16 KPIs Finance and Accounting Teams Must Analyze

Blog post

Share

The need for Key Performance Indicators (KPIs) in finance and accounting is widely known, but are finance organizations tracking the right KPIs? Determining success on delivering business strategy objectives is dependent on measuring the right KPIs effectively. One of the benefits of automation in accounting is that, with automation, finance teams can identify and dig into the right KPIs to improve processes across the Record to Report.

So what are important KPI examples for finance departments? In this blog, we will cover KPIs for finance and accounting that fall into five key categories:

- Holistic Record to Report

- Close Monitoring

- Balance Sheet Reconciliation

- Journal Entry

- Compliance

Holistic Record to Report KPIs

Tracking and measuring holistic Record to Report metrics ensures that the entire process is being managed effectively. These give much-needed visibility into the process, as well as the impact of the Record to Report’s quality on the organization’s revenue.

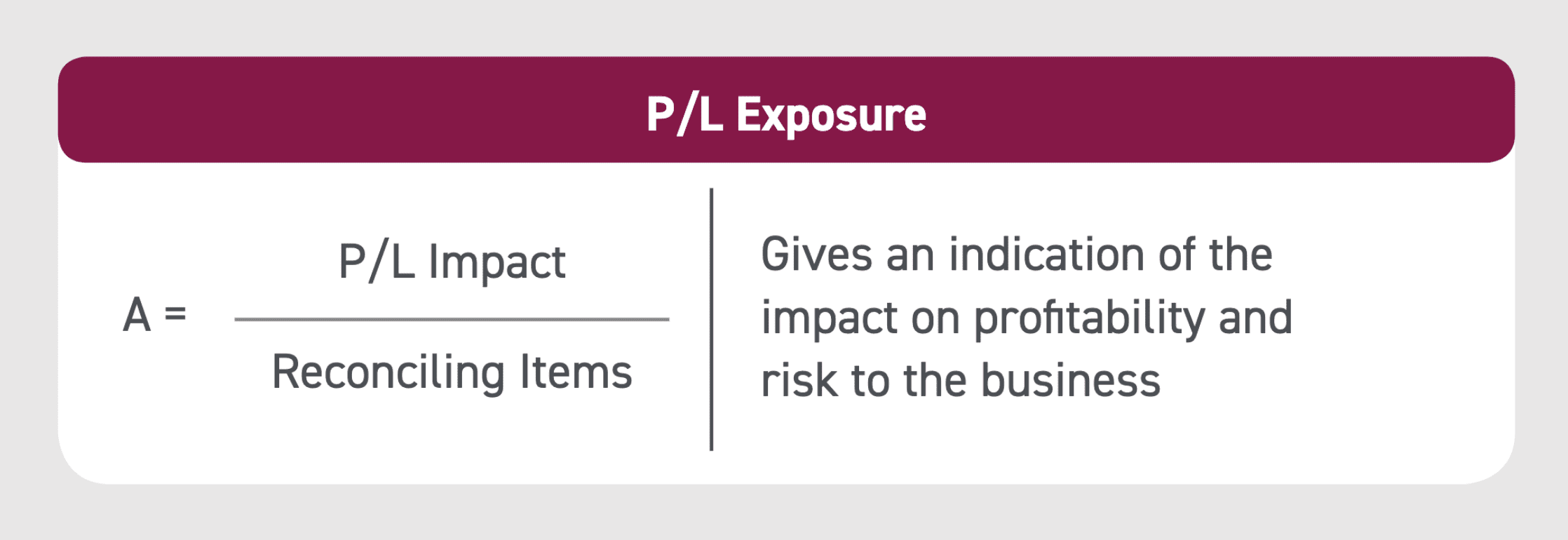

KPI #1: Profit and Loss

The profit and loss accounting metric allows organizations to measure the risk and consequential impact that certain items will have on the business. Without this metric, finance and accounting miss a significant analysis in the Record to Report that could create an opportunity for future improvement.

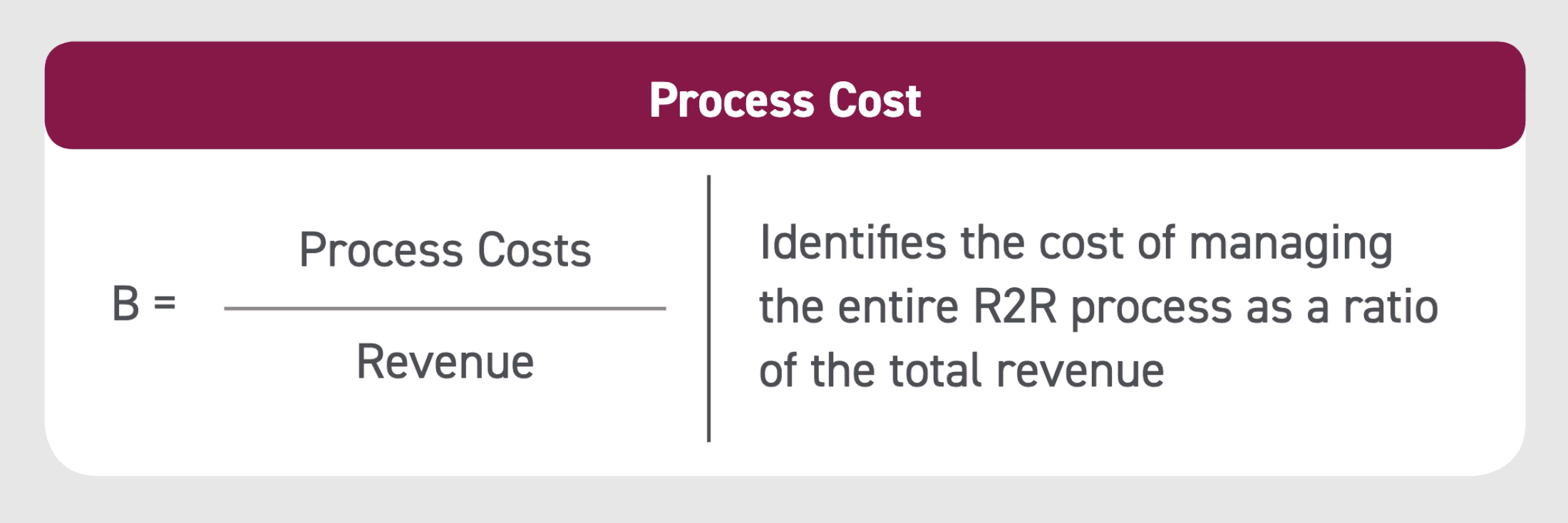

KPI #2: Process Cost

This metric allows leadership to measure the cost of managing the entire Record to Report process in the larger context of organizational revenue. Two key benefits of automation in accounting include monitoring this metric and working to reduce Record to Report costs (both direct and indirect).

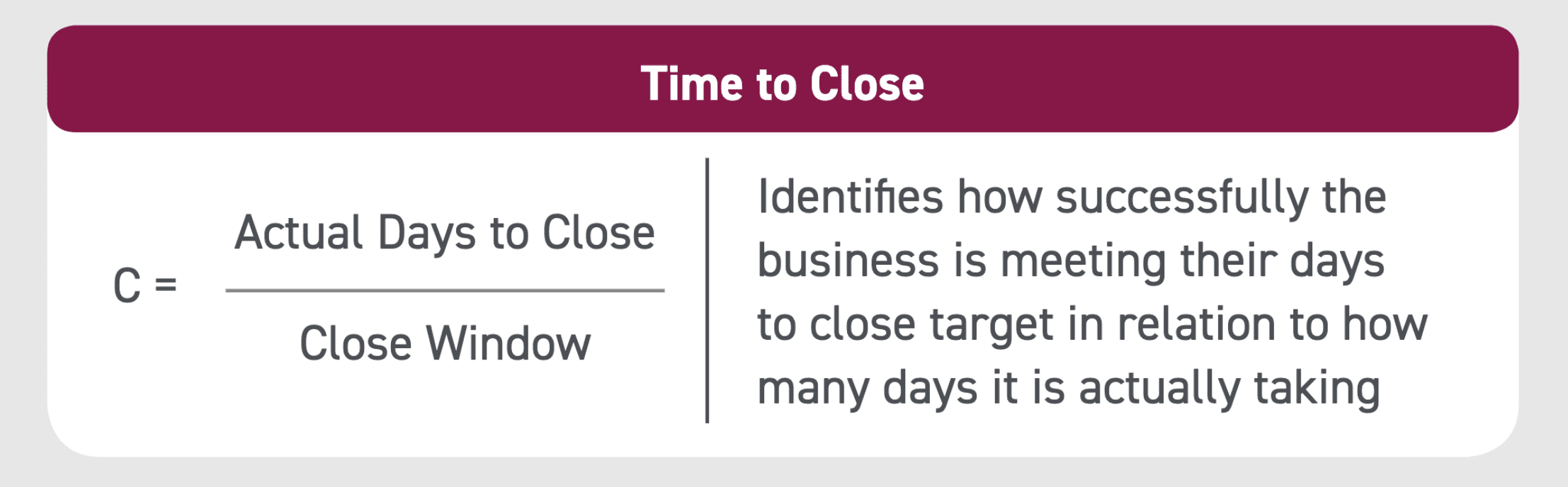

KPI #3: Time to Close

Time to close is one of the most critical KPIs for finance and accounting to track by comparing the actual number of days it takes to close to the target period. If the actual days to close is higher than the target period, what’s causing the delay? Analyzing this KPI helps gain visibility into a part of the process that otherwise is not transparent.

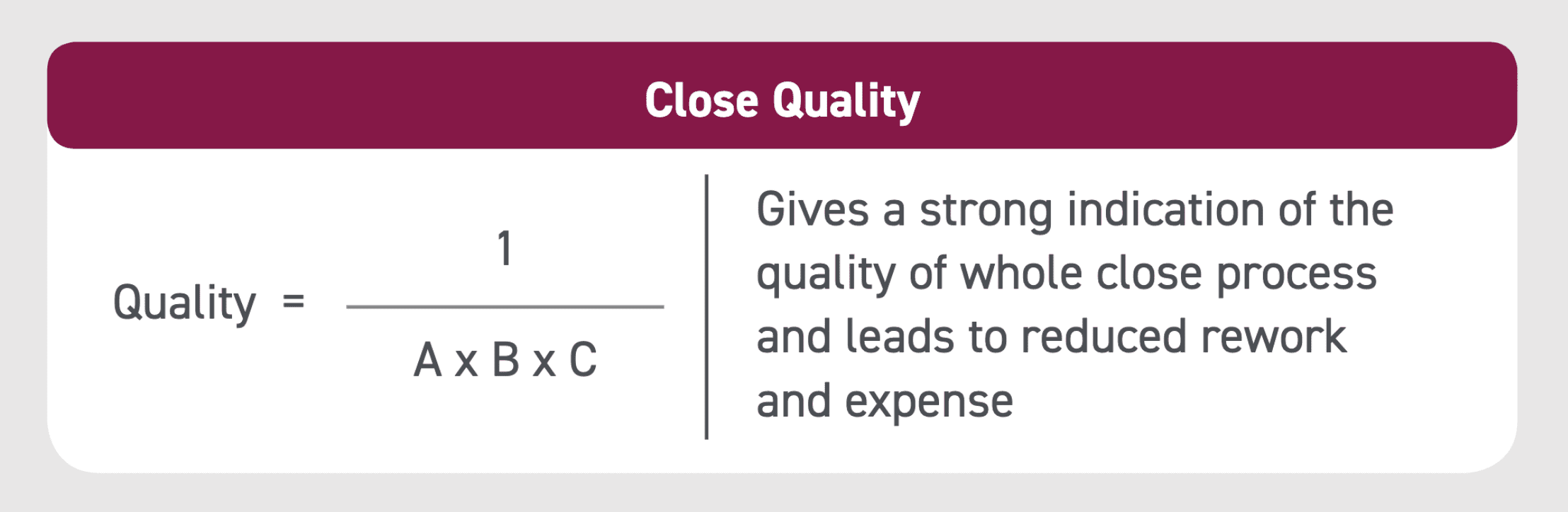

KPI #4: Close Quality

The close quality KPI relies on the numbers from the previous three metrics. Analyzing this metric gives an indication of the quality of the overall Record to Report process.

Close Monitoring KPIs

Managing financial close metrics allows finance leaders to have confidence in the consolidated management report that is filed.

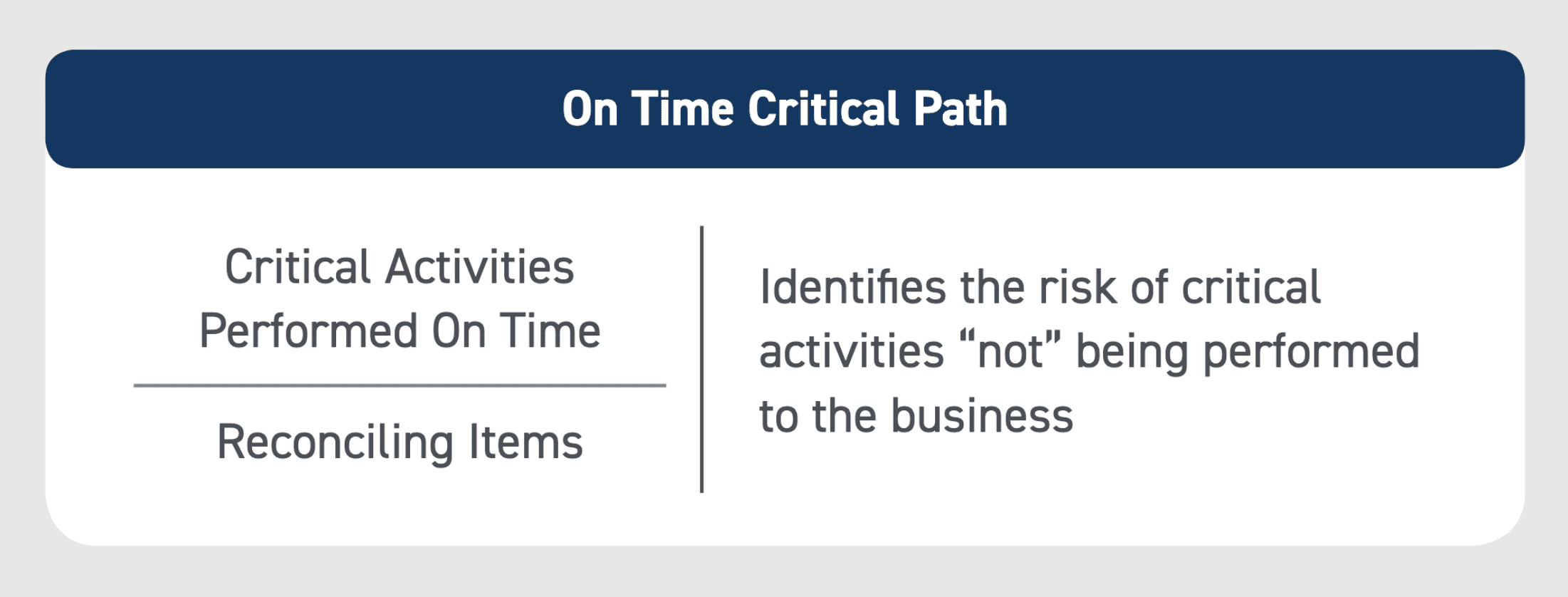

KPI #5: On Time Critical Path

What is the impact of critical financial close activities not performed — whether that means never performed, or not performed by deadline? Too many critical activities left incomplete or not performed on time can significantly raise an organization’s risk profile.

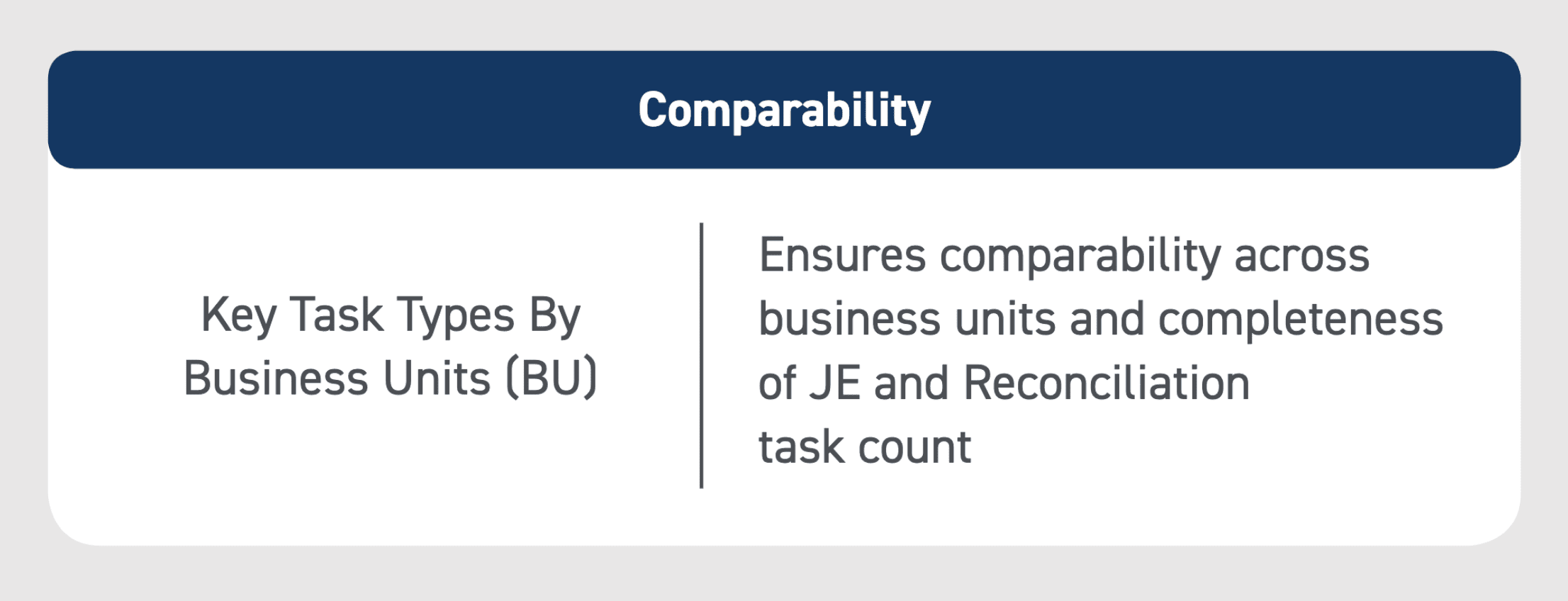

KPI #6: Comparability

A great KPI example for finance departments to measure and optimize from is the comparability close metric. This metric allows finance leadership to understand and optimize the tasks that are distributed across business units, so the workload is allocated among many individuals, rather than burdening a select few.

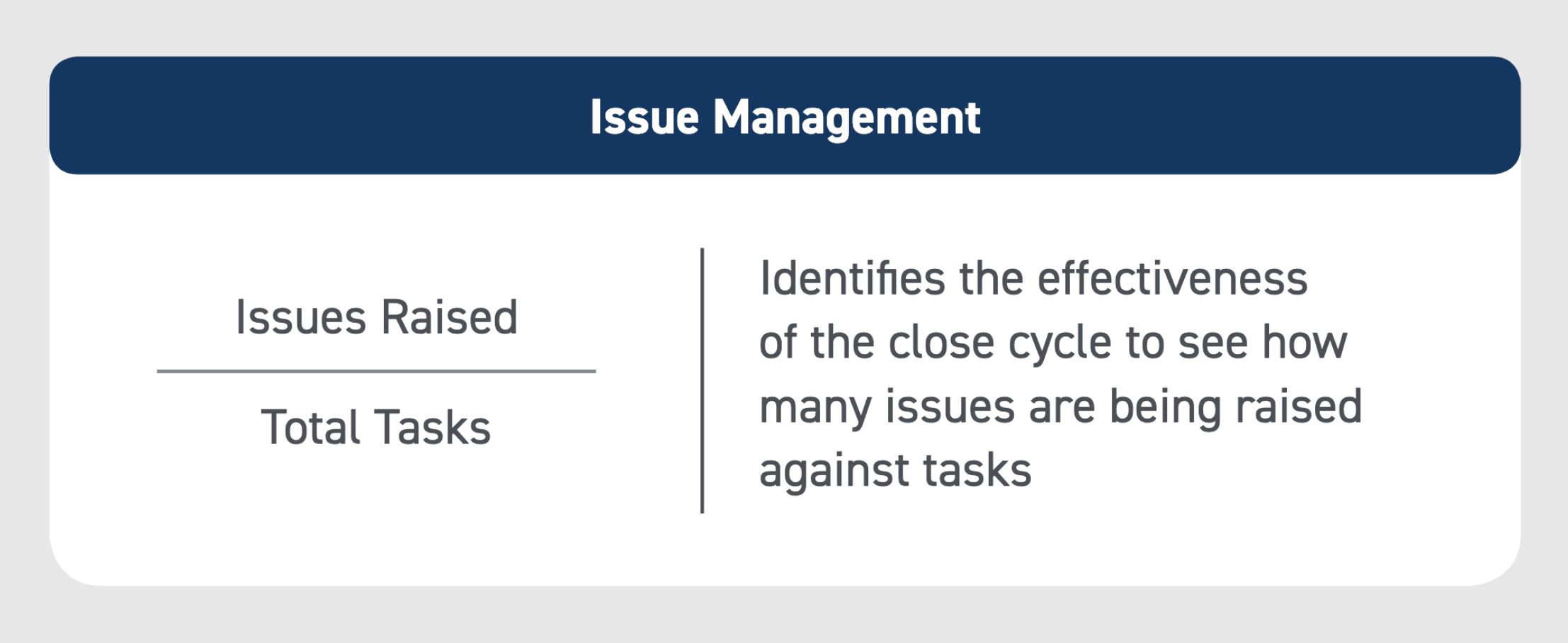

KPI #7: Issue Management

The issue management KPI identifies the ratio of issues that are raised in the close process to the total tasks being performed. A high ratio of issues raised should alert finance leadership to inefficiencies that could lead to lower quality tasks.

Balance Sheet Reconciliation KPIs

The balance sheet reconciliation process is the foundation of the entire Record to Report. To that end, it should be measured and optimized correctly. There are three important KPI examples for finance departments to analyze in the reconciliation process.

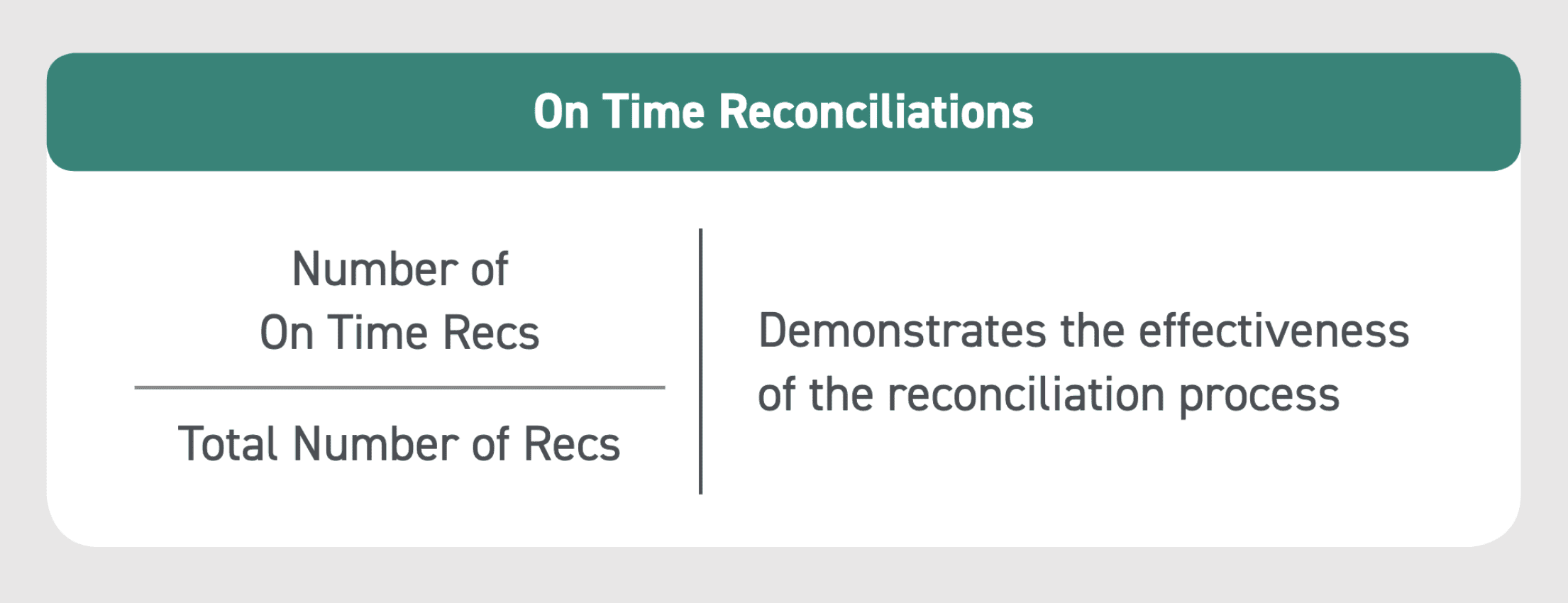

KPI #8: On Time Reconciliations

The on time reconciliations KPI helps analyze the efficiency of the balance sheet reconciliation process. A lower number of on time reconciliations might indicate process bottlenecks that need to be solved.

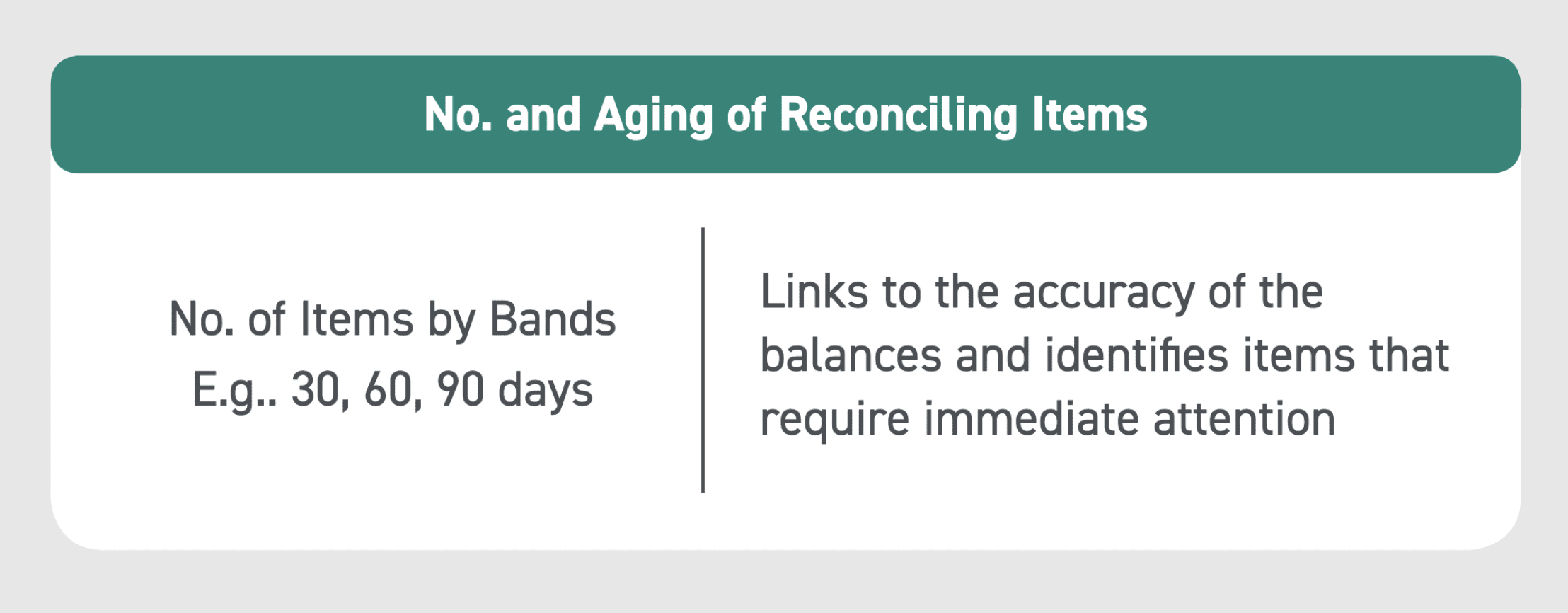

KPI #9: Number of Aging of Reconciling Items

This metric gives leadership insight into how long certain tasks have been assigned out, and indicates which tasks should be prioritized.

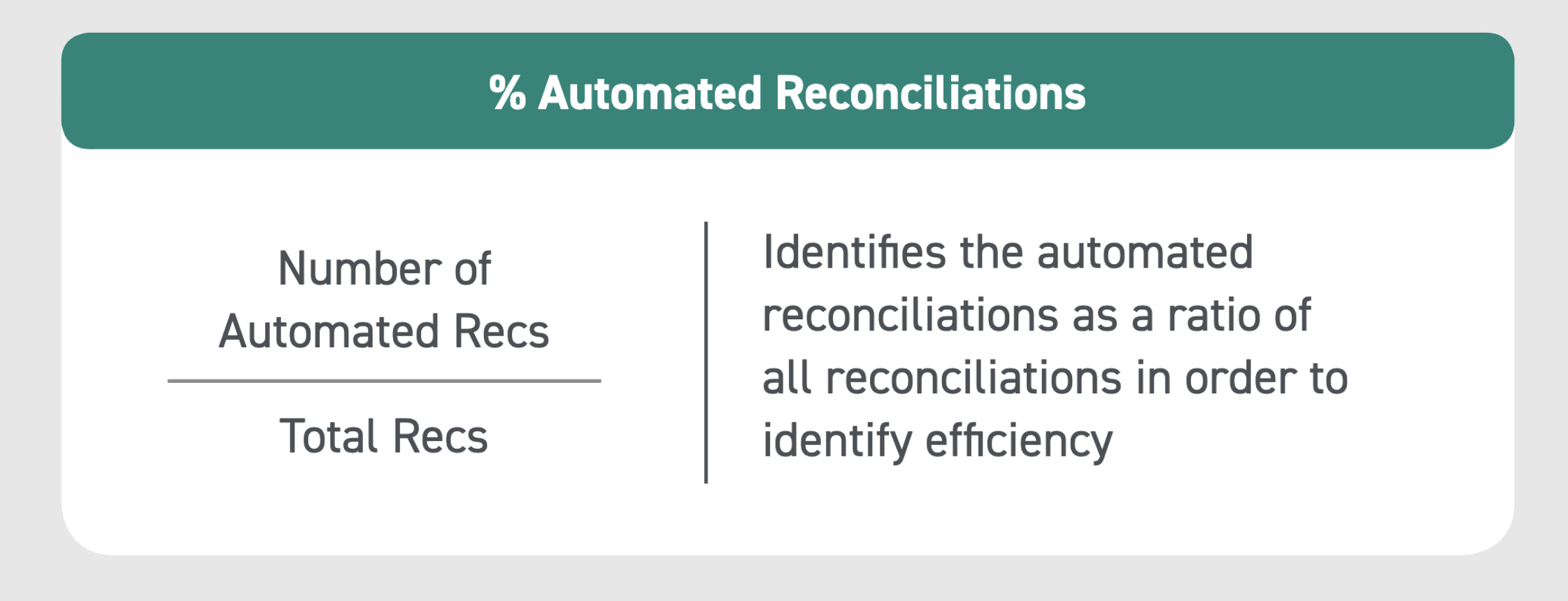

KPI #10: Percentage of Automated Reconciliations

When balance sheet automation is brought into the process, this metric becomes increasingly important. One of the benefits of automation in accounting is a reduced workload for finance staff because automation can handle certain reconciliations, such as those that are low risk. Tasks that can be handled by automation should be handled by automation.

Journal Entry KPIs

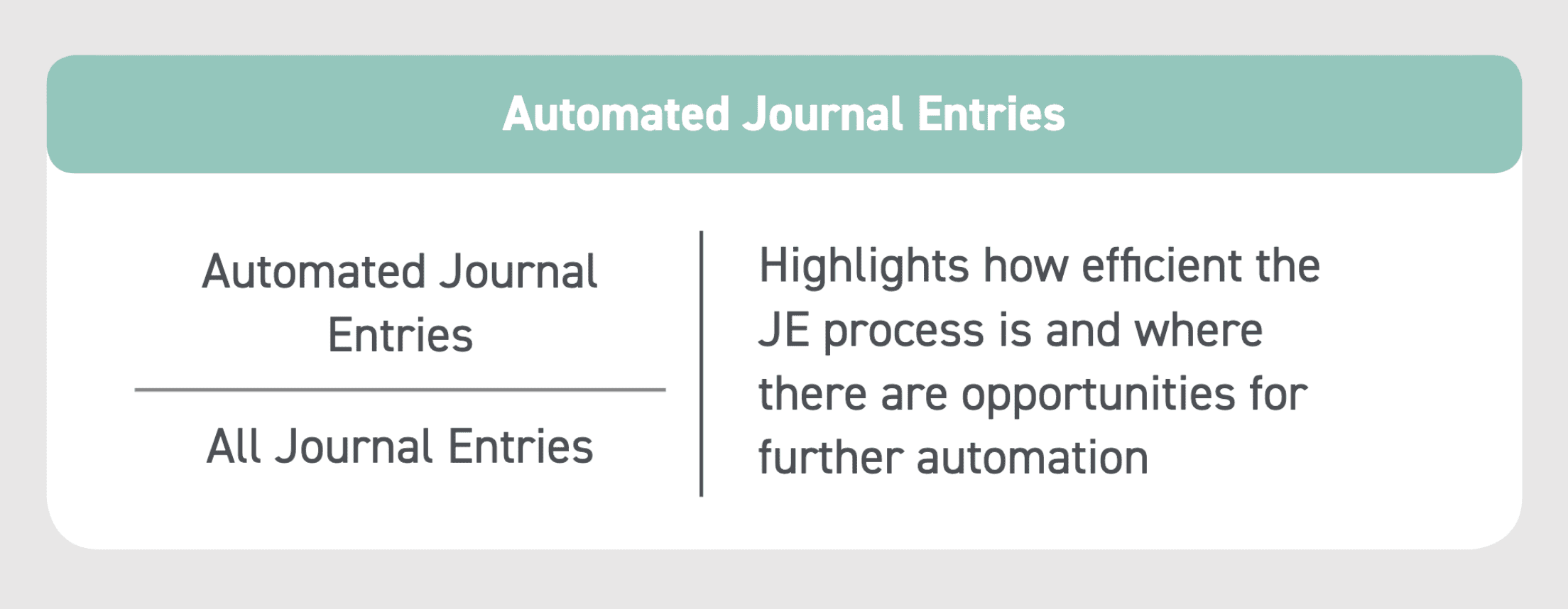

KPI #11: Automated Journal Entries

As mentioned before, what can be handled by automation should be, and the journal entry process is a great example. If your organization has implemented automation, analyzing this metric can help dig into the ROI that automation is bringing to the organization, as well as identify if automation can do more in the journal entry process.

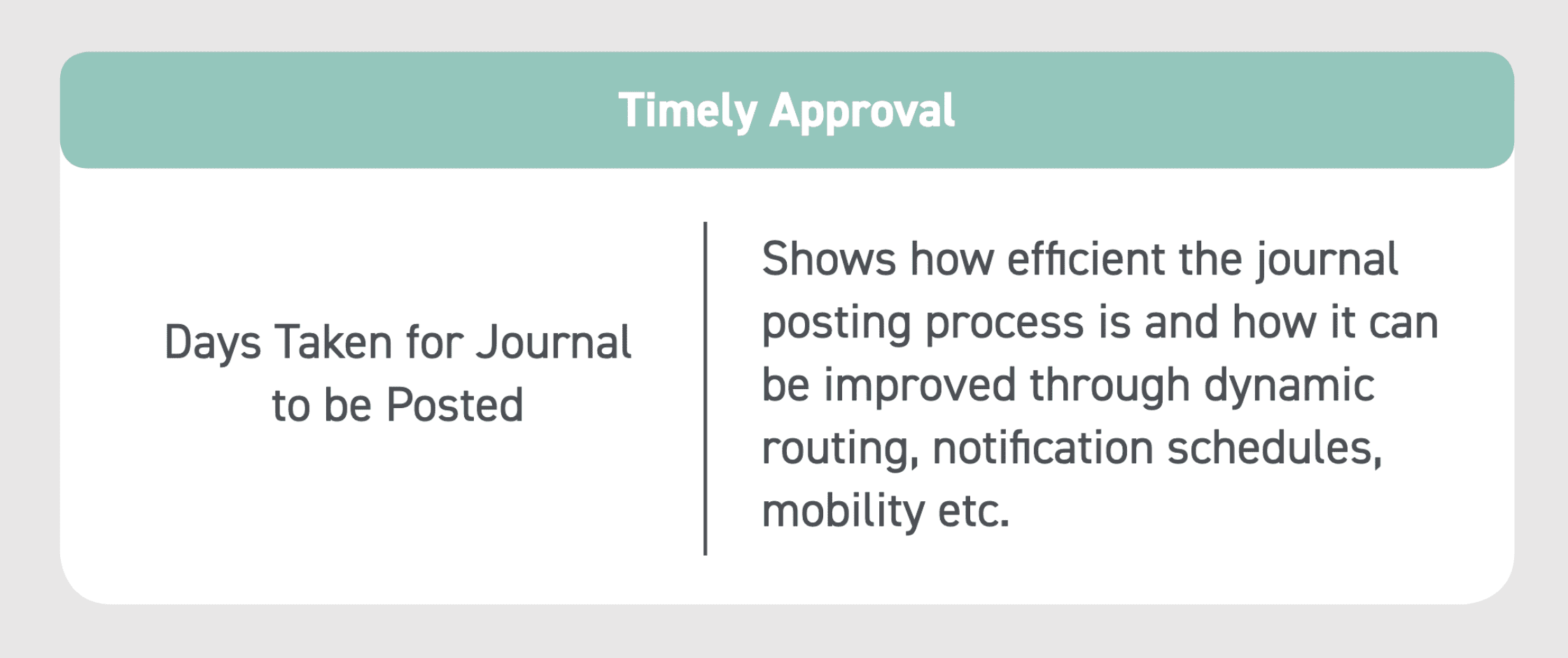

KPI #12: Timely Journal Approval

One of the major bottlenecks in the journal entry process is the approval process. This metric helps gain visibility into how efficient the journal entry process is by measuring how many days it took for journals to be posted.

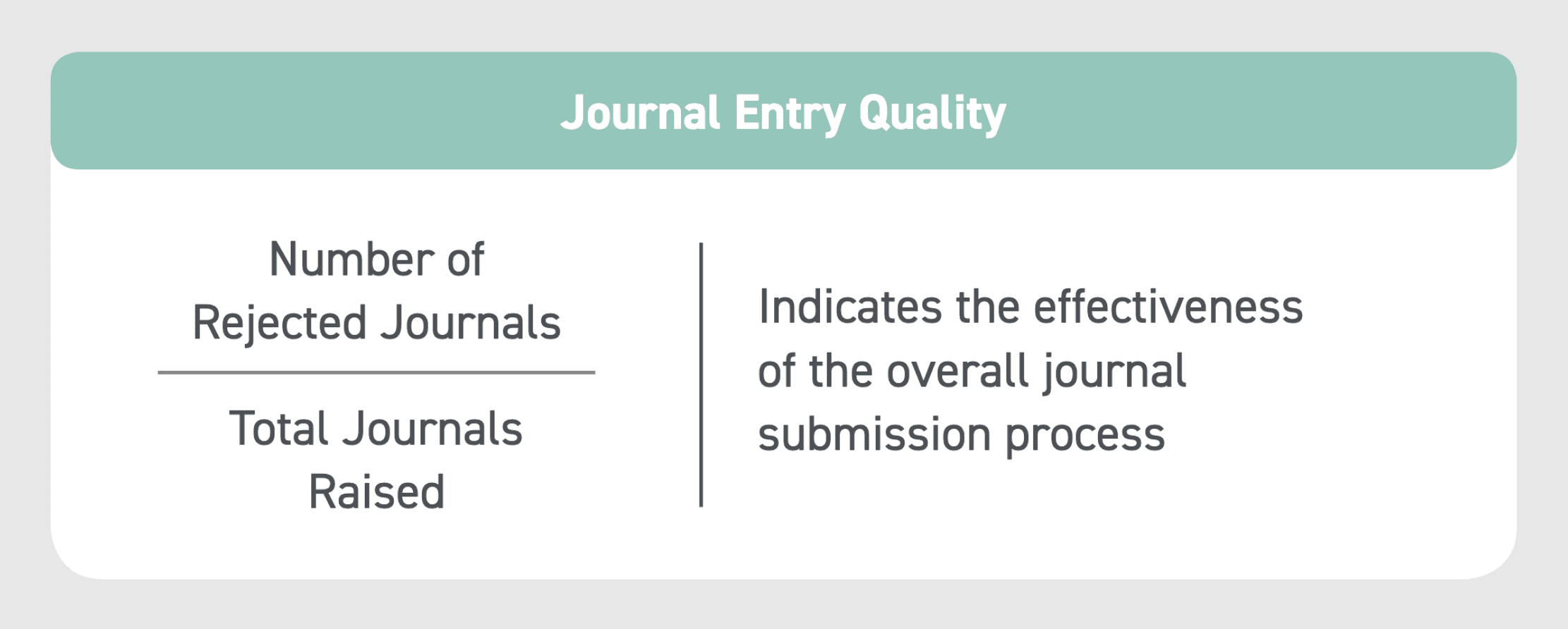

KPI #13: Journal Entry Quality

Efficiency is nothing without effectiveness, but truly measuring effectiveness is complicated. The journal entry quality KPI helps measure effectiveness by comparing the number of rejected journals to the number of total journals raised.

Compliance KPIs

How effective is your organization’s compliance environment? Without testing and measuring KPIs, finance cannot accurately measure the impact of controls on the organization’s compliance framework.

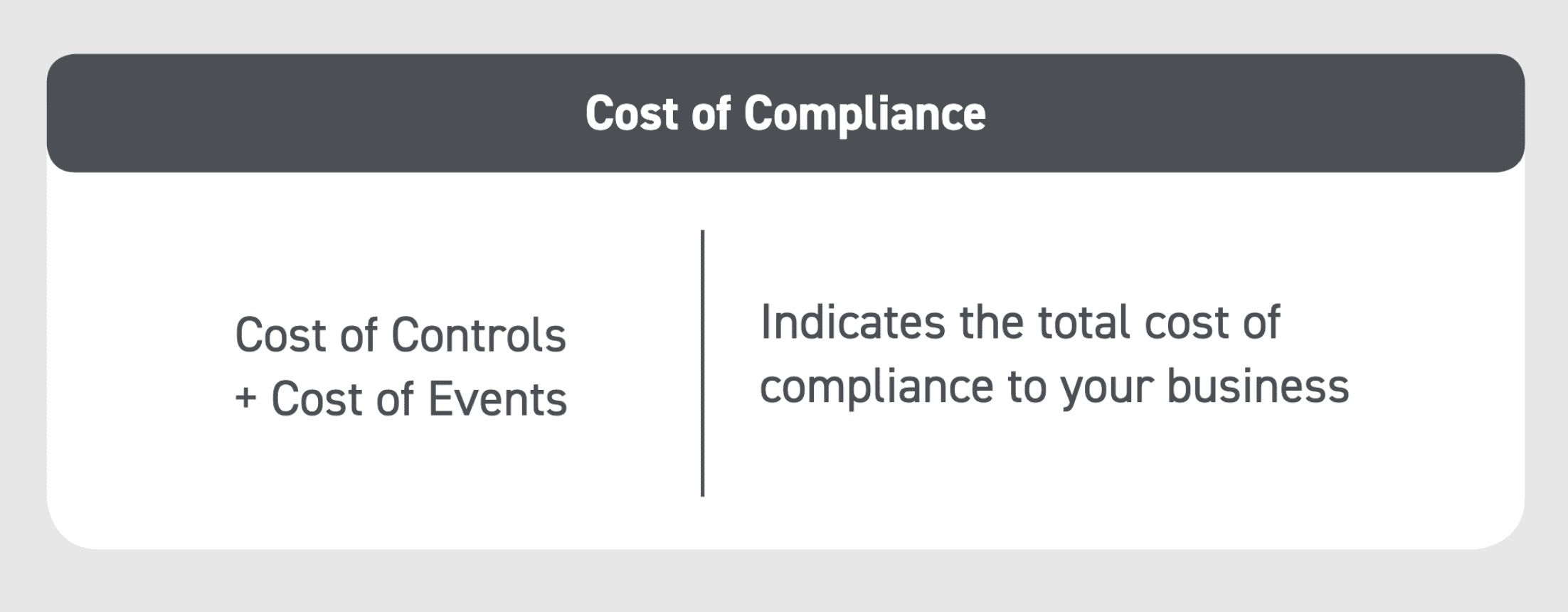

KPI #14: Cost of Compliance

The cost of compliance KPI measures the total cost of the organizations’ compliance framework.

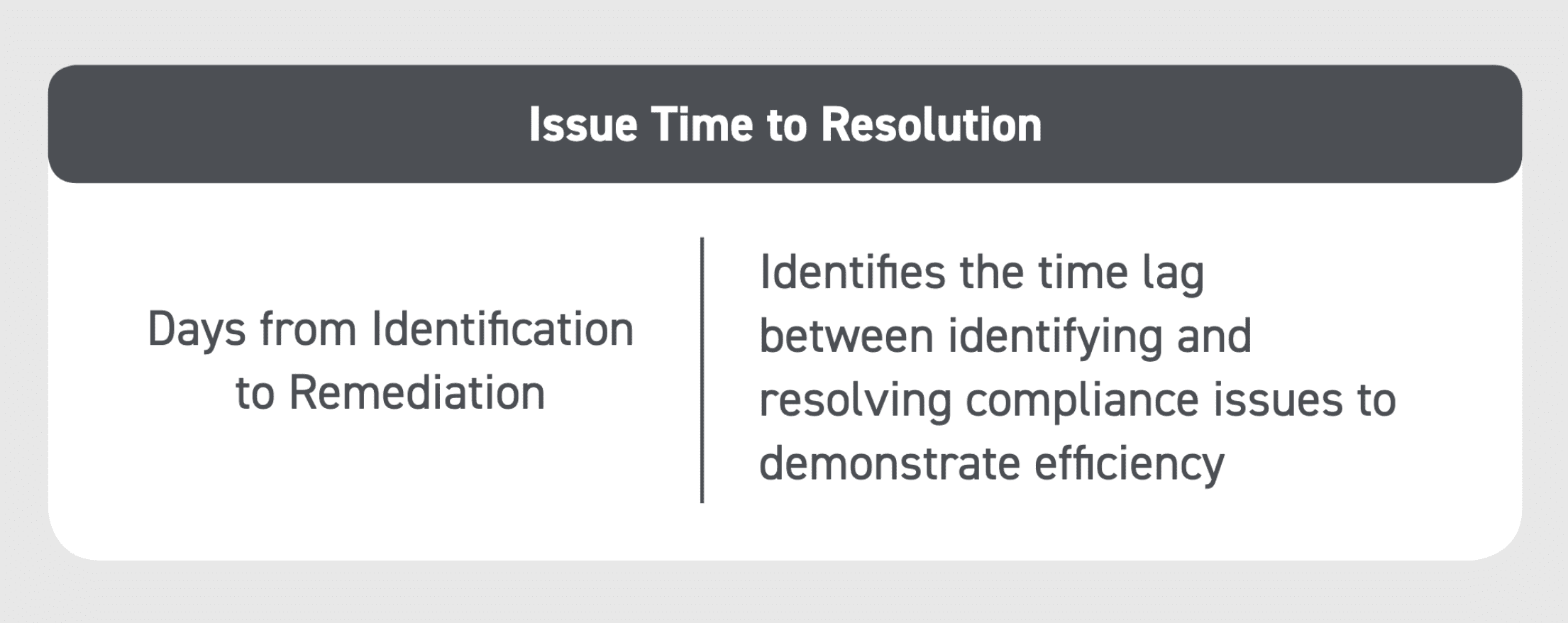

KPI #15: Issue Time to Resolution

The issue time to resolution KPI clearly identifies the time period from when an issue is caught to the time the issue is solved. This an increasingly important metric that auditors want to know, and internal stakeholders will want to measure this as well.

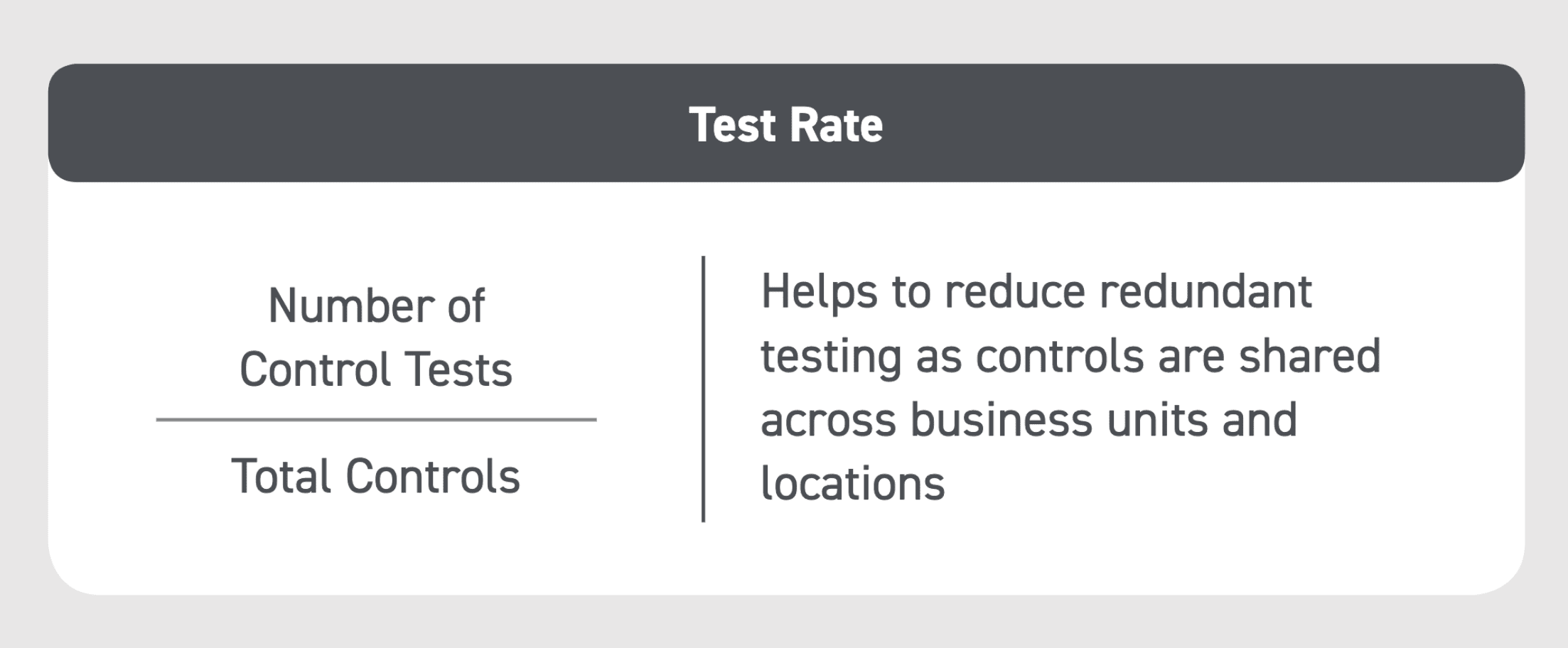

KPI #16: Test Rate

Upkeep of the control environment is as important as implementing an effective control environment. The test rate KPI enables finance leadership by identifying if controls are being adequately tested to ensure functionality.

Prioritize KPIs in Finance and Accounting

The KPI examples for finance departments outlined here represent the best practices and starting point for achieving goals such as reducing days to close or improving the quality of the journal entry process. Leading organizations are prioritizing and measuring across these five areas to drive efficiency and effectiveness within finance and accounting in order to better support the wider organization.

[cta-content-placement]

Without these metrics, finance and accounting departments don’t have the visibility needed to be able to improve the Record to Report and optimize costs or execute on the growing demands for strategic activities.

Written by: Ashton Mathai