Your ERP Can’t Do It All

Blog post

Share

As long as a train is moving forward, it’s hard to tell if it could be moving faster. The same could be said for your company’s financial close process. With constant deadlines, controls and activities to juggle, the close process is one train car after another. If you’re managing your close inside your ERP simply because it’s what you’ve always done, possibly even with a little help from spreadsheets, risks and time loss will both arise.

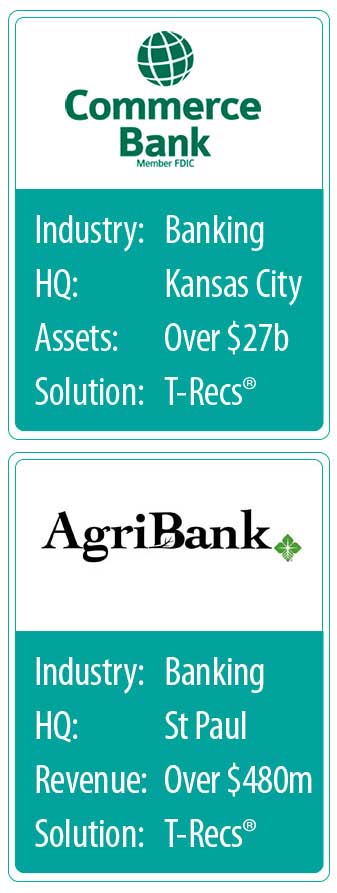

Manual processes are commonly accepted in many financial organizations. Even credit/debit card pioneer Commerce Bank and farm-focused AgriBank, knowing that they must be prime examples of low-risk financial governance and efficiency to stay credible in their industries, still struggled with spreadsheets. Both organizations also had ERPs already in place, but realized they had to improve their reconciliation processes through the implementation of reconciliation software. Removing data from their ERP and then manipulating it ran the risk of introducing issues that were not originally there. By implementing an automated solution, they reduced the risk created by manually maintained spreadsheets and human error.

Manual processes are commonly accepted in many financial organizations. Even credit/debit card pioneer Commerce Bank and farm-focused AgriBank, knowing that they must be prime examples of low-risk financial governance and efficiency to stay credible in their industries, still struggled with spreadsheets. Both organizations also had ERPs already in place, but realized they had to improve their reconciliation processes through the implementation of reconciliation software. Removing data from their ERP and then manipulating it ran the risk of introducing issues that were not originally there. By implementing an automated solution, they reduced the risk created by manually maintained spreadsheets and human error.

Despite companies’ outward differences, we have seen patterns emerge when it comes to businesses’ ERP environments, including:

- Multiple instances of a single ERP: Often quantity outweighs quality, and even when companies only have a single ERP, they will often have multiple instances which aren’t necessarily talking to each other. Again, within a decentralized business, various sections have different standards, which quickly lead to inefficiencies, a lack of visibility, poor controls and increased costs. On your balance sheet it’s hard to gauge accuracy when you don’t know what steps are or are not being taken within a process.

- A single instance of a single ERP: Beware of a situation that seems too good to be true, even when you have achieved what looks to be perfection. While all the information may be centralized, the tools to efficiently manage and coordinate the various activities, tasks and controls between the relevant individuals and teams are often missing; again, leading to data being manually manipulated outside of the ERP itself and shared around the business in offline files.

Complex challenges lie ahead, so what can be done to solve these problems?

Leading financial analysts recommend a fully-integrated solution that removes all these white spaces and offers a single view of your close, including all reconciliations, journal entries, documentation and controls. A solution that can integrate not only across your ERP landscape for consistent data management, but also across your whole financial close process, to offer a single view across the business at any time. High visibility across a complex and critical process will keep the tracks clear and your cars rolling smoothly down the line.

As Gartner states, “When considering the automation and unification of critical financial processes, such as account reconciliations, compliance and Financial Close, the whole is greater than the sum of its parts. These activities are highly dependent on each other and, when unified, create new insights and return on investment (ROI) savings.”

As companies evolve, their technology and processes must grow with them. An essential factor in growth is staffing. While your tried and true employees are accustomed to your manual process, many find that burnout inevitably occurs and your best talent moves on. On the other hand, millennial hires often come with fresh ideas and advanced technical knowledge, but little patience for manual processes and their tedious nature. Implementing an automation solution that can grow with you will not only save your company money on labor now, but will also prevent you from encouraging turnover due to burnout or boredom.

For more information on how automated reconciliation technology can help make the most of your ERP investment, view our eBook “Your ERP Can’t Do It All: Why You Need to Conduct the Financial Close Outside of Your ERP.”

Written by: Chelsea Downey