AI for Finance: Real Use Cases for the Office of Finance

Blog post

Share

While AI continues to dominate headlines and boardroom discussions, many professionals in the Office of Finance still quietly wonder: how exactly does this apply to me? Despite the growing popularity of AI for finance and accounting, the practical, day-to-day use cases can often feel vague or overhyped.

Despite all the excitement around artificial intelligence, finance leaders are rightly cautious. They need to understand not just the “wow factor,” but the working value—how AI tools for finance and accounting can streamline cumbersome, error-prone or just tedious parts of their jobs and ultimately improve team efficiency and outcomes.

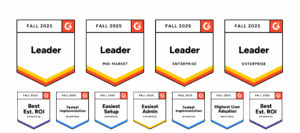

As a leading provider of financial close software, Trintech has narrowed our lens to one area where AI’s impact is both immediate and transformative: the AI-powered financial close. From a practical perspective, applying Generative and Agentic AI across four key domains of the close process opens up a world of possibilities:

- Close automation

- Insights

- User support

- Governance & security

Each domain presents clear, actionable opportunities to increase efficiency and accuracy. While our white paper, The AI Financial Close: Redefining Month-End Close Processes and KPIs for the Next Era of Finance, offers a deep dive into all four use case areas, this blog hones in on a pivotal area of value: AI-Assisted User Support.

AI-Assisted User Support: Empowering Finance Teams with Intelligent Guidance

One of the core benefits first realized for LLM-based Generative AI in any industry has been user support within specific applications. For the Office of Finance, not only does it speed up or eliminate cumbersome manual research time for team members, it allows for faster onboarding, faster troubleshooting, and empowerment of team members with infrequently needed or rarely used accounting processes or system activities.

When it comes to protecting the team’s time – smart enterprises will use AI tools for accounting at their most basic level to perform human-scale research in context, quickly analyze documents, and navigate through workflows and UI. AI acts like a smart, ever-present assistant—one that understands your tools, your data, and your role.

Key Use Cases:

- LLM-Based Help for Application Tasks: Answers delivered instantly in-app, reducing time lost to tickets and training

- Agentic Error Assistance: AI interprets error messages and suggests real-time fixes

- LLM-Based Onboarding Assistant: Personalized guidance for new users, based on roles and workflows

- AI Document Summarizer: Converts complex docs into short, action-oriented summaries

- Voice-to-Navigate: User voice-controlled navigation of close tasks and workflows for speed and accessibility

This intelligent layer creates a finance environment that’s more intuitive, more scalable, and more human-centric. In this way, AI enhances the team’s experience – removing friction and enabling self-service inside of complex systems.

Ready to See What’s Next in AI for Finance?

This example represents just one use case with AI for accounting and AI for finance today. For more use cases and to dive deeper into how AI is redefining the financial close, our white paper: The AI Financial Close: Redefining Month-End Close Processes and KPIs for the Next Era of Finance. By reframing traditional metrics and embracing new AI-driven capabilities and KPIs, CFOs will lead their organizations in identifying revenue opportunities, proactively managing risk, and delivering real-time insights that drive fast decision-making.

Whether you’re searching for the best AI for finance to streamline operations or evaluating AI tools for accounting to support your team, now is the time to explore. Unlock the future of finance and discover actionable strategies to drive transformation—today.

Written By: Lindsay Rose