Operational Reconciliation Uses Cases: Perform Daily, Intraday, or On-Demand

- Payments-to-Bank Reconciliation: Ensure payments settle accurately across rails and channels by reconciling payment systems to bank activity daily – preventing revenue leakage and downstream reporting issues.

- Clearing and Suspense Account Reconciliation: Continuously reconcile high-volume clearing and suspense accounts to surface issues early, before balances grow stale or require write-offs.

- Card, Digital, and Real-Time Payments: Reconcile card transactions, real-time payments, and settlement files across processors, networks, and banks to maintain transaction-level accuracy.

- POS, Cash, and Deposit Operations: Match point-of-sale, cash office, and deposit activity to bank and ledger data to ensure accurate cash visibility across locations and channels.

- Operational Cash and High-Volume Transaction Processes: Automate any operational reconciliation where volume, velocity, and timeliness matter – even outside traditional finance workflows.

Real Customers. Real Results.

Bangor Savings Bank Automates Reconciliations, Cuts Manual Work by 80%, and Future-Proofs Finance Operations with Trintech

Read Case StudyHighlights:

- 90%+ match rate across reconciliations

- 150+ new reconciliations added in the past year and a half

- Up to 30,000 transactions/day handled through automation

- 80% reduction in manual workload

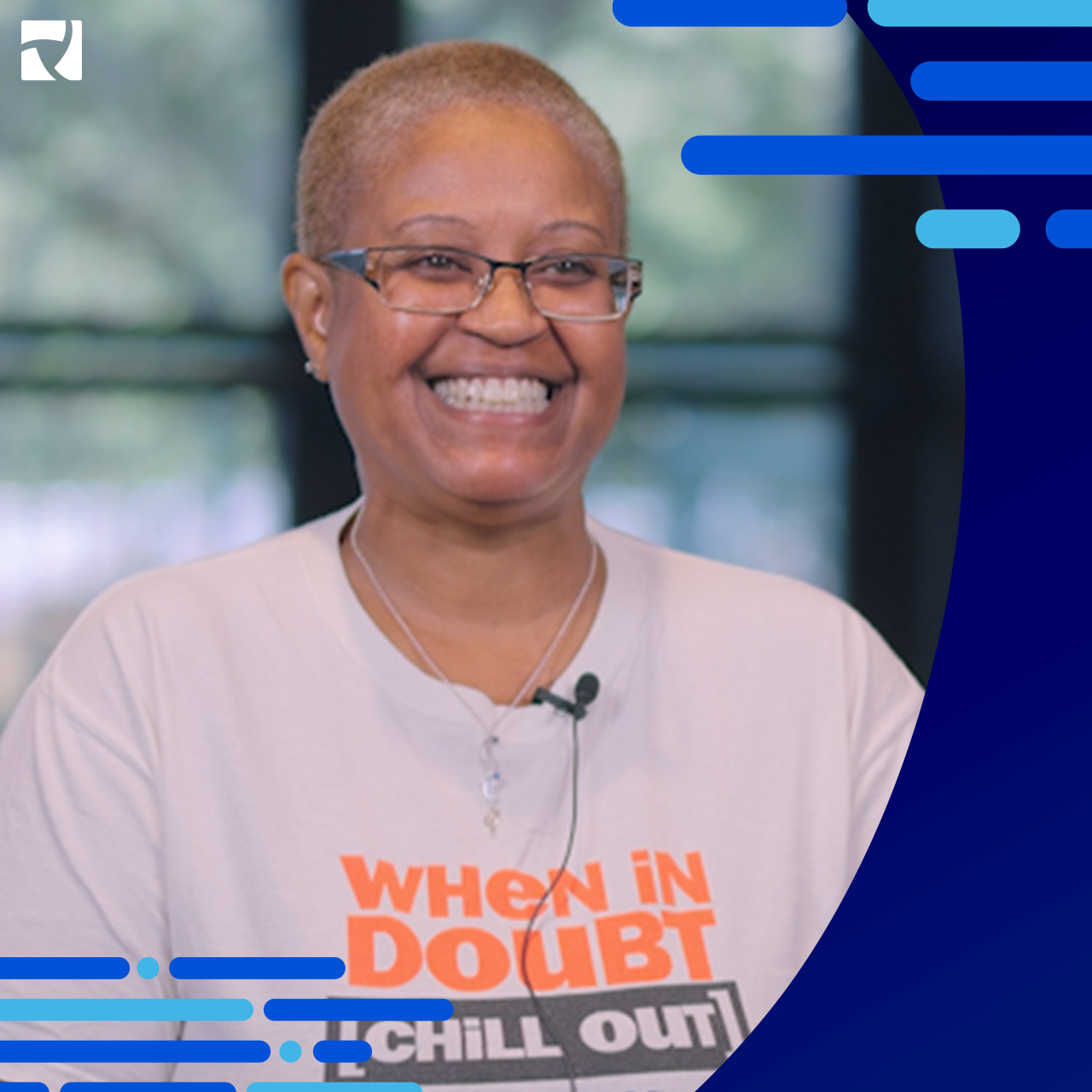

Trintech empowered us to modernize our reconciliation process. We went from looking at 100+ recons to just 20. That’s a huge lift.”

Proshop Reduces Bank Reconciliation Process from 5 Hours to 10 Minutes with Trintech

Read Case StudySince implementing, Proshop has:

- Cut daily bank reconciliation

- Enabled automatic matching

- Replaced manual spreadsheets

Out of approximately 6,000 daily reconciliations, there might be 50 exceptions that need human intervention, which only takes the team about 10 minutes to handle. Compared to the previous 4-5 hours spent daily on 4,000 line items, that’s a huge win for us.”

Costa Coffee Brews Up a 99.6% Match Rate with Trintech

Read Case StudyHighlights:

- Increased match rates from ~40% to 70–90%, reaching 99.6% across 3.5M transactions

- Lowered costs by eliminating bank fees and manual slip book expenses

- Reduced treasury team staffing needs to 1 FTE

The biggest benefit is that Trintech allows us to be more agile and proactive with our processes. It has completely changed how we work.”

End-to-End Automation: From Data Source to Documentation

Connect any data source

Ingest data from any system, format, or source – including payment platforms, banks, ERPs, and operational systems.

High-volume matching at scale

Standardize and reconcile massive transaction volumes using configurable matching logic built for speed and accuracy.

Centralized exception management

Identify, route, and resolve exceptions with full transaction-level detail, commentary, and ownership tracking.

Configurable workflows and approvals

Apply role-based workflows, approvals, and sign-offs to enforce control without slowing operations.

Audit-ready documentation by default

Automatically capture evidence, activity logs, and resolution history – eliminating manual audit preparation.

Seamless connection to the financial close

Operational reconciliations flow naturally into period-end processes, ensuring daily accuracy supports month-end confidence.

Operational Reconciliations Across Industries

Trintech supports a wide range of operational reconciliation scenarios across industries:

Financial Services

Payment rails, clearing and suspense accounts, trades and positions, deposits, loans, settlements, SWIFT, Nostro/Vostro, ACH, wires, cards, real-time payments, ATM and teller cash

Retail & Hospitality

POS-to-bank, deposits, e-commerce gateways, gift cards and loyalty programs, refunds, chargebacks, cash office operations

Healthcare

Patient payments across channels, billing, insurer remittances, refunds, adjustments, and clearing accounts

Insurance

Premium receipts, claims disbursements, commissions, investor remittance, and operational cash processes

FAQs

How does a continuous operational reconciliation solution support daily and intraday processes?

A continuous operational reconciliation solution automatically ingests and matches data throughout the day, identifying breaks and exceptions as they occur rather than waiting for month-end. This enables faster issue resolution, improved cash visibility, and reduced downstream risk.

Can Trintech automate high-volume operational reconciliations outside the general ledger?

Yes, Trintech automates high-volume operational reconciliations across external systems such as banks, payment processors, and operational platforms, without relying solely on GL balances. This allows organizations to reconcile millions of transactions daily at the operational level.

How does Trintech handle operational reconciliations across multiple payment systems and banks?

Trintech connects to multiple payment systems, processors, and banks, applying configurable multi-way matching rules to reconcile data across sources. Exceptions are centrally managed with full transaction-level detail and workflow-driven resolution.

Does Trintech support GL reconciliation with ERP integration for operational data?

Yes, Trintech integrates with leading ERPs to reconcile operational data back to the general ledger, ensuring operational accuracy flows seamlessly into financial close processes. Certified connectors and APIs support secure, automated data exchange.

What audit trail capabilities are available for operational reconciliations?

Trintech automatically captures audit-ready documentation, including source data, matching logic, exception history, approvals, and resolution evidence for every reconciliation cycle. This provides full traceability without manual audit preparation.

Can Trintech reconcile operational data from non-finance systems like POS or payment platforms?

Yes, Trintech reconciles operational data from non-finance systems such as POS, e-commerce gateways, card networks, and payment platforms by ingesting and matching data directly from those sources. This ensures operational accuracy across channels and systems.