand and evaluate the financial position of your business. No other internal control is capable of mitigating errors and omissions in balance sheet accounts. The timing of your balance sheet reconciliation process is also key to detecting misstatements in advance of the filing deadline. Errors that are identified by your auditor and not initially by the company indicate a weakness in the overall internal control environment.

If you’re thinking about where to start in your transformation journey, it may be helpful to review this blog, which covers these main topics:

- Defining what a reconciliation is

- Creating a standard process for reconciliations

- Driving a reconciliation calendar according to a risk-based policy

Challenges that Complicate Balance Sheet Reconciliation for Multinational Companies

Organizations engaged in large-scale, cross-border business face a myriad of challenges and potential issues that can undermine the reconciliation process and call into question the reliability of the numbers produced. Being mindful of and addressing such issues is vital if a company hopes to maintain financial integrity, operational efficiency, and compliance. The following are just some of the issues that can, and often do, complicate the reconciliation process for multinational organizations.

Fluctuating Exchange Rates

It can be difficult to arrive at reliable numbers if what was worth X yesterday is worth Y today. Fluctuating exchange rates pose a significant challenge to the reconciliation process for multinational companies as they have a direct effect on the value of assets, liabilities, and expenses. When auditors catch errors in a company’s financial statements, those errors are often a function of fluctuating exchange rates.

Regulatory Compliance

Depending on how many different countries your company operates in, you may have to deal with anywhere from 2 to 20 (or more) different sets of accounting standards and regulatory requirements. Ensuring the numbers that emerge from the balance sheet reconciliation process accurately reflect compliance across the board is a substantial challenge.

Language Barriers

A fair percentage of the £90 trillion global economy moves back and forth across international borders every day. But despite the unprecedented integration of the world’s economies, formidable language barriers remain. This often leads to errors in financial reporting for multinational companies.

Different Tax Laws

Tax laws differ from country to country and can make managing the reconciliation process a major headache. Headache or not, there is no option but to comply with the different tax laws if a company is to avoid legal issues and potentially significant penalties.

Variations in Data Quality

Not every organization employs the latest technology, and trying to reconcile data sourced from a variety of different systems can present a challenge. Incomplete or incompatible data can lead to delays and errors in the reconciliation process.

Consolidation of Financial Statements

Reconciling financial data from a variety of units and subsidiaries into a single financial statement is an accounting team’s nightmare. One of the primary concerns has to do with identifying and eliminating duplicates.

Get a Grip on Your Balance Sheet Reconciliation Process

With many large enterprises falling into financial difficulty lately, finance and accounting teams should start to think about how confident they are with the internal controls in their business. Given some of the concerns that regulators have had as of late, it would not be surprising if auditors start to become more demanding. For example, the United Kingdom’s Financial Reporting Council (FRC) has increased its scrutiny on audit standards following the collapse of several major organizations, sanctioning and reprimanding a major accountancy firm for audit misconduct. What this means is that finance management teams with an opaque view of their balance sheet will need to step up their game and start taking their balance sheet reconciliations—and overall close process—more seriously.

This is not to say that the next year-end audit will be significantly different, but your finance and accounting teams may need to provide more evidence as part of the substantive work carried out by auditors, which is likely to increase the cost of preparing financial statements. This is especially true if controls are not operating dependably. When this is the case, companies may face a substitution of forward-looking priorities for backward ones, representing an opportunity cost in terms of lost business value.

As you standardize the balance sheet reconciliation process, you also need to be aware of risks inherent in complex transactions, or situations where there is a high degree of judgment or estimation. This is especially true for multinational companies that need to aggregate information from multiple areas. Operational structures today often include offshore shared services and third-party providers taking on parts of the close—including reconciliations. This complex structure creates a barrier to collaborative working and sharing of best practices that may ultimately prevent you from industrializing the close process.

However, with the emergence of web-based technology solutions, there are several opportunities to get real-time visibility over all reconciliations that roll into financial statement line items, with a clear view of risks and opportunities aggregated across multiple levels of the organizational hierarchy.

What is a Risk-Based Approach to Balance Sheet Reconciliation

Risk-based reconciliation entails prioritizing and managing the reconciliation process based on the level of risks associated with the various transactions and accounts involved. The following are some of the key components of the risk-based approach to balance sheet reconciliation:

Categorizing Accounts

If risk-based reconciliation is to work, care must be taken to make sure accounts are properly classified regarding the level of risk they pose. Misclassification can lead to wildly inaccurate financial statements.

Prioritizing Reconciliation Activities

Your first instinct may be to allocate more resources to reconciling high-risk accounts and fewer resources to low-risk accounts. It’s important that you strike the right balance if you are to ensure efficiency as well as accuracy.

Automated Monitoring of High-Risk Accounts

Automation tools that enable a business to monitor high-risk accounts and report anomalies in real-time can help you deal with potential issues before they result in compromised financial statements.

Documentation

Thorough documentation and review of all procedures is vital to maintaining the integrity of information produced via a risk-based approach to balance sheet reconciliation. Risk assessments must be continually reviewed and updated to reflect a changing business environment, new or updated regulations, and new processes.

Continuous Improvement

If the risk-based approach to balance sheet reconciliation is to remain effective, there must be a commitment to continual reassessment and improvement. That includes establishing procedures to upgrade automation tools and refining the risk categorization process.

Risk & Efficiency: An Automated Approach

The ability to add a risk profile to accounts is key to delivering the notion of a “smoother” and less intensive period-end. By automating the calculation and application of risk ratings, we are now moving away from a human-centric endeavor with accounting professionals engaged as the centerpiece of the activity. A risk-based approach to account reconciliations is a key way to reduce your costs by deferring or removing low-risk activities from the schedule, instead of focusing on higher-risk areas earlier on.

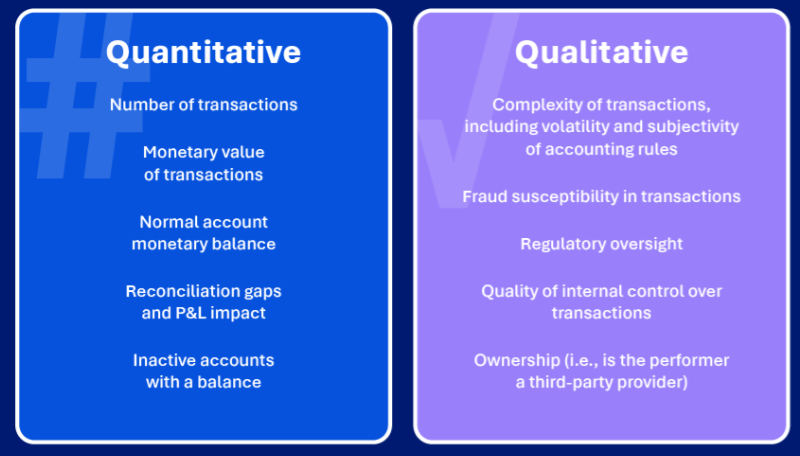

Clearly, we need a way to identify risky accounts, as this is an easy way to accelerate the process, and at the same time reduce the risk of financial restatements. Risk classifications can be based on a set of quantitative and qualitative criteria, with the application of high/medium/low classes being based on the likelihood the account is misstated by a material amount (rule of thumb is that accounts will be assigned a higher risk when it is more likely to be materially misstated). Here are some examples of the criteria:

Want a quick reference to identify risky accounts? Download our infographic!

Implementing a Risk-Intelligent Balance Sheet Reconciliation Process

When evaluating an automated reconciliation solution, dynamic risk-based analysis for accounts is vital for any organization wanting to take a risk-based approach to balance sheet reconciliations. This ensures that companies are eliminating low-value activities rather than simply spreading accounting activities daily to reduce the month-end burden.

Of course, we can’t discuss risk without mentioning security controls and increased visibility. Highly flexible data profiles increase user security, and on-demand visibility via a dedicated R2R console with balance sheet KPIs, performance, and financial statement line-item risk analysis helps you identify issues early.

Cadency by Trintech is a cloud-based platform that provides a System of Controls to validate the reliability of financial statements produced by the system of record (ERP). Trintech’s approach is key to transforming internal controls over financial reporting, as all processes and controls are interoperable, and this connectedness makes them dependable. Along with having a dedicated R2R console and flexible data profiles, Cadency’s risk-based analysis is powered by Risk-Intelligent RPA, which is automation within a risk-based, risk-intelligent framework. Business flows are driven by attributes such as account materiality, transaction types, and P&L impact and ownership.

With best-in-class technology, Cadency by Trintech helps your organization achieve:

- Real-time enforcement of risk-based policies (global and regional) with minimal manual effort

- An aggregated view of reconciliation items, showing risks and opportunities as well as unreconciled balances by financial statement line item

- Balance Sheet integrity, accuracy, and completeness