Serving Efficiency: Wagamama Automates Reconciliation and Reclaims 1-2 FTEs with Trintech

Case Study

Share

Overview

For over three decades, Wagamama has been a staple of modern Asian-inspired dining, delighting guests across the UK and beyond. As part of The Restaurant Group (TRG)—which also includes brands like BarBurrito, TRGC, and Brunning & Price—Wagamama operates in a fast-paced, high-volume environment where accurate financial reconciliation is critical.

When the company migrated its ERP from Navision to Microsoft Dynamics 365 F&O, they encountered significant operational challenges in transaction matching and reconciliation. Manual processes in Excel created inefficiencies and introduced unnecessary risks. Seeking a scalable, automated solution, Wagamama turned to Trintech to transform their financial close operations.

The Challenge: Manual, Error-Prone Processes After ERP Migration

Prior to implementing Trintech’s solution, Wagamama’s finance operations team relied heavily on Excel to manage transaction matching and reconciliation. When they transitioned from Navision to Microsoft Dynamics 365, they discovered that the ERP’s built-in matching

functionality was too limited for their needs.

As Nadine Brammer, Finance Operations Manager, explained, “There were too many restrictions within the ERP in terms of matching transactions with the detail we needed—particularly at the site level. We were looking at very detailed transaction-by-transaction information,

and because of those restrictions, we had to go out and find another solution.”

The lack of automation not only slowed down month-end close but also left room for human error. The manual approach was cumbersome, time-consuming, and unsustainable as Wagamama’s business continued to grow.

Why Wagamama Chose Trintech

Wagamama needed a solution capable of handling three-way matching—reconciling data between their bank, payment service providers (PSPs), and sales systems. While Microsoft Dynamics 365 supported two-way matching, it couldn’t reconcile data from all three sources simultaneously.

“The absolute must-haves were the kind of three-way match between bank, PSP, and our sales or takings,” said Brammer. “That was something Dynamics simply couldn’t do.”

After evaluating multiple vendors, Wagamama selected Trintech’s solution for its ability to automate complex reconciliation processes, integrate seamlessly with their existing ERP, and provide clear exception visibility.

Implementation: A Journey from Complexity to Control

While the implementation process wasn’t without its challenges, collaboration between Wagamama and Trintech’s team won out in the end. Brammer explained, “Having someone who understood the system differently made all the difference.”

Once the solution was up and running, the team quickly embraced the new way of working. After a few adjustments, the tangible benefits of automation won everyone over: “Once the team saw the benefits of Trintech’s solution, they never looked back. The team really enjoys not having to do 10 steps to get where they need to be—now it’s just two.

We have so much more information in Trintech’s solution that we did in our old tools. The visibility we have now helps us identify and resolve discrepancies faster.”

Results: Greater Accuracy, Efficiency, and Visibility

Since implementing Trintech’s solution, Wagamama’s finance team has achieved significant efficiency gains and cost savings.

- Headcount Efficiency: “We’ve been able to reduce by one to two heads within the team just due to the auto-match,” Brammer shared.

- Improved Productivity: With automation handling routine matching,

the team can now focus on investigating variances and improving

financial insight. - Enhanced Visibility: “We have so much more information in Trintech’s solution than we did in our old tools. The visibility we have

now helps us identify and resolve discrepancies faster.”

Today, thousands of transactions flow seamlessly through Trintech,

supporting the cash and banking teams.

The solution also plays a critical role in ensuring financial integrity. “Trintech’s solution tells us what’s OK and what’s not. It helps us

identify when there’s a discrepancy—whether it’s a data issue, a site declaration error, or even a theft concern. That level of clarity is invaluable,” said Brammer.

Looking Ahead

Building on their success, Wagamama is now expanding Trintech’s solution across the entire Restaurant Group. “We’d like to get the whole group onboarded,” said Brammer. “Right now, a few divisions are still using spreadsheets, but the goal is to have everything in one place.”

For Brammer, the benefits of financial automation are clear: “I’m a big supporter of bank reconciliation tools. Anywhere I’ve worked that doesn’t have one, I’ve pushed to implement it. It saves time and improves accuracy—it’s absolutely worth it.”

Conclusion

From manual spreadsheets to streamlined automation, Wagamama’s journey with Trintech illustrates the transformative power of financial technology done right. With Trintech’s solution, the brand has reduced manual workloads, increased accuracy, and gained the visibility needed to scale confidently.

As Wagamama continues expanding its use of Trintech across new divisions, the partnership remains a cornerstone of their financial excellence strategy— empowering their teams to focus less on reconciliation and more on delivering the exceptional dining experiences that define the Wagamama name.

Read the Full Case Study

Discover key insights and actionable strategies by downloading our full case study.

See Trintech in Action

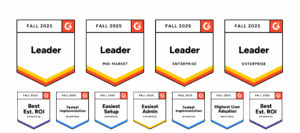

Seeing is believing. Discover why Trintech is the real leader in financial close automation.