Enhancing Risk Management for Manual Journal Entry with Artificial Intelligence

Blog post

Share

Double entry book-keeping is claimed to have been invented in 1494 by Luca Pacioli, a Venitian monk who was friends with Leonardi da Vinci. In his 1494 publication, he wrote, “quanto alor debito e anche credito” or “whenever there is a debit entry there is also a credit entry.” This 1494 publication remains the basis of modern-day accounting: a company’s credits must balance its debits.

For 500 years we have been trying to master the journal entry process. While today the majority of transactions are automated, the manual journal entry has become the necessary evil that needs to be managed and controlled.

Large enterprises are in a continual state of change as they strive for growth and profitability.

- Mergers and acquisitions

- New product lines and services

- Changes in supply chains

- Transformation projects

- Ongoing changes in statutory regulations and reporting

— all add pressure on the Office of Finance to deliver accurate and timely reporting. In order to enable accurate reporting, the manual journal then becomes a key transaction.

Common Manual Journal Entry Challenges

Common Manual Journal Entry Challenges

Many organizations struggle with completing their journal entries during the financial close period whether it is monthly, quarterly or yearly. According to some of our own Trintech polls, there are five areas of the journal entry process finance professionals struggle with:

- Creating journal entries

- Review and approval process

- Posting of the entry

- Overall journal entry process

- Ensuring the trial balance is complete

Entering and posting journals is one of the most time-consuming and demanding parts of the Record to Report process. And, due to the short amount of time given to finish the work required, how can the Office of Finance complete the period close in a timely manner, with as few errors as possible while keeping an eye on the many types of risk that can be associated with accounting journals?

Solving These Challenges with Journal Entry Automation

The biggest challenge with high-risk journals is making sure they are completed swiftly, and that any issues are resolved comprehensively to satisfy internal controls and external auditors.

In a typical control environment, the journal routing for approval is based on the materiality of the journal, however AI Risk Rating for Journal Entry in Cadency® by Trintech enhances your Global System of Control by now considering other variables to then allocate a risk rating for the journal.

Now, leadership can rest assured that high-risk journals will get the visibility they need to be processed quickly and accurately with the correct level of approval before posting. The AI Risk Rating Range of Values brings together automation and efficiency to your journal entry workflow process. It saves time and money by lowering the occurrence of errors and bringing high risk journals to the forefront to be handled quickly and explained more thoroughly.

It is more important than ever to streamline the financial close workflow, especially with so much pressure on the Office of Finance to not only keep up with standardizing journals and their associated workflows, but to find new ways of increasing efficiency.

How AI Risk Rating for Journal Entry Works

Currently, routing journals using the Dynamic Journal Approval tool provides a way for different approvers to be assigned to a journal, based on the amount.

However, high risk accounts are not always based on higher value amounts, and there are other factors that can impact the risk a journal poses:

- Nature of financial impact

- Resolution responsibilities

- Expected resolution deadlines

- Resolution assistance required

- Resolution ownership

With the addition of the AI Risk Rating Values to the DAR, journals can be routed with a risk-based approach, eliminating high volume approvals for low-risk journals and thus reducing costs associated with financial close.

Cadency Journal Entry® leverages powerful Cadency-specific AI Risk Rating and integrates it with the Dynamic Journal Approval. This integration refines the approval functionality a step further by efficiently streamlining lower risk journals while at the same time providing increased transparency and making higher risk journals more visible.

By allowing for several risk criteria to be calculated for each journal and routing to approvers accordingly, the AI Risk Rating can get journals for accounts associated with risk to the correct approvers faster, which shortens the audit process and improves confidence of each financial close.

When journal entry month end arrives, there is a mountain of work that needs to be completed in just a few days. Getting through the financial close as quickly and easily as possible is crucial. Adding the ability to route approvers using the AI Risk Ratings values can give companies a leg up in reducing the volume of journals that need to be handled manually.

Imagine getting topside or low-use account journals to the correct person for approval immediately upon submission!

This can be a reality by automating the approval workflow to efficiently send high-risk journals through a higher level of approval, thereby freeing up low-risk journals to be fully automated — which results in saving time, while reducing cost and risk.

Benefits of AI Risk Rating for Journal Entry:

- The AI Risk Rating Range of Values uses your existing ERP risk ratings that are passed through the Cadency API connector

- High risk journals are automatically routed to the correct approver in the workflow saving time and money by resolving journals with higher risk faster

- More transparency during the financial close which lowers risk and makes audits more efficient

- AI Risk Rating integration into the Dynamic Journal Approval tool makes configuration easier for admins to set up to use effectively

- AI Risk Rating in Dynamic Journal Approval can be used on the same templates as the standard Dynamic Journal Approval to save time

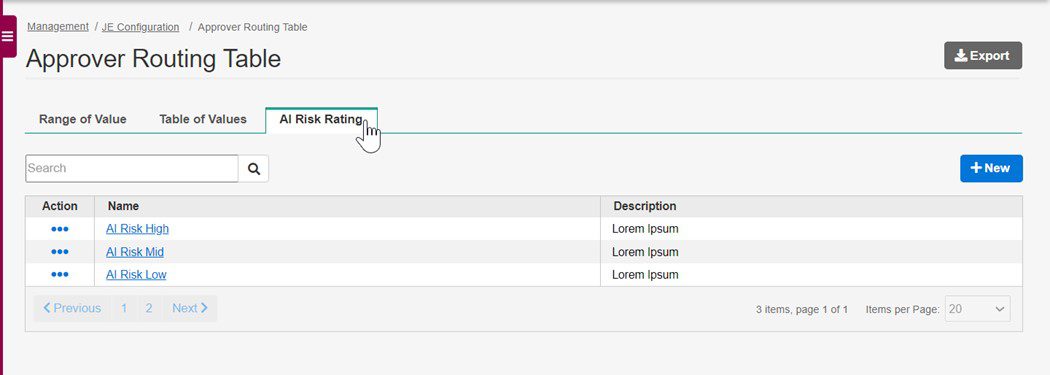

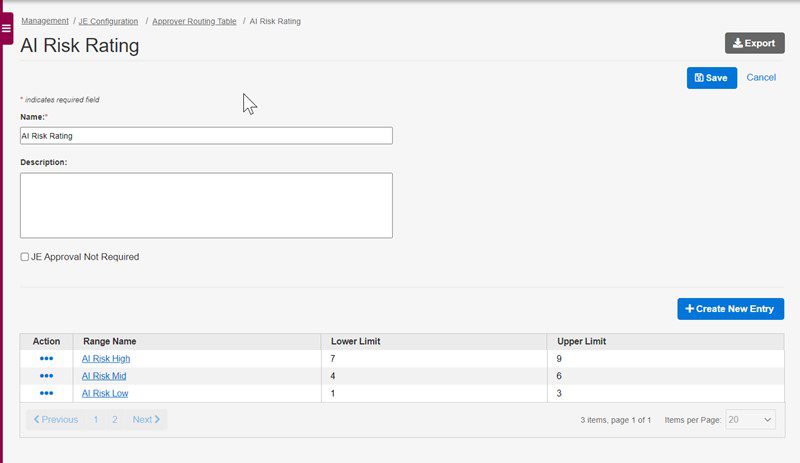

We’ve made configuring the AI Risk Rating for your Dynamic Journal Approval as easy as the standard Dynamic Journal Approval by creating the AI Risk Rating Values tables. We’ve redesigned the Approver Routing Table page in your Cadency administrator’s Journal Entry Configuration with tabs to make navigation easier and more convenient within the Dynamic Journal Approval tool.

Keeping in line with our Range of Values, we’ve made the AI Risk Rating page with the same formatting, so admins see a familiar way to set up the new risk rating values. We’ve kept the ability to bypass the approval workflow so that low risk journals can automatically bypass the approval workflow.

Having the most cost-effective financial close possible poses many unique challenges. Taking advantage of AI Risk Rating for Journal Entry in Cadency brings more journal entry automation and more convenience when it comes to managing risk. Focusing on areas of higher risk with ease improves the financial close saving time and money while boosting confidence in your automated processes.

[cta-content-placement]

Written by: Michelle Reich, Software Engineer at Trintech & David Woodall, Director of Product Marketing at Trintech