SAP® Tax Journal Automation within Cadency

Blog post

Share

Are you spending a significant amount of time manually managing Journal Entries (JEs) posting in SAP®? How about the ones that include JEs posting to tax accounts with various validations for-profit centers that fall within different country, state and county jurisdictions? If so, I am sure you are looking for a better solution to shift your team’s focus from manual, repetitive tasks to strategic cognitive work.

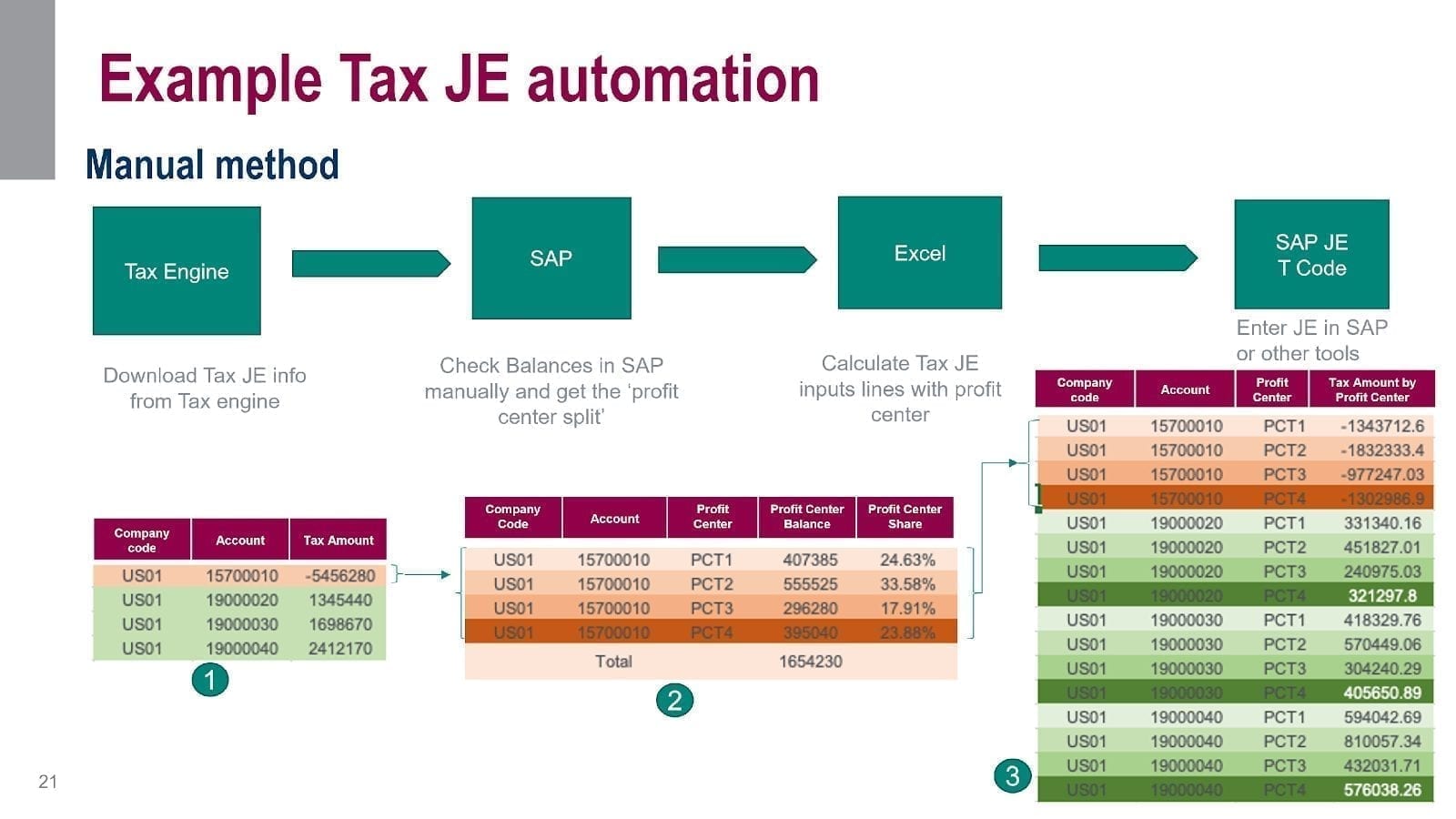

So, what does this process typically look like for most organizations without a solution in place? As part of the “Tax transfer to Netting” process, many companies need to post tax JEs in their SAP® ERP which involves several manual steps. For proper balance sheet segmentation, you might need to manually derive a “profit center split” on journal entry information downloaded from an external tax engine prior to posting. The below diagram depicts the typical flow:

- Manually download the tax journal entry information (company code, account and tax amount from tax engines such as OneSource, Vertex, Taxware, etc.)

- Log into SAP® and download profit center balance for each account and manually calculate the profit center percentage share using the balance amount

- Manually calculate the tax amount for each profit center within an account using the profit center percentage share from the previous step using Excel. Perform rounding for the tax amount and ensure it adds up to the exact total tax amount. Use custom or native ERP tools to post JE manually.

It is evident that following this manual approach not only increases the operational cost but also increases the risk of error, delays period-end closing and potentially increases audit risk. Trintech can help streamline and automate this process, reducing cost and risk drastically.

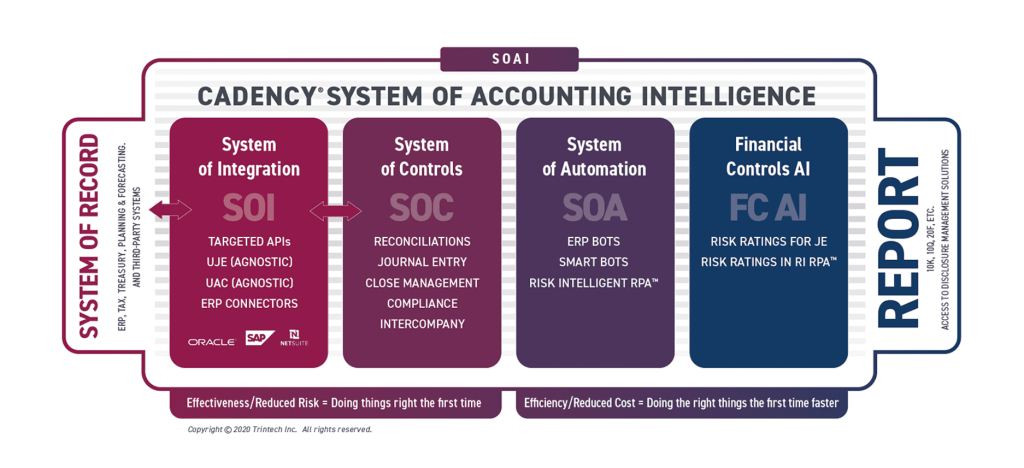

Now, you may wonder why you should invest in another solution when you have already made investments in third-party tax engines, created home-grown custom codes within your ERP, or have plans to move to SAP® S/4HANA. It’s true, you can perform these manual tasks and integrations to accomplish this, but I’m sure you have taken that route in the past only to be burnt by overrun budget and delayed projects. What your organization needs is to take a deeper look into a comprehensive System of Accounting Intelligence™ (SOAI) platform that includes:

- System of Integration – Leverage purpose-built ERP and JE connectors for major ERPs and APIs

- System of Controls – Automate key Record to Report processes including Reconciliation (Balance Sheet, Intercompany and High-Volume), Journal Entry, Close and Compliance processes that are designed to provide seamless workflow from one process to another

- System of Automation – Apply innovative Risk Intelligent RPATM, such as Dynamic Account Maintenance, Dynamic Approval Routing, etc., to your processes, as well as, a suite of ERP Bots which provide native automation within leading ERPs to provide journal entry automation and close task automation

- Financial Controls AITM(FC-AI) – Use machine learning algorithms and artificial intelligence to examine trends in your data over time, identify abnormalities, and automate workflows based on the associated risk

The breadth and depth of offerings that Cadency provides is simply unmatched in the Record to Report space. With an extensive roadmap that is continually updated based on market feedback and internal R&D, and differentiated offerings such as a SAP-Certified Connector and ERP Bots, FC-AI (AI Risk Rating for JE), etc. our customers can rest assured that they can grow with Trintech as their business needs evolve over the years.

We understand that the CFO organization is focused on improving and optimizing the Record to Report process to produce accurate financial reporting while reducing risk and cost. CIO organizations care about aligning 3rd party software with their core IT strategies such as standardization of tools and processes, reducing customization effort and support, and ensuring compliance with all security requirements. Cadency is designed with both the CFO and CIO in mind and its core System of Controls provides peace of mind to CFOs while its System of Integration and Automation offering directly aligns with CIO’s priorities. It provides standard interfaces with end to end data and transport security and is completely maintained and supported by Trintech. This not only eliminates the expensive customization, maintenance and support efforts for our customers but also future proofs them for new ERP upgrades. Further, as more and more companies increase their remote working, the Wall Street Journal discusses how companies who rely heavily on cloud-based technologies to automate accruals, adjustments and internal transactions may be in for a smoother close than those that use on-premise technology on virtual private networks or enter data into spreadsheets manually.

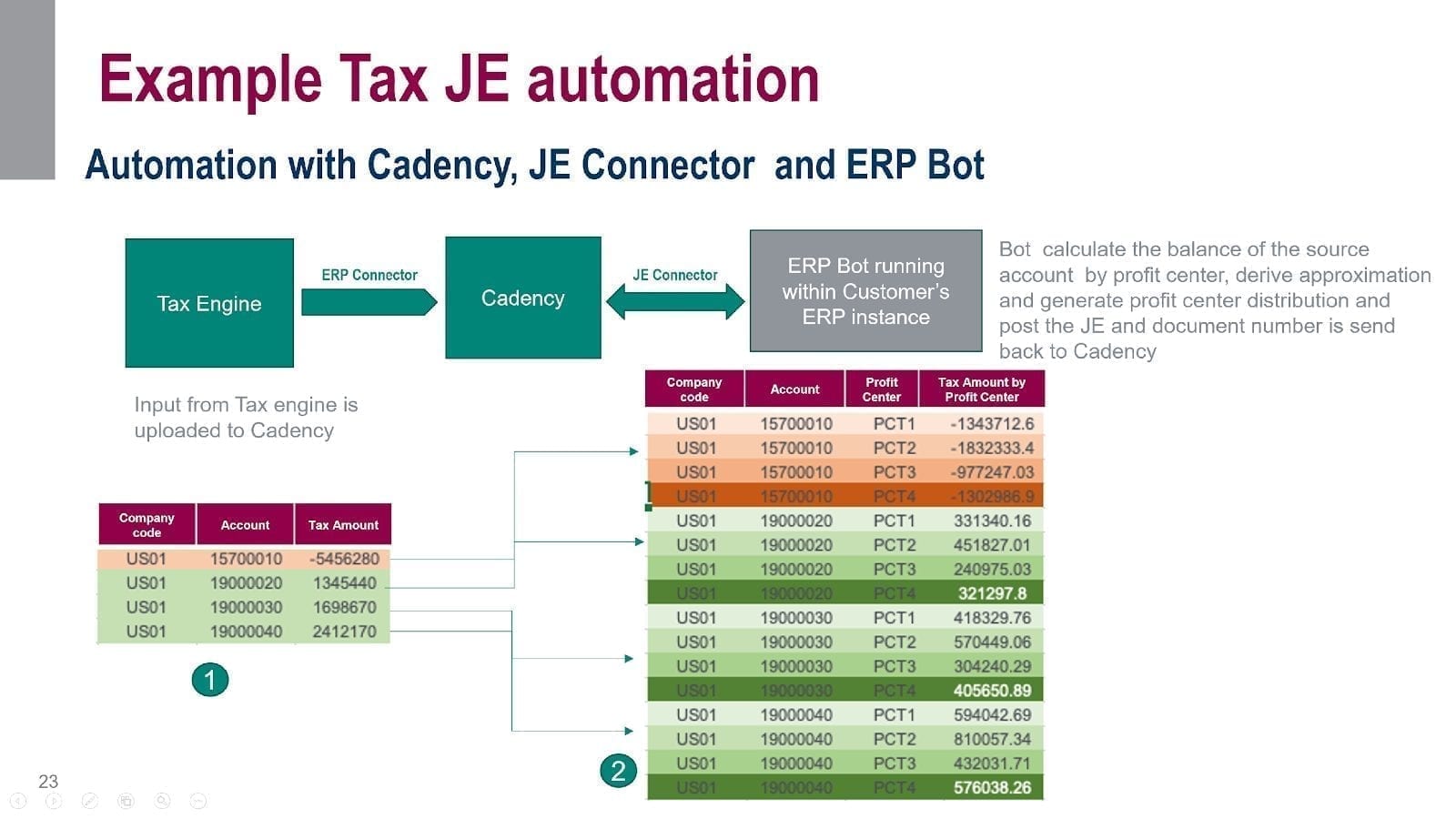

So, let’s look at that posting tax JE example again, but this time using automation. Cadency provides a seamless and comprehensive solution within its Journal Entry process (System of Controls), using its Cadency JE Connector (System of Integration) and ERP Bots (System of Automation) to eliminate manual steps completely. With Cadency, customers can:

- Use Cadency’s ERP connector to automatically import tax JE data into Cadency

- Use Cadency to manage the JE approval and submission workflow

When the JE is being posted in real-time using Cadency’s JE connector, the ERP Bot calculates the profit center split for the tax amount, performs the rounding and posts the JE. Cadency is then updated with the document number sent back from the ERP via the JE connector.

This is what it looks like after implementing Cadency:

If you are looking at a new tax process, implementing SAP S4/HANA and require this capability, or looking to improve your SAP ECC6 JE / Tax cost and effectiveness, implementing Cadency and its System of Accounting Intelligence eliminates the manual steps and simplifies the flow drastically, reducing cost and risk leading to a significant increase in operational efficiencies.