Amplify Your Automation Initiatives While Reducing Risk within Your Office of Finance

Blog post

Share

The role of the CFO and CIO has undergone a profound shift in recent years. Traditionally, the CFO’s focus was on accounting, financial reporting and compliance. Today, CFOs play a more strategic role in the business where they drive the direction and success of their organizations using their knowledge and understanding of the financial position of the company. Similarly, the CIO position has shifted from not only having to build and maintain IT assets, but also build a holistic technology strategy to fuel the business growth.

Given these shifts, adopting deeper automation is not a choice but a necessity, to free up time for people to focus on strategic initiatives. Most companies have adopted Robotic Process Automation (RPA) as their automation strategy but according to a recent article, “Gartner’s Top 10 Technology Trends for 2020,” an RPA strategy is not enough. “Hyperautomation” is the top trend called out in the report which calls for a shift from RPA and task-oriented automation to a much more sophisticated Artificial Intelligence (AI) and Machine Learning (ML) based automation. Hyperautomation extends across a range of tools that can be automated, but also refers to the sophistication of the automation (i.e., discover, analyze, design, automate, measure, monitor and reassess).

At Trintech, we proactively envisioned this shift coming, which is why we have been adding these capabilities into our System of Accounting Intelligence™ (SOAI) platform to help our customers stay ahead of the curve in their automation journey within the Office of Finance.

Our (SOAI) platform has native automation capabilities that seamlessly work with other applications within the Office of Finance’s ecosystem, reducing time to get up and running and increasing your return on investments:

- System of Integration – Leverage purpose-built ERP and JE connectors for major ERPs and APIs

- System of Controls – Automate key Record to Report processes including Reconciliation (Balance Sheet, Intercompany and High-Volume), Journal Entry, Close and Compliance processes that are designed to provide seamless workflow from one process to another

- System of Automation – Apply innovative Risk Intelligent RPA™, such as Dynamic Account Maintenance and Dynamic Approval Routing to your processes, as well as, a suite of ERP Bots which provide native automation within leading ERPs to provide journal entry automation and close task automation

- Financial Controls AI™ (FC-AI) – Use machine learning algorithms and artificial intelligence to identify any hidden risk in the Record to Report (R2R) process, and automate workflows based on the associated risk within all Cadency processes – Match, Journal Entry, Certification, Close and Compliance.

- Risk Ratings: Cadency provides the capability to calculate quantitative risk scores based on the historical and operational data. For example, within the journal entry process, preparers and reviewers can see the risk rating on a scale of 1 to 10 (this can also be configured as High, Medium and Low) for journal entries before posting them to the system of record (ERP). These risk ratings are calculated by the proprietary AI/ML models that are continuously learning based on additional operational data processed.

- In the near future, we plan to introduce Benchmarking and Optimization capabilities that would allow our customers to calibrate the maturity of their processes with leaders in the industry, for further optimization.

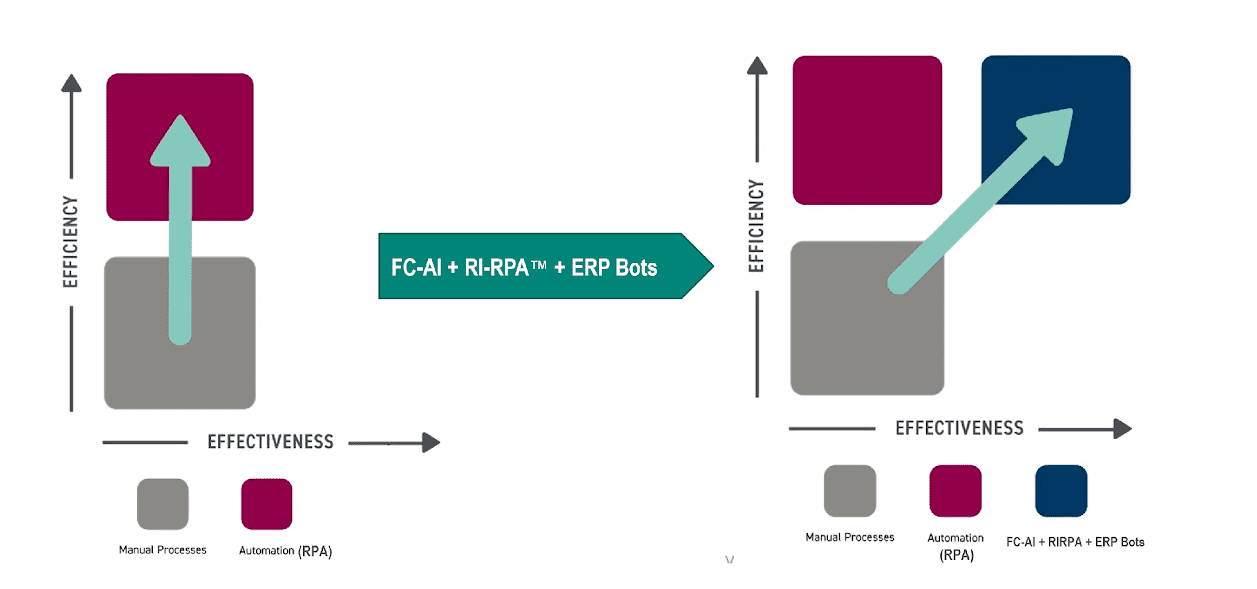

Our System of Accounting Intelligence leverages innovation technologies such as Financial Controls AI (FC-AI) offerings, RI RPA™ and ERP Bots, giving our customers a massive head start on the Hyperautomation trend. As depicted below, this not only improves your efficiency but also the effectiveness of your Record to Report process, while simultaneously reducing your cost and risk.

The breadth and depth of offerings that Cadency provides is simply unmatched in the Record to Report space. With an extensive roadmap that is continually updated based on market feedback and emerging trends, and differentiated offerings such as a SAP-Certified Connector and ERP Bots, and FC-AI (AI Risk Rating for JE) our customers can be assured that they can grow and scale with Trintech, as their business needs evolve over the years.

For more information on how Cadency can transform your Office of Finance, contact us.

Written by: Mantosh Kumar