Trusted By:

AI Financial Close Software for Power & Utilities

Energy, power, and utility companies operate in one of the most complex and regulated financial environments, managing high-volume transactions, multi-entity operations, massive capital assets, and constant audit and compliance pressure.

See why leading companies like Atmos Energy, Engie and Severn Trent trust Trintech to provide the automation, control, and visibility needed to streamline reconciliations, accelerate the close, and ensure absolute accuracy across every reporting cycle. Our AI Financial Close platform eliminates manual workload and reduces risk, so finance and accounting teams can shift their focus toward driving strategic decisions that strengthen reliability, support regulatory confidence, and fuel long-term operational performance.

Energy, Power & Utilities Use Cases for Financial Close Software

Billing to Cash Reconciliation

Billing-to-cash reconciliation ensures customer usage, billing systems, and cash receipts align with the general ledger. Automating this process helps utilities quickly identify rate errors, unbilled revenue, and collection issues while maintaining accurate revenue recognition.

Fixed Asset Reconciliation

Fixed asset reconciliation validates that large-scale infrastructure assets, such as generation plants, transmission lines, and distribution networks, are accurately reflected between asset systems and the GL. This provides confidence in asset values, supports regulatory reporting, and reduces risk in rate cases and audits.

Trading / Hedging / Mark-to-Market Reconciliations

Reconciles energy trading activity, hedge positions, and mark-to-market valuations across trading, risk, and finance systems. Automated reconciliation and the ability to track daily improves valuation accuracy, supports compliance with hedge accounting requirements, and reduces earnings volatility driven by timing and valuation differences.

Tackle Your Energy & Utilities Challenges Head-On

Start a conversation with experts who know your world.

Financial Close Automation Powers a Better Close

Ensure Data Integrity

AI Financial Close automation ensures all financial information is secure and accurate.

Shorter Time to Close

AI transaction matching and account reconciliations reduce the burden of each close cycle.

Increased Control & Visibility

With all financial close information in one place, F&A teams can perform in-depth analysis on your close data to further increase efficiency and improve accuracy, preparing your organization for future growth.

Enable Regulatory Reporting

AI Financial Close automation establishes an effective control framework to govern your finance processes—with an easily accessible audit trail.

100% of our tasks were completed on time, with nearly everyone out the door by 5pm. That’s what Trintech has enabled us to accomplish. People have a better work-life balance because of Trintech, and the quality of our reconciliations has improved dramatically.”

The Trintech Difference

At Trintech, complexity is where we shine. Whether your challenges involve high-volume reconciliations, complex reconciliation practices, the need for strict financial controls, or even a private cloud environment—our platform empowers you to tackle them with ease. Trintech handles reconciliation volumes that other providers can’t touch through a robust, highly secure AI financial close platform that you can trust with your most sensitive financial data.

Real Customers. Real Results.

Severn Trent Simplifies Journal Entries and Eases Workloads with Trintech

Read Case StudySince implementing, Severn Trent has:

- Streamlined Journal Entries: Integration with SAP ERP simplified intercompany journal entries, with auto-populated data and integrated approvals

- Significant Reduction in Reconciliations: By grouping reconciliations, Severn Trent decreased the total number, enhancing efficiency

- Enhanced Error Prevention: Proactive error detection improved the quality of reconciliations

Trintech’s journal entry automation allows for different approval routings based on journal value; this allows journals to be distributed to the correct reviewer based on the level of risk associated with the journal, helping distribute journal reviews across a larger population and easing workloads.”

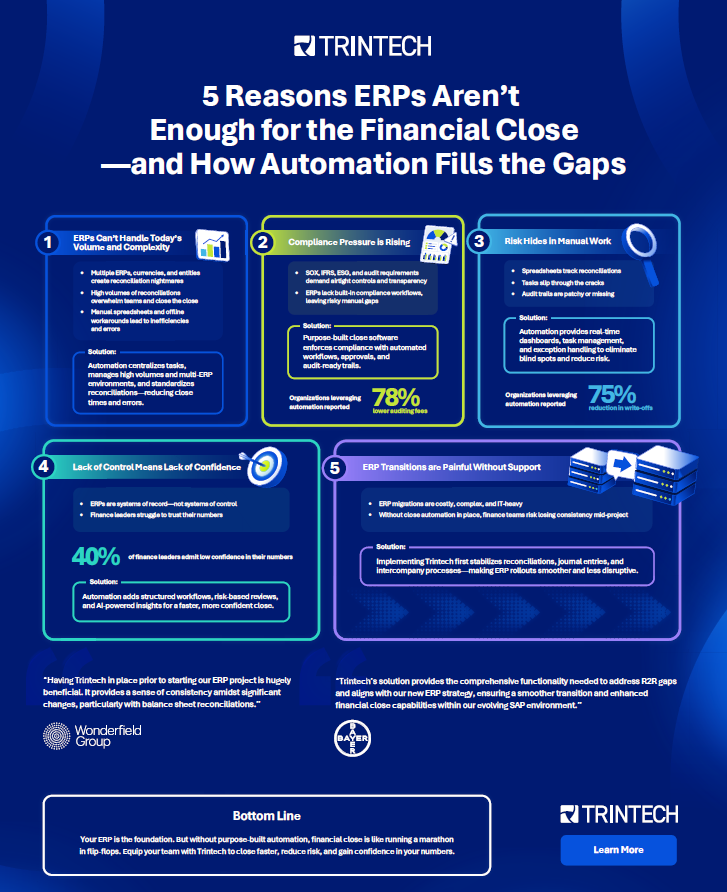

Trintech and Your ERP

Trintech offers certified, direct ERP connectors for providers such as Workday, SAP, Oracle and Microsoft Dynamics, so ERP integration is faster, easier and more secure.

FAQs

Why is the financial close so complex for energy and utility companies?

Because these organizations manage high-volume transactions, multi-entity operations, long-lived capital assets, and regulatory reporting requirements, every close cycle involves significant reconciliation work, strict controls, and extensive documentation.

How does regulatory oversight impact the close process?

Regulators, Federal or otherwise, require precise, auditable financial data for rate cases, compliance filings, and external reporting. This increases the need for standardized workflows, strong evidence management, and transparent audit trails.

Why do many energy and utility companies struggle with data integration?

Mergers, legacy systems, regional billing tools, and disconnected ERPs create fragmented data environments that force finance teams to rely on manual processes to align and reconcile information.

Can Trintech support multi-entity or geographically distributed operations?

Yes. Trintech standardizes processes across locations, entities, and business units, delivering visibility and control even in highly decentralized operational models.

Can Trintech handle complex energy use cases like trading, hedging, and fixed assets?

Yes. Trintech automates reconciliations for fixed assets, billing-to-cash, and trading or mark-to-market activity across multiple systems and entities.