The Biggest Risks and Challenges Facing Finance Teams Today

Blog post

Share

Trintech conducted a survey of 160+ finance professionals around the globe in the first half of 2022. This included organizations from Mid-Market to Large Enterprise, across multiple industries and job titles. We asked them about the state of their financial close, risks facing their business, and maturity level of financial close automation.

In this blog, we will dive into the results surrounding the biggest risks and challenges that finance teams are facing today.

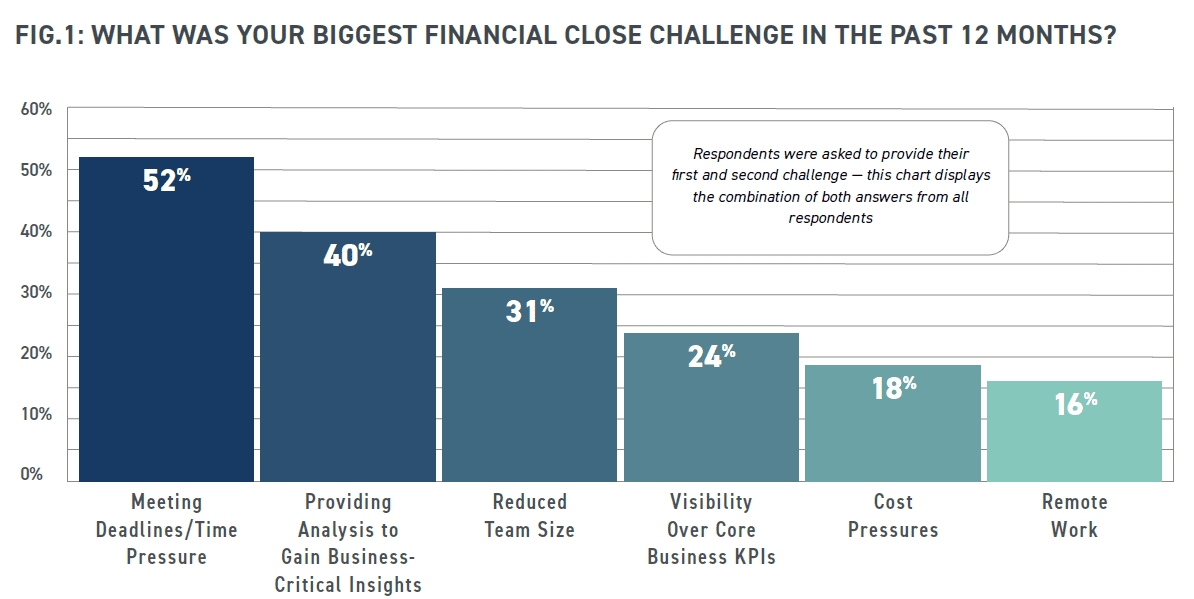

Meeting Deadlines/Time Pressures and Providing Analysis to Gain Business-Critical Insights Continue to be a Challenge with Reduced Team Size Becoming a Bigger Threat

52% of financial professionals noted that meeting deadlines and time pressures was the biggest challenge in their current financial close process (Figure 1). Manual processes, lack of visibility, and the limited use of financial automation solutions have exacerbated the ability to provide insight while working in a remote or hybrid environment.

As teams spend most of the time on manually intensive processes, they lose the opportunity to dive into the data and deliver higher-value analysis to the organization. Only by automating some of the repetitive, rules-based tasks, will the Office of Finance be able to free up time and resources to provide true business-partner type results. This is especially true as they are challenged with reduced team size as well, due to increased churn in the market overall.

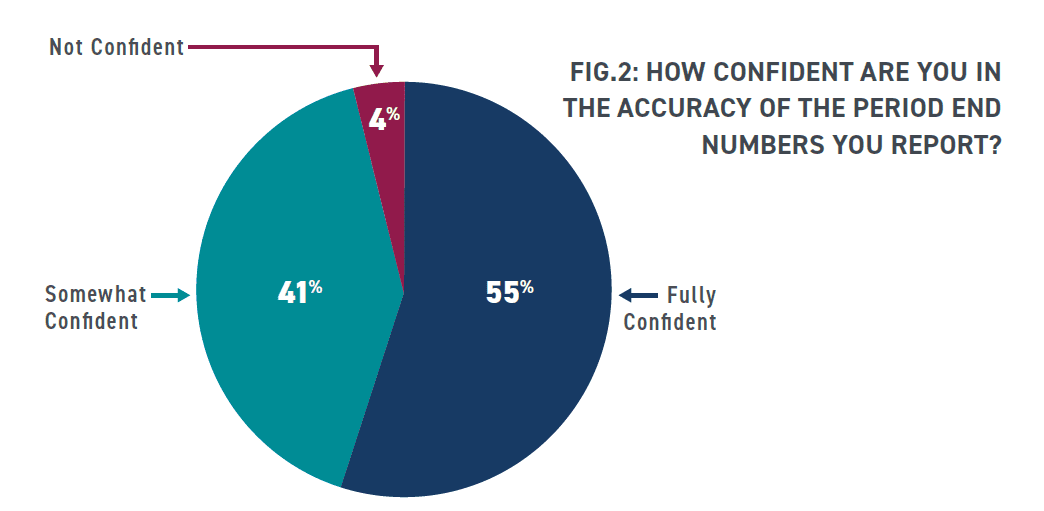

45% of finance professionals say they are not fully confident in the numbers they are reporting (Figure 2). Considering today’s demand on the Office of Finance to evolve to a function that helps drive commercial insights & business decisions, this lack of confidence in the figures has a significant impact on the overall culture across the finance teams and can be a block when trying to evolve to a business partnering model. If recipients of data find errors, this leads to uncertainty and often results in teams mirroring or duplicating activities. This lack of trust creates friction across the teams, negatively impacting the long-term goal of achieving a top-performing finance team.

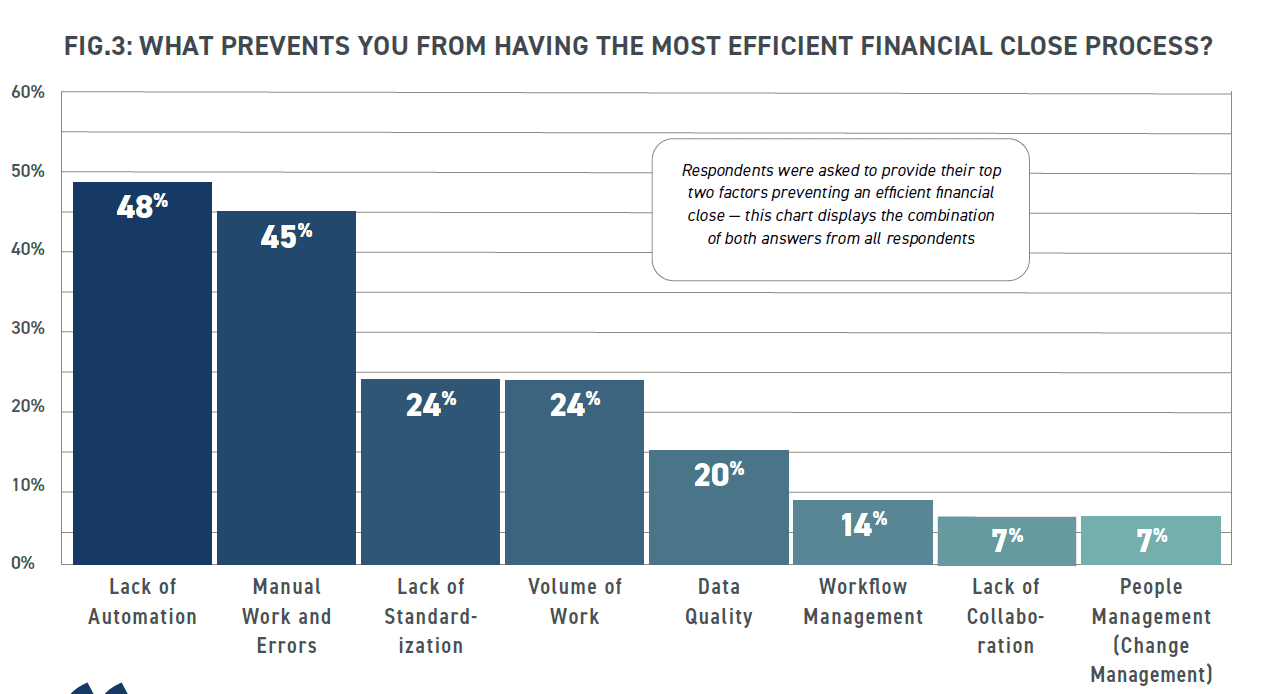

A Lack of Financial Automation and Manual Work & Errors Were Identified as the Biggest Factors Preventing an Efficient Financial Close Process

In an article by EY, 62% of CFOs acknowledge that their closing process happens manually. Furthermore, when asked what was preventing them from having the most efficient financial close process, respondents reported “lack of automation” and “manual work & errors” as the key factors (Figure 3). Year over year, organizations are aware that manual processes and a lack of financial automation greatly contribute to challenges throughout their financial close, yet they have not taken action to remedy the issue, since 74% of respondents reported they still do not have “mature” automation in place today.

Today, talent holds the power in the labor market. They are searching for roles that add value to their skillset, provide growth opportunities, and enable better work/life balances. To remain competitive, organizations must implement solutions that remove mundane or tedious tasks and leverage automation that improves efficiency while reducing risk to enable their finance teams to devote more time to strategic thought and initiatives.

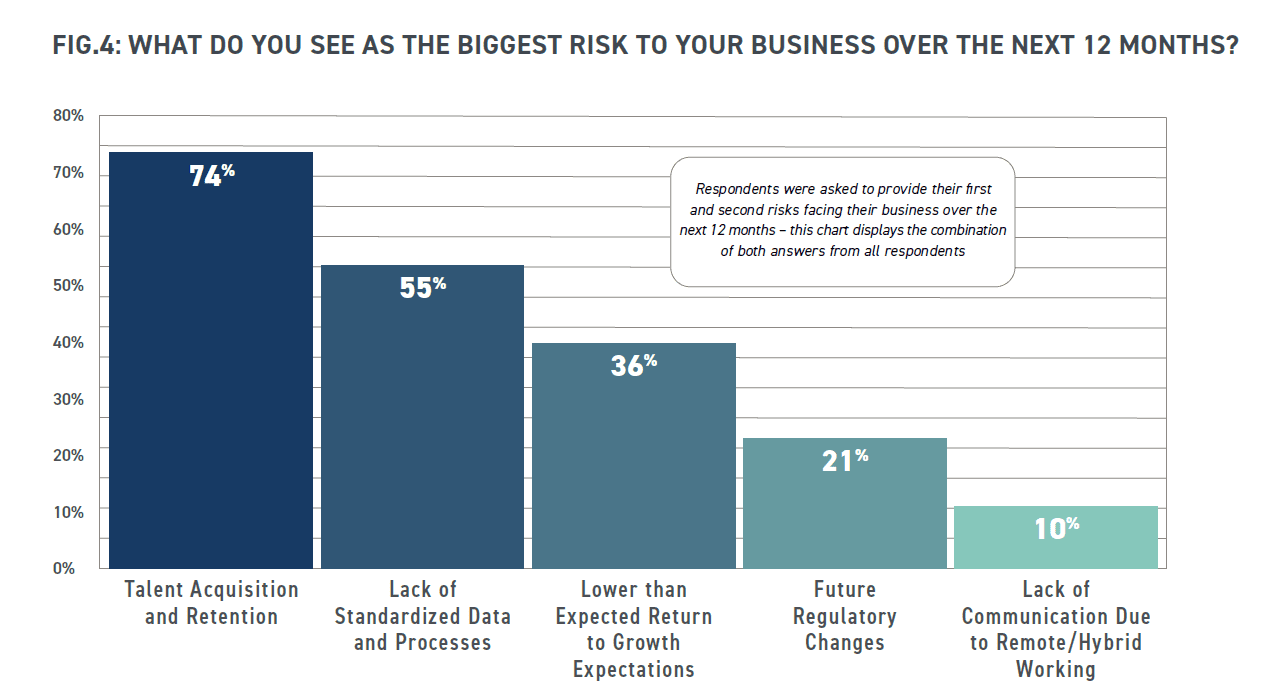

Talent Acquisition/Retention and Lack of Standardized Data & Processes Bring Increased Risk to the Business

74% of financial professionals said that talent acquisition and retention is the biggest risk to their business over the next 12 months. A lack of standardized data and processes is the second biggest risk at 55%. And it is interesting to note that lack of communication due to remote/hybrid working has become less of a risk year over year, indicating teams have learned to adapt to a “virtual or hybrid” work environment (Figure 4).

For the first time, employees have leverage over employers. With a finite pool of skilled finance talent, individuals have options about where they want to go. They won’t choose a role where they are manually managing spreadsheets or spending hours on transaction matching — they are looking to play a strategic role in an organization and grow their skillset by leveraging the technology tools available today. To stay competitive, there are many things companies can do, but most importantly, companies must prioritize financial automation and an efficient work environment that empowers their team to succeed.

Optimized processes enable finance teams to effectively manage the financial close process across all entities with clear visibility and allows teams to drive for improved data analysis. Defining a standardized process also provides opportunities for scalability and an increased opportunity for collaboration between leadership teams and the CFO, which leads to better engagement throughout the entire financial close.

Ultimately, this will help leadership quickly identify and resolve problem areas or bottlenecks.

Download our 2022 Global Financial Benchmark Report to discover even more insights and data surrounding the Office of Finance today.

[cta-content-placement]

Written by: Mikayla Jordan